- United States

- /

- Software

- /

- NasdaqGM:AIP

Subdued Growth No Barrier To Arteris, Inc. (NASDAQ:AIP) With Shares Advancing 39%

Arteris, Inc. (NASDAQ:AIP) shareholders are no doubt pleased to see that the share price has bounced 39% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 82% in the last year.

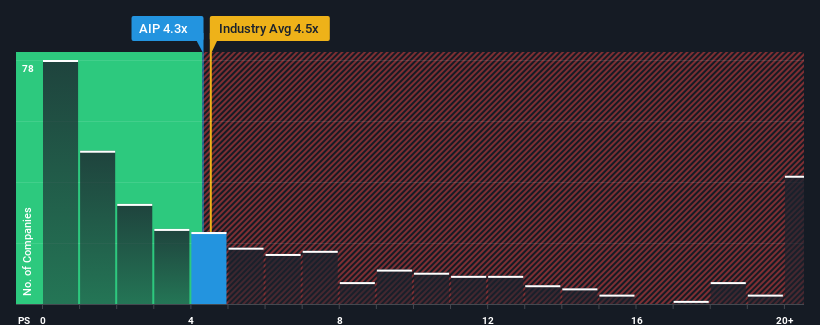

Although its price has surged higher, there still wouldn't be many who think Arteris' price-to-sales (or "P/S") ratio of 4.3x is worth a mention when the median P/S in the United States' Software industry is similar at about 4.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Arteris

What Does Arteris' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Arteris has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Arteris' future stacks up against the industry? In that case, our free report is a great place to start.How Is Arteris' Revenue Growth Trending?

In order to justify its P/S ratio, Arteris would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.5% last year. This was backed up an excellent period prior to see revenue up by 65% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 5.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

With this in mind, we find it intriguing that Arteris' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Arteris' P/S Mean For Investors?

Its shares have lifted substantially and now Arteris' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Arteris' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Arteris (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIP

Arteris

Provides semiconductor system intellectual property solutions in the United States, rest of the Americas, China, Korea, the rest of the Asia Pacific, Europe, and the Middle East.

Slight risk with concerning outlook.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026