- United States

- /

- Software

- /

- NasdaqGS:ALKT

Alkami Technology (ALKT): Exploring Valuation After CFO Appointment and Key Client Partnership Renewal

Reviewed by Simply Wall St

Alkami Technology (ALKT) is drawing attention after announcing Cassandra Hudson as its new Chief Financial Officer. The company has also renewed a key client partnership with Belco Community Credit Union. These moves highlight Alkami’s focus on leadership continuity and sustained client relationships.

See our latest analysis for Alkami Technology.

Alkami’s momentum has cooled this year, with a 1-year total shareholder return of -47.8% and the share price down sharply from its highs, despite upbeat earnings growth and big client wins. However, the firm’s three-year total shareholder return of 50.2% shows it can rebound when the market mood shifts.

If you’re interested in finding more companies led by growth-focused management teams, consider seeing what you can discover with our fast growing stocks with high insider ownership.

With shares trading well below analyst targets and recent price cuts by major brokerages, the question now is whether Alkami Technology is an overlooked bargain or if the stock’s challenges are already reflected in its valuation.

Most Popular Narrative: 44.8% Undervalued

Compare the narrative's fair value to Alkami Technology's last close and you see a sharp gap, implying a potential opportunity if these bullish assumptions prove right. The narrative sets out why this price level could be justified, avoiding passive speculation and instead focusing on specific future business drivers.

Demand for platform integration and digital onboarding/account opening capabilities is accelerating among banks and credit unions as they compete for younger, digitally-native account holders. Alkami's strong cross-sell momentum (MANTL, data analytics, marketing modules) and seamless integration strategy position it to capitalize on this shift, likely driving sustained revenue growth and increasing average revenue per user.

Want to know what’s fueling this optimism? The fair value rests on aggressive growth, bold margin improvement, and ambitious assumptions for future earnings power. Curious about the quantitative leaps that analysts believe Alkami can make? Dive in and be surprised by how disruptive the projections really are.

Result: Fair Value of $35.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if new customer onboarding is slower than expected or if there is increased competition from larger fintechs, Alkami’s growth trajectory could be challenged and its forward valuation could be pressured.

Find out about the key risks to this Alkami Technology narrative.

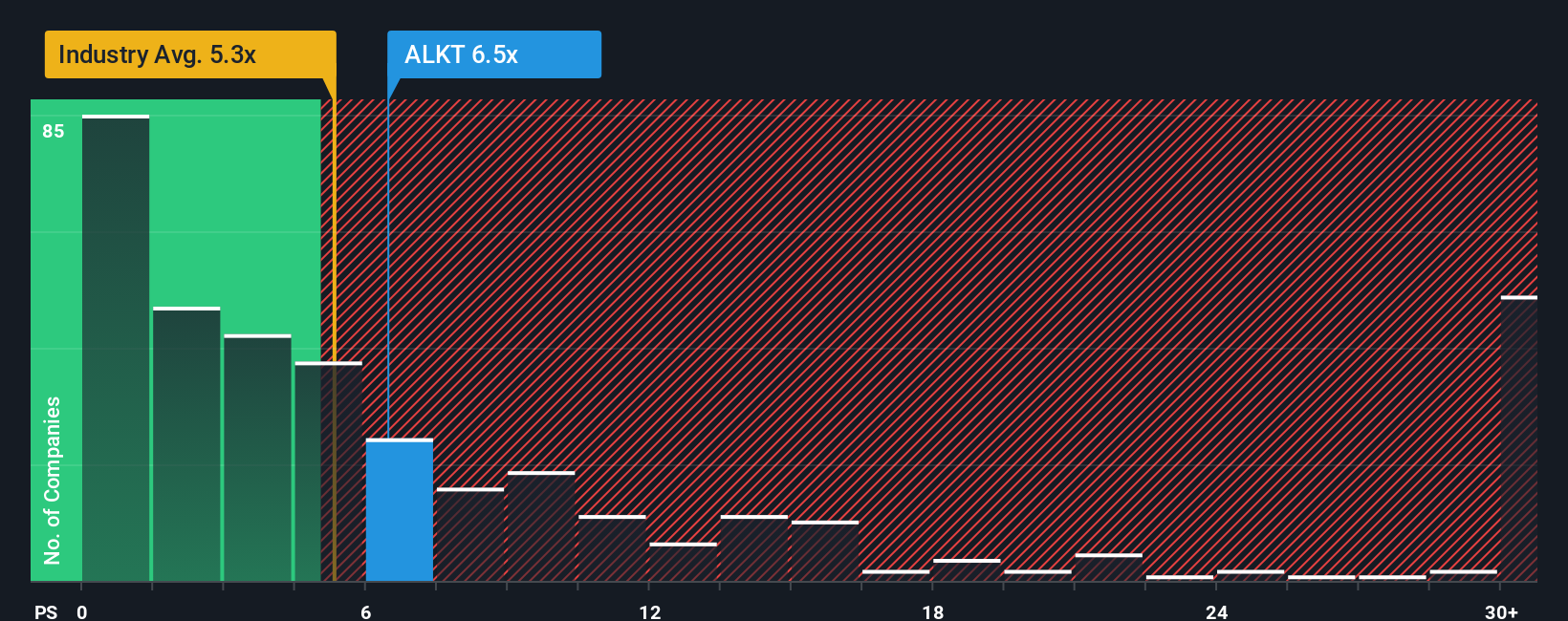

Another View: Multiples Tell a Different Story

While the previous analysis suggests Alkami Technology is undervalued, looking at its price-to-sales ratio paints a more cautious picture. At 5x, Alkami trades above its peers’ average of 3.4x and just above its fair ratio of 4.8x. This premium means investors are paying more for each dollar of revenue compared to peers and where the market might head. Does this higher valuation point to confidence in future growth, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alkami Technology Narrative

If you want to test your own investment ideas or think differently about Alkami Technology’s outlook, you can create your own company narrative in just a few minutes using the following tool: Do it your way.

A great starting point for your Alkami Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar tuned for emerging opportunities. Don’t let the market’s next winners pass you by.

- Spot high-yield potential by checking out steady performers in these 20 dividend stocks with yields > 3%, where robust dividends meet solid business models.

- Uncover breakthrough innovation and companies at the forefront of digital intelligence by starting with these 26 AI penny stocks.

- Capture serious value where the numbers don’t lie with these 842 undervalued stocks based on cash flows for the most attractively priced stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion