- United States

- /

- Semiconductors

- /

- NYSEAM:EMAN

The eMagin (NYSEMKT:EMAN) Share Price Has Soared 304%, Delighting Many Shareholders

eMagin Corporation (NYSEMKT:EMAN) shareholders might be concerned after seeing the share price drop 21% in the last week. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In fact, it is up 304% in that time. So we wouldn't blame sellers for taking some profits. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for eMagin

Given that eMagin didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, eMagin's revenue grew by 25%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 304% in the last year. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at eMagin.

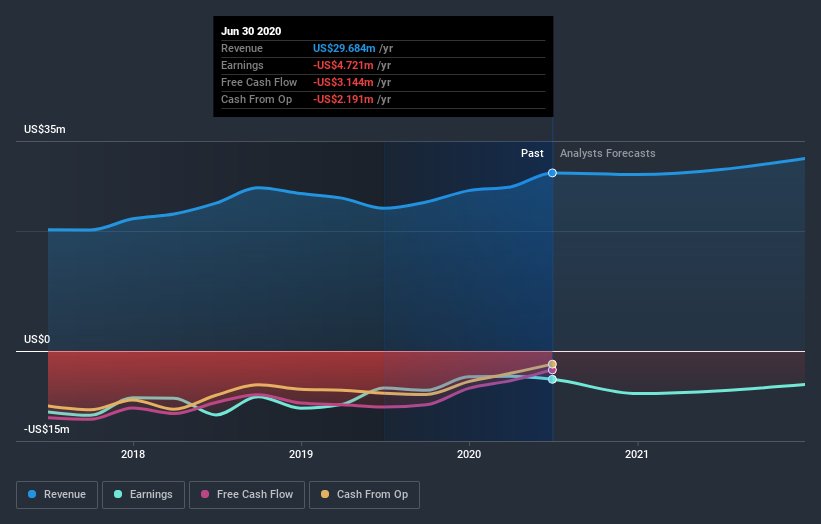

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on eMagin's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that eMagin has rewarded shareholders with a total shareholder return of 304% in the last twelve months. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - eMagin has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

But note: eMagin may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade eMagin, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:EMAN

eMagin

eMagin Corporation engages in the design, develop, manufacture, and market of organic light emitting diode (OLED) miniature displays on-silicon micro displays, virtual imaging products that utilize OLED micro displays, and related products in the United States and internationally.

Imperfect balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion