- United States

- /

- Software

- /

- NasdaqGS:ADEA

How Investors May Respond To Adeia (ADEA) Lawsuit Against AMD and Lowered 2025 Revenue Guidance

Reviewed by Sasha Jovanovic

- Adeia Inc. recently filed a lawsuit against AMD, alleging infringement of ten critical semiconductor patents tied to hybrid bonding and advanced process node technology, after prior licensing discussions failed.

- The company also lowered its 2025 revenue guidance, highlighting how the unresolved dispute with AMD could materially affect Adeia's financial outlook and underscores the importance of a possible licensing agreement.

- We'll now consider how litigation-driven revenue pressure may alter Adeia's investment narrative and future earnings expectations.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Adeia Investment Narrative Recap

To own Adeia stock, you need to believe that its intellectual property can power recurring, high-margin licensing revenues from a growing roster of semiconductor and streaming technology clients. The recent lawsuit against AMD now puts heightened focus on the outcome of large licensing deals as a primary short-term driver, but it also amplifies the risk that major customers may hold out or renegotiate agreements, either scenario could cause near-term financial swings.

Of the recent announcements, Adeia's decision to lower its 2025 revenue and net income guidance is most relevant here. This update makes clear how unresolved patent disputes with key partners like AMD can directly affect earnings expectations, which investors now see reflected in reduced forecasts and heightened uncertainty around future settlements.

By contrast, while licensing wins have underpinned stable results in the past, investors should also be aware that the need for continual patent renewal and customer negotiations...

Read the full narrative on Adeia (it's free!)

Adeia's outlook anticipates $466.7 million in revenue and $124.5 million in earnings by 2028. Achieving these targets would require a 7.2% annual revenue growth rate and a $40.6 million increase in earnings from the current $83.9 million level.

Uncover how Adeia's forecasts yield a $19.75 fair value, a 62% upside to its current price.

Exploring Other Perspectives

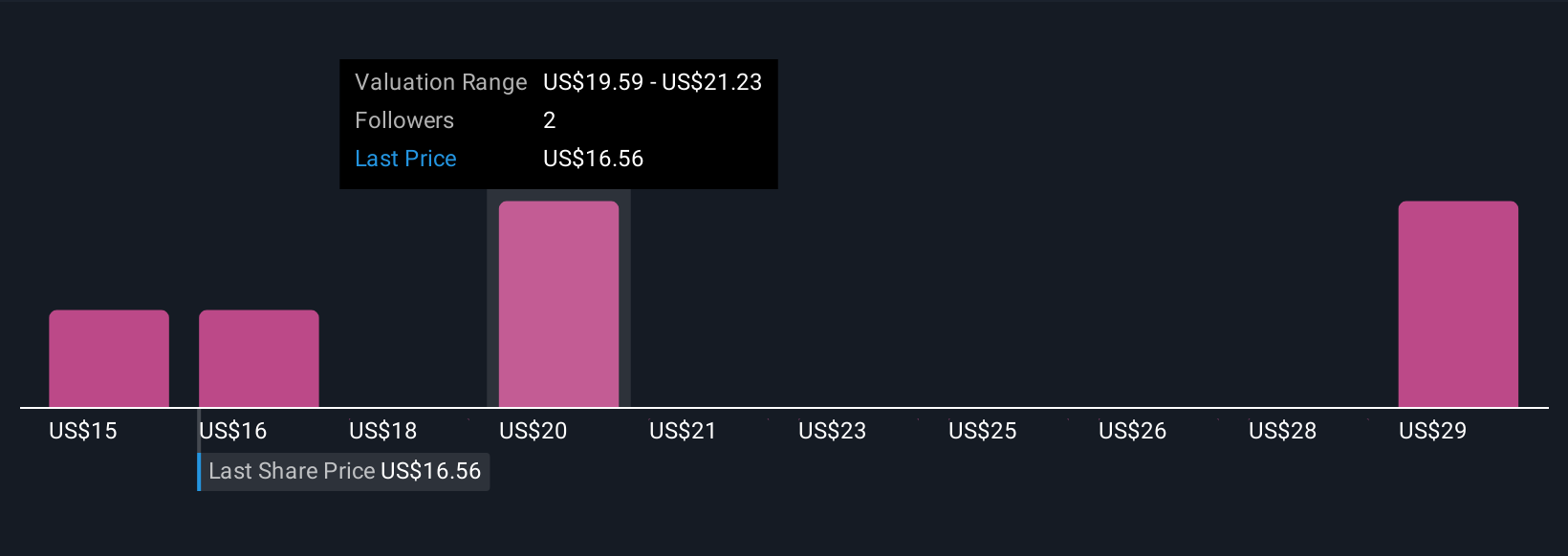

Simply Wall St Community members submitted four distinct fair value estimates for Adeia, ranging from US$14.65 to US$29.92 per share. In light of this spread, consider how Adeia’s reliance on a few large licensees could make near-term revenue outcomes far less predictable.

Explore 4 other fair value estimates on Adeia - why the stock might be worth just $14.65!

Build Your Own Adeia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adeia research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Adeia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adeia's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADEA

Adeia

Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success