- United States

- /

- IT

- /

- NasdaqGS:AKAM

The Akamai Technologies (NASDAQ:AKAM) Share Price Is Up 48% And Shareholders Are Holding On

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

You can receive the average market return by buying a low-cost index fund. But you can make superior returns by picking better-than average stocks. For example, the Akamai Technologies, Inc. (NASDAQ:AKAM) share price is up 48% in the last three years, slightly above the market return. More recently the stock has gained 9.3% in a year, which isn't too bad.

See our latest analysis for Akamai Technologies

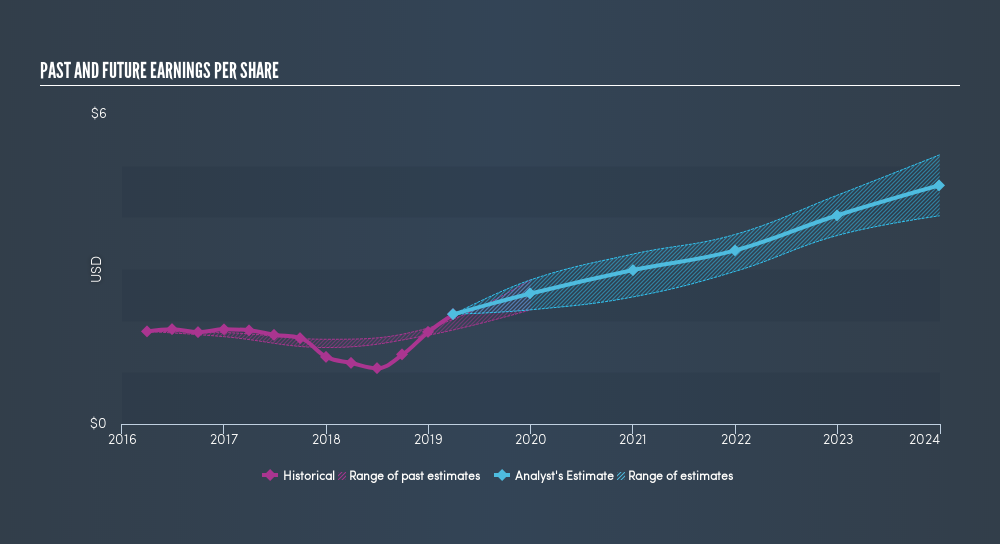

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Akamai Technologies achieved compound earnings per share growth of 5.9% per year. In comparison, the 14% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

We know that Akamai Technologies has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Akamai Technologies will grow revenue in the future.

A Different Perspective

We're pleased to report that Akamai Technologies shareholders have received a total shareholder return of 9.3% over one year. That gain is better than the annual TSR over five years, which is 6.2%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Akamai Technologies it might be wise to click here to see if insiders have been buying or selling shares.

But note: Akamai Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:AKAM

Akamai Technologies

Engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives