- United States

- /

- Software

- /

- NasdaqCM:ABTC

American Bitcoin (ABTC): Assessing Valuation After a Sharp Multi-Month Share Price Pullback

Reviewed by Simply Wall St

American Bitcoin stock reacts to mounting losses and sharp pullback

American Bitcoin (ABTC) has quietly slid over the past month, with the stock down roughly 66% and about 78% in the past 3 months. This has prompted investors to reassess its Bitcoin focused model.

See our latest analysis for American Bitcoin.

That rapid drawdown sits on top of an already weak year to date share price return of about 75% and signals fading momentum as investors reassess both Bitcoin volatility and American Bitcoin’s ability to turn its infrastructure ambitions into durable cash flows.

If this sharp pullback has you rethinking your exposure, it can help to compare with other high growth tech names by exploring high growth tech and AI stocks.

With shares now trading far below analyst targets yet still tied to highly volatile Bitcoin economics, investors face a key question: is ABTC a beaten down mispricing to accumulate, or is the market already baking in limited future upside?

Price-to-Earnings of 8.9x: Is it justified?

ABTC changes hands at a price-to-earnings ratio of 8.9x, a steep discount to both peers and the broader US Software industry despite its recent sell off.

The price-to-earnings multiple compares what investors pay today for each dollar of current earnings. It is especially closely watched for profitable software and infrastructure platforms. For American Bitcoin, a low P/E can signal the market is sceptical that today’s earnings power and Bitcoin linked returns are sustainable.

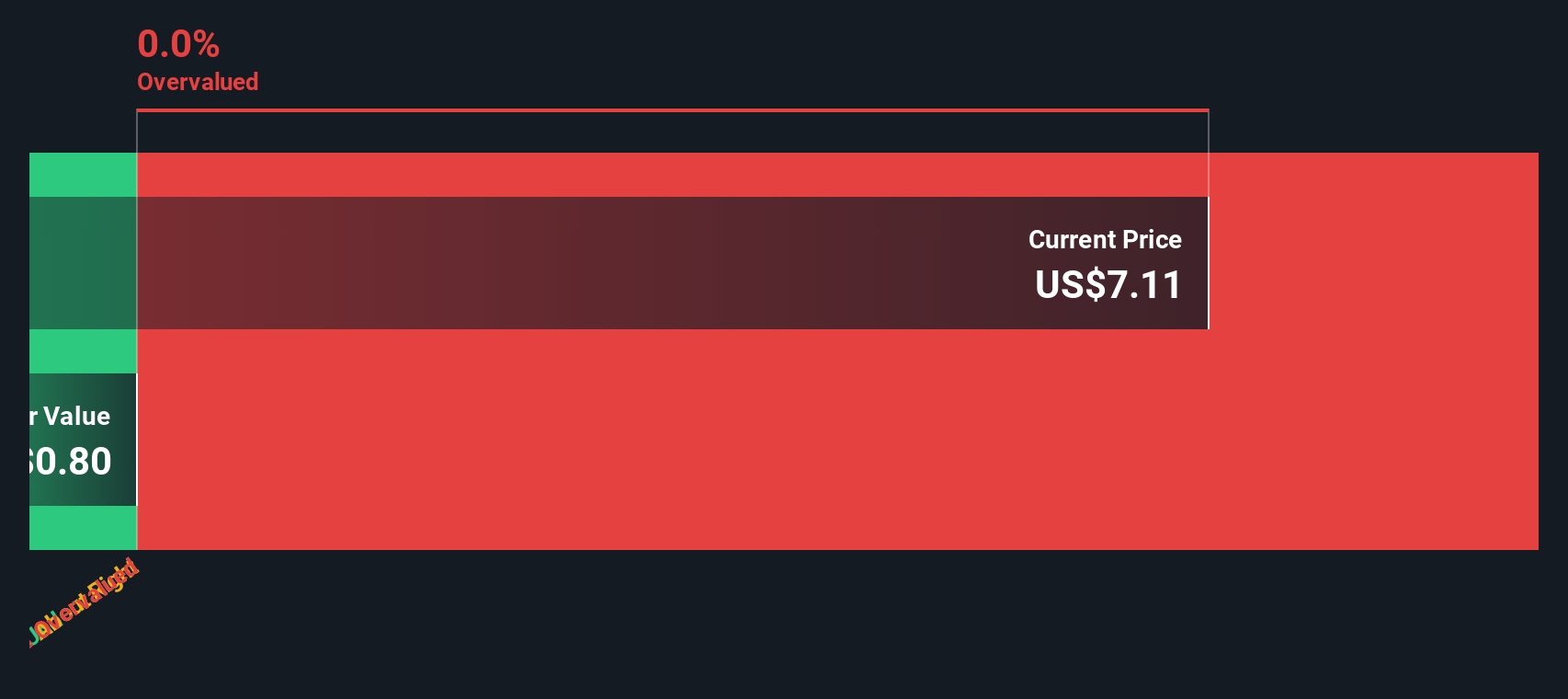

Against that backdrop, ABTC’s 8.9x P/E looks striking when set beside the US Software industry average of 31.2x and an even richer 35.9x peer average. The gap implies investors are heavily discounting its future profit path relative to typical software names, even though the stock is also trading 45.9% below our SWS DCF fair value estimate of 2.94 dollars.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.9x (UNDERVALUED)

However, lingering Bitcoin price volatility and American Bitcoin’s falling net income growth could quickly erode today’s apparent valuation discount if conditions worsen.

Find out about the key risks to this American Bitcoin narrative.

Another View: Cash Flows Tell a Different Story

ABTC looks cheap on an 8.9x earnings multiple, yet our DCF model points to shares trading around 45.9% below a fair value of 2.94 dollars. If both earnings and cash flows indicate undervaluation, is the discount an opportunity, or a warning about future Bitcoin risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Bitcoin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Bitcoin Narrative

If you see the data differently or want to stress test your own assumptions, you can build a personalized view in just minutes: Do it your way.

A great starting point for your American Bitcoin research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity when you can scan the market like a pro. Use the Simply Wall St screener to explore more investment candidates that may fit your strategy.

- Consider these 3616 penny stocks with strong financials with resilient balance sheets and the potential for earnings growth.

- Look at these 25 AI penny stocks that are involved in automation and data-related developments.

- Explore these 918 undervalued stocks based on cash flows that are trading below estimates of their cash flow-based fair values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABTC

American Bitcoin

A Bitcoin accumulation platform company, focuses on building Bitcoin infrastructure platform.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion