- United States

- /

- Software

- /

- NasdaqGS:ADSK

Strong Analyst Forecasts Signal Potential Game Changer for Autodesk’s (ADSK) Growth Strategy

Reviewed by Sasha Jovanovic

- In the past week, analysts projected Autodesk to report quarterly earnings of $2.49 per share and revenue of $1.8 billion, reflecting year-over-year growth across key business segments including subscriptions and industry-focused product families.

- This signals increased demand for Autodesk’s cloud-based and industry-specific solutions, supporting wider adoption and sustained business momentum.

- We'll examine how analyst forecasts for Autodesk’s robust earnings and revenue growth could influence the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Autodesk Investment Narrative Recap

To be a shareholder in Autodesk, you need to believe the market for design and engineering software will remain robust, underpinned by recurring subscription revenue and Autodesk’s ability to drive innovation in cloud and AI-powered tools. The latest analyst projections for double-digit earnings and revenue growth reinforce optimism around Autodesk’s product adoption, but these expectations do not fundamentally change the biggest short-term risk: increasing competition from open-source or low-cost software that could compress pricing power and slow growth in key segments.

The launch of Autodesk AI, which introduces generative design features and intelligent assistance across multiple products, is especially relevant to recent forecasts. This initiative supports one of the strongest growth catalysts: ongoing product innovation and integration of AI-driven tools that help maintain Autodesk’s competitive edge and justify premium pricing. Sustained execution here is seen as essential to supporting long-term margins and differentiating Autodesk from new entrants.

In contrast, there are rising concerns about whether Autodesk can defend its market position as alternative software solutions rapidly evolve, a factor every investor should be aware of if...

Read the full narrative on Autodesk (it's free!)

Autodesk's narrative projects $9.3 billion revenue and $2.0 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $1.0 billion earnings increase from $1.0 billion today.

Uncover how Autodesk's forecasts yield a $363.71 fair value, a 25% upside to its current price.

Exploring Other Perspectives

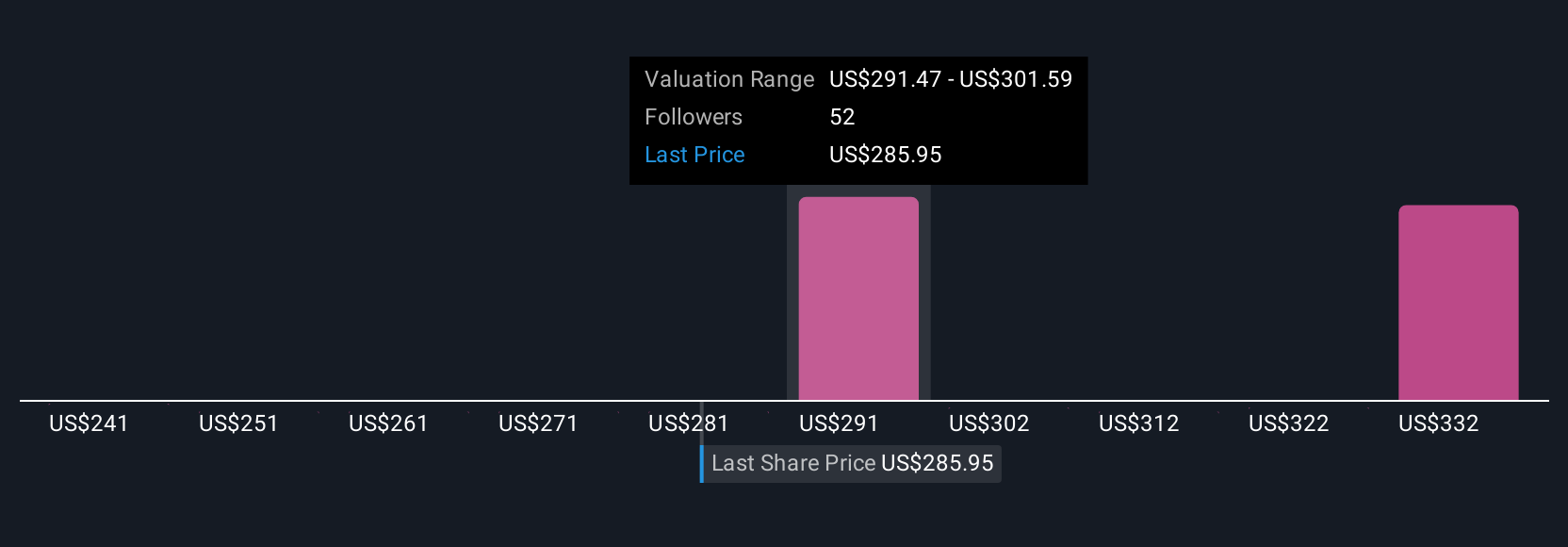

Retail investors in the Simply Wall St Community have set fair value estimates from US$288.75 to US$363.71, demonstrating a wide spread of views across 4 independent forecasts. With analyst optimism focused on Autodesk’s AI-driven tools to reinforce its competitive edge, you can compare these contrasting opinions and see how investor sentiment interacts with key business catalysts.

Explore 4 other fair value estimates on Autodesk - why the stock might be worth just $288.75!

Build Your Own Autodesk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autodesk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autodesk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autodesk's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives