- United States

- /

- Software

- /

- NasdaqGS:ADBE

Does the Recent 25.9% Drop Offer a Compelling Entry Point for Adobe in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Adobe stock right now? You are not alone. Whether you are a long-term investor wondering if it is time to double down, or a newcomer keeping an eye out for a compelling entry point, Adobe’s recent price action is giving everyone something to consider. Over the past week, shares have barely budged, eking out a modest 0.7% gain. Zoom out, however, and the picture gets more complex. The past year has seen the stock slide by 25.9%, weighed down by broad tech uncertainty and a recalibration in growth stock sentiment. But this is not just a story of market pessimism. Adobe’s management continues investing in AI and workflow alliances that have kept the company’s solutions relevant, and that has brought speculation about where the true value lies for shareholders.

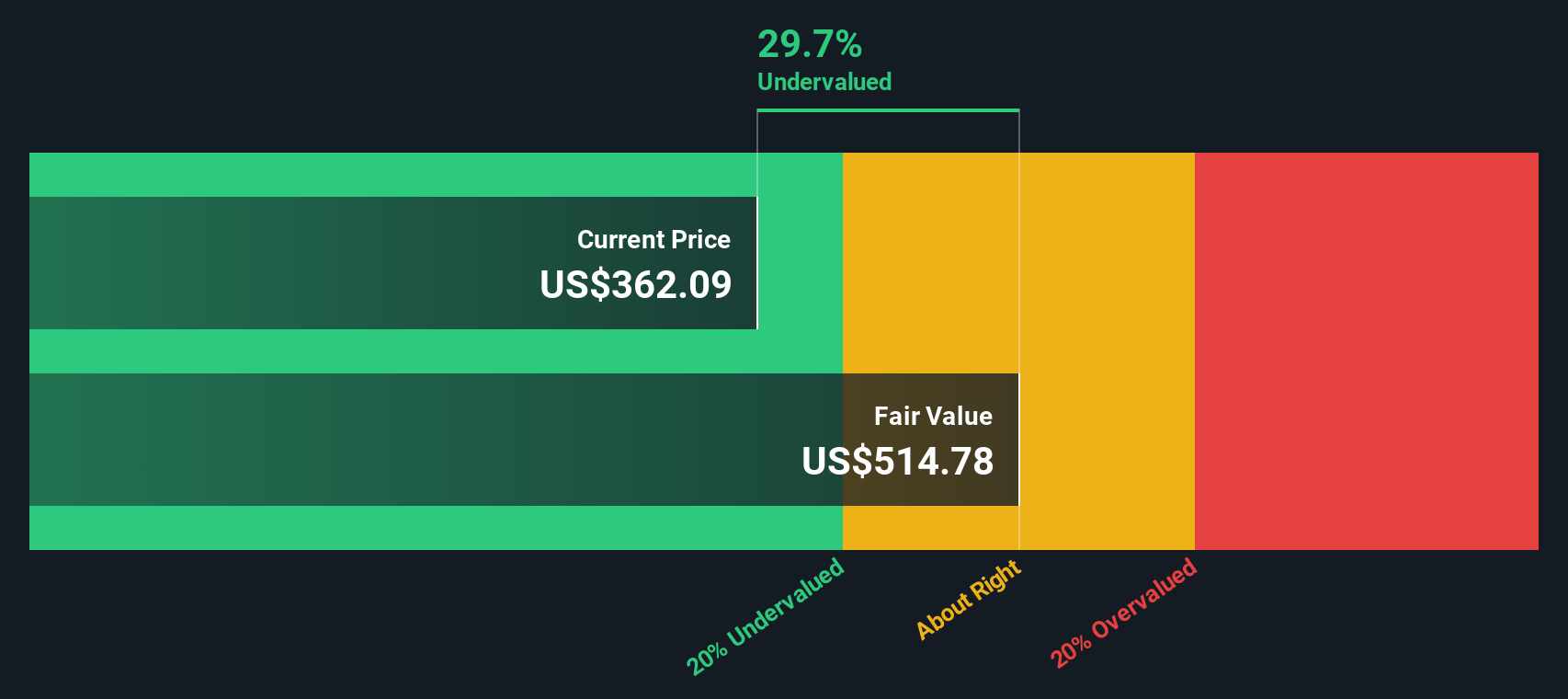

In recent months, the narrative around Adobe has shifted. After years of outperformance, investors seem to be re-evaluating what future growth looks like in a world getting accustomed to generative AI and shifting software budgets. Many are asking: does the market fully appreciate Adobe’s long-term prospects, or is this dip an opportunity hiding in plain sight? According to our framework, Adobe scored a 5 on our valuation checklist out of a maximum 6, indicating the stock appears undervalued across most of our key factors.

Let’s break down what’s driving that valuation score and dive into the different approaches analysts use to size up Adobe. Stick around, because after we cover the classic methods, we will look at a smarter way to cut through the noise and understand what the numbers really mean for investors today.

Why Adobe is lagging behind its peers

Approach 1: Adobe Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its expected future cash flows and then discounting them back to today’s value. This approach is particularly useful for businesses like Adobe that generate strong and predictable free cash flows.

For Adobe, the analysis looks at its current Free Cash Flow, which stands at $9.50 billion. Analysts provide cash flow projections for up to five years, with further forecasts extrapolated to round out a ten-year view. Looking ahead, Adobe’s Free Cash Flow is expected to reach $13.3 billion by 2029, indicating healthy growth as the company continues to invest in its core platforms and artificial intelligence capabilities.

Using this two-stage Free Cash Flow to Equity DCF model, the estimated fair value of Adobe’s shares is $562.73. This suggests the stock is trading at a 36% discount to its intrinsic value based solely on these projected cash flows.

If the market aligns with the company’s fundamentals, there could be notable upside for patient investors willing to look past the current noise.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Adobe is undervalued by 36.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

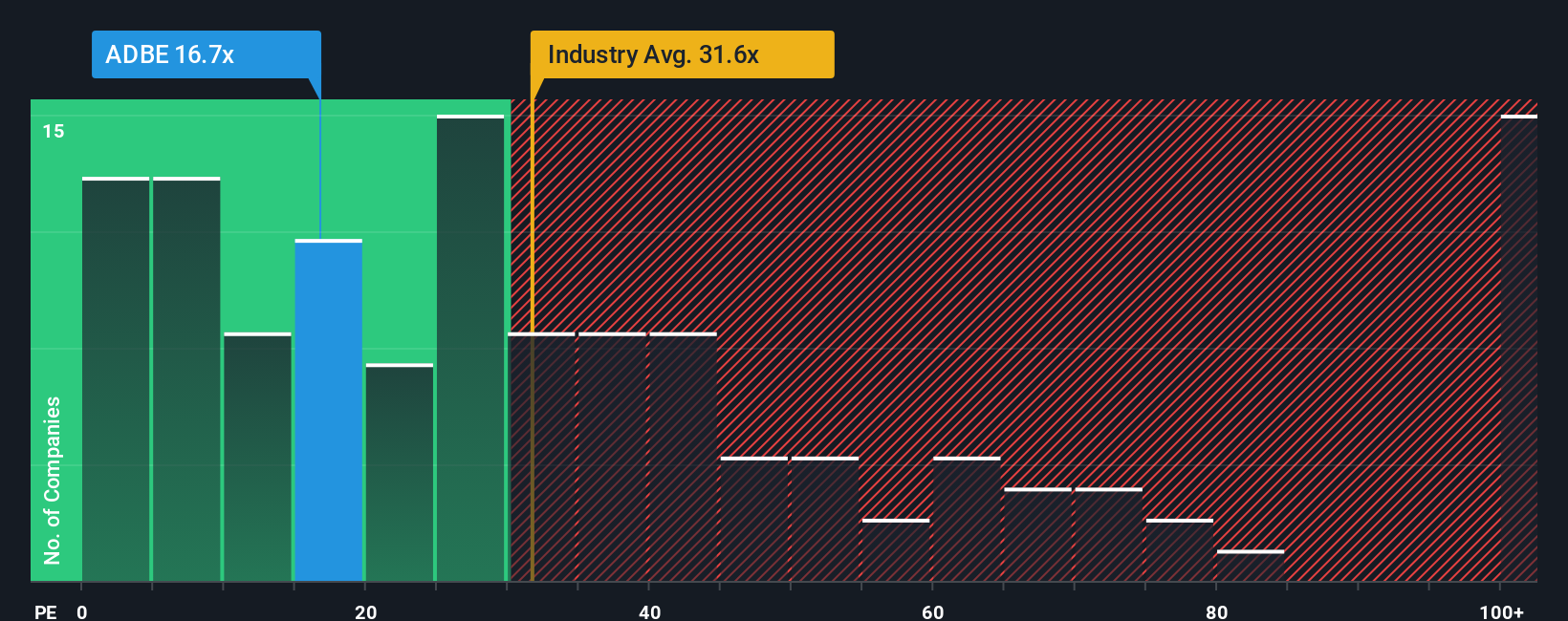

Approach 2: Adobe Price vs Earnings

The Price-to-Earnings (P/E) ratio is one of the most common ways to value profitable companies like Adobe. It measures how much investors are willing to pay for each dollar of current earnings, making it especially useful for firms with consistent profits and established business models.

Market expectations for growth and perceived risk are big factors that determine what qualifies as a “normal” or “fair” P/E ratio for any given company. High-growth and lower-risk companies often trade at premium multiples, while firms facing uncertainty or slower prospects are usually valued at a discount.

At present, Adobe trades at a P/E ratio of 21.66x, which is well below both its industry average of 34.25x and the peer average of 61.41x. However, these simple comparisons can miss important context. That is where Simply Wall St's Fair Ratio comes in. For Adobe, the Fair Ratio is 38.18x, a proprietary benchmark that considers more than just raw earnings or competitive averages. It blends in variables like expected earnings growth, market cap, industry, margins and risk to arrive at a more tailored fair value multiple.

Using this method gives a clearer sense of value because it accounts for Adobe’s specific strengths and challenges, rather than just assuming all companies in the industry should trade similarly. When comparing the current 21.66x P/E to the Fair Ratio of 38.18x, Adobe’s shares appear undervalued on an earnings basis at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

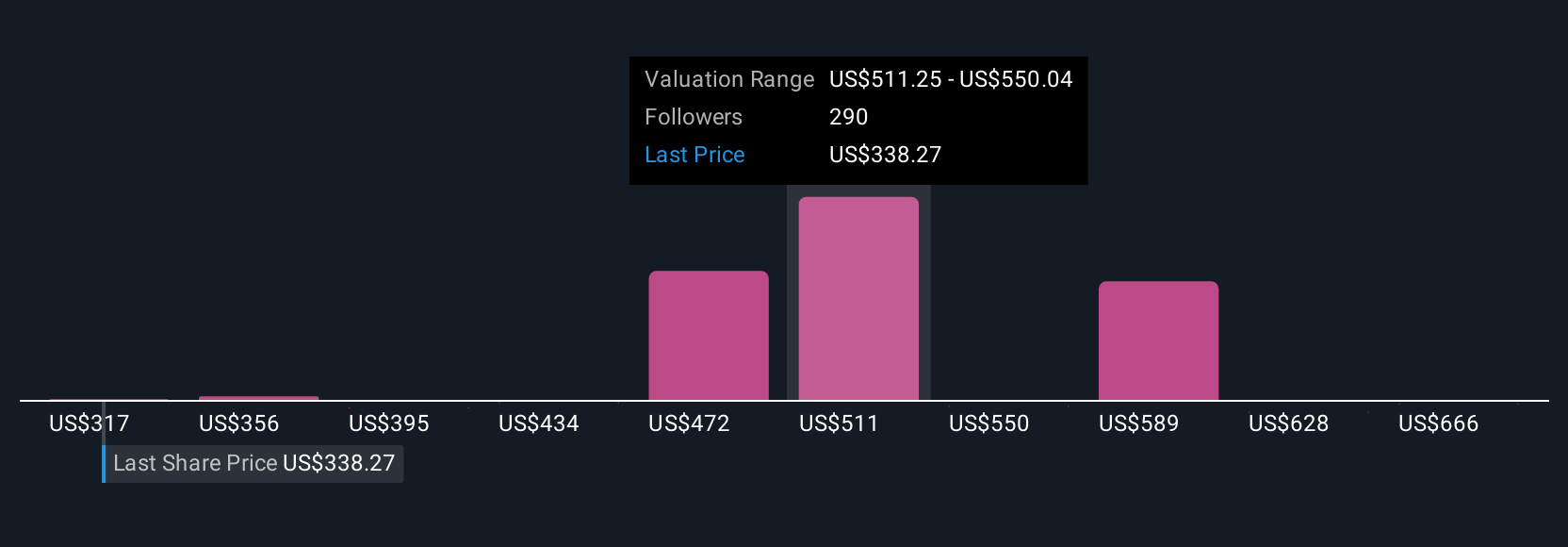

Upgrade Your Decision Making: Choose your Adobe Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way to combine your big-picture view of a company—why it will win, struggle, or thrive—directly with your numbers: your assumptions about Adobe’s future revenue, profit margins, and what you would pay as a fair price.

Narratives connect a company’s story to a concrete financial forecast and ultimately your estimate of fair value, putting your perspective at the center of your investing process. On Simply Wall St’s Community page, Narratives make it easy for anyone to build and share these story-driven valuations, compare them with millions of investors, and see how Fair Value compares to today’s price.

Best of all, Narratives do not stay static. They update automatically when new information hits the market, such as earnings or news. For Adobe, you will see bullish Narratives valuing the stock at $605 (expecting rapid AI-driven growth) and more bearish ones at $380 (pricing in fierce competition and margin pressure). Narratives empower you to make smarter decisions based on your beliefs and the evolving facts.

Do you think there's more to the story for Adobe? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion