- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Is Automatic Data Processing, Inc. (NASDAQ:ADP) The Right Choice For A Smart Dividend Investor?

Could Automatic Data Processing, Inc. (NASDAQ:ADP) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

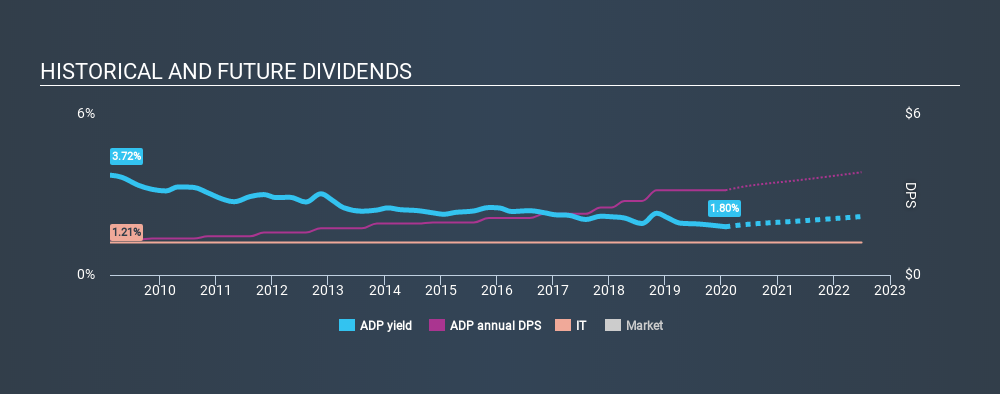

A 1.8% yield is nothing to get excited about, but investors probably think the long payment history suggests Automatic Data Processing has some staying power. During the year, the company also conducted a buyback equivalent to around 1.2% of its market capitalisation. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Automatic Data Processing!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Automatic Data Processing paid out 58% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Automatic Data Processing paid out 56% of its cash flow as dividends last year, which is within a reasonable range for the average corporation. It's positive to see that Automatic Data Processing's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

We update our data on Automatic Data Processing every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Automatic Data Processing has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was US$1.32 in 2010, compared to US$3.16 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.1% a year over that time.

Businesses that can grow their dividends at a decent rate and maintain a stable payout can generate substantial wealth for shareholders over the long term.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's good to see Automatic Data Processing has been growing its earnings per share at 16% a year over the past five years. Earnings per share have been growing rapidly, but given that it is paying out more than half of its earnings as dividends, we wonder how Automatic Data Processing will keep funding its growth projects in the future.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Automatic Data Processing is paying out an acceptable percentage of its cashflow and profit. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments. Automatic Data Processing has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 16 Automatic Data Processing analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The "Geopolitical Discount" vs. The Monopolistic Floor: The Two Narratives of TSM

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.