- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Shareholders Are Thrilled That The Automatic Data Processing (NASDAQ:ADP) Share Price Increased 106%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the Automatic Data Processing, Inc. (NASDAQ:ADP) share price has soared 106% in the last half decade. Most would be very happy with that. Meanwhile the share price is 2.0% higher than it was a week ago.

Check out our latest analysis for Automatic Data Processing

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

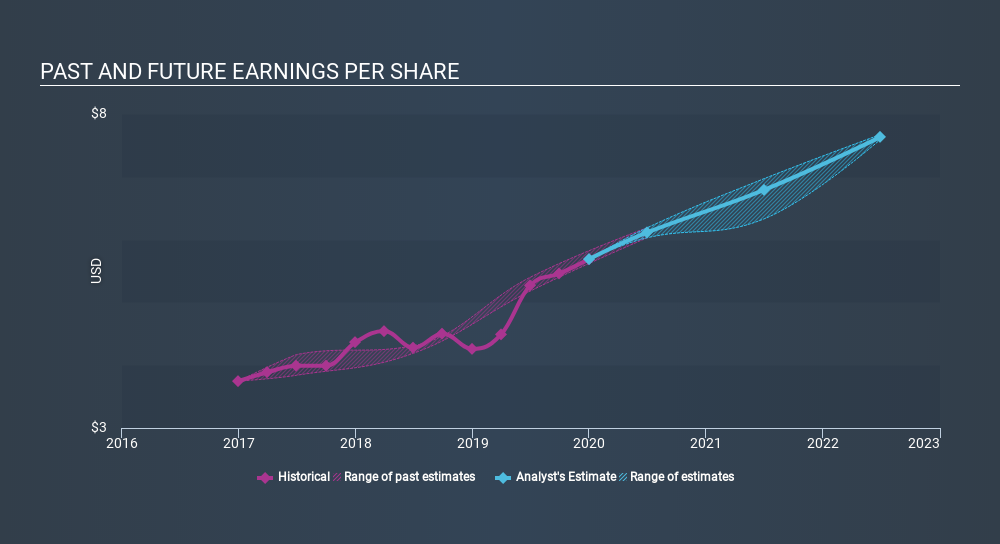

Over half a decade, Automatic Data Processing managed to grow its earnings per share at 16% a year. That makes the EPS growth particularly close to the yearly share price growth of 16%. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Automatic Data Processing has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Automatic Data Processing the TSR over the last 5 years was 130%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Automatic Data Processing shareholders have received returns of 22% over twelve months (even including dividends) , which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 18%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Before deciding if you like the current share price, check how Automatic Data Processing scores on these 3 valuation metrics.

We will like Automatic Data Processing better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.