- United States

- /

- Semiconductors

- /

- NYSE:TSM

A Fresh Look at TSMC (NYSE:TSM) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Taiwan Semiconductor Manufacturing.

TSMC’s recent gains reflect continued strong momentum that has been building over the past year, with its 1-year total shareholder return soaring past 60% and the latest 90-day share price return showing over 21% growth. While the past month saw a modest pullback, the long-term trend signals investors remain confident about the company’s growth potential and its pivotal role in the global semiconductor industry.

If you’re curious which other leading tech and semiconductor companies have been gaining traction lately, see the full list for free with our curated See the full list for free..

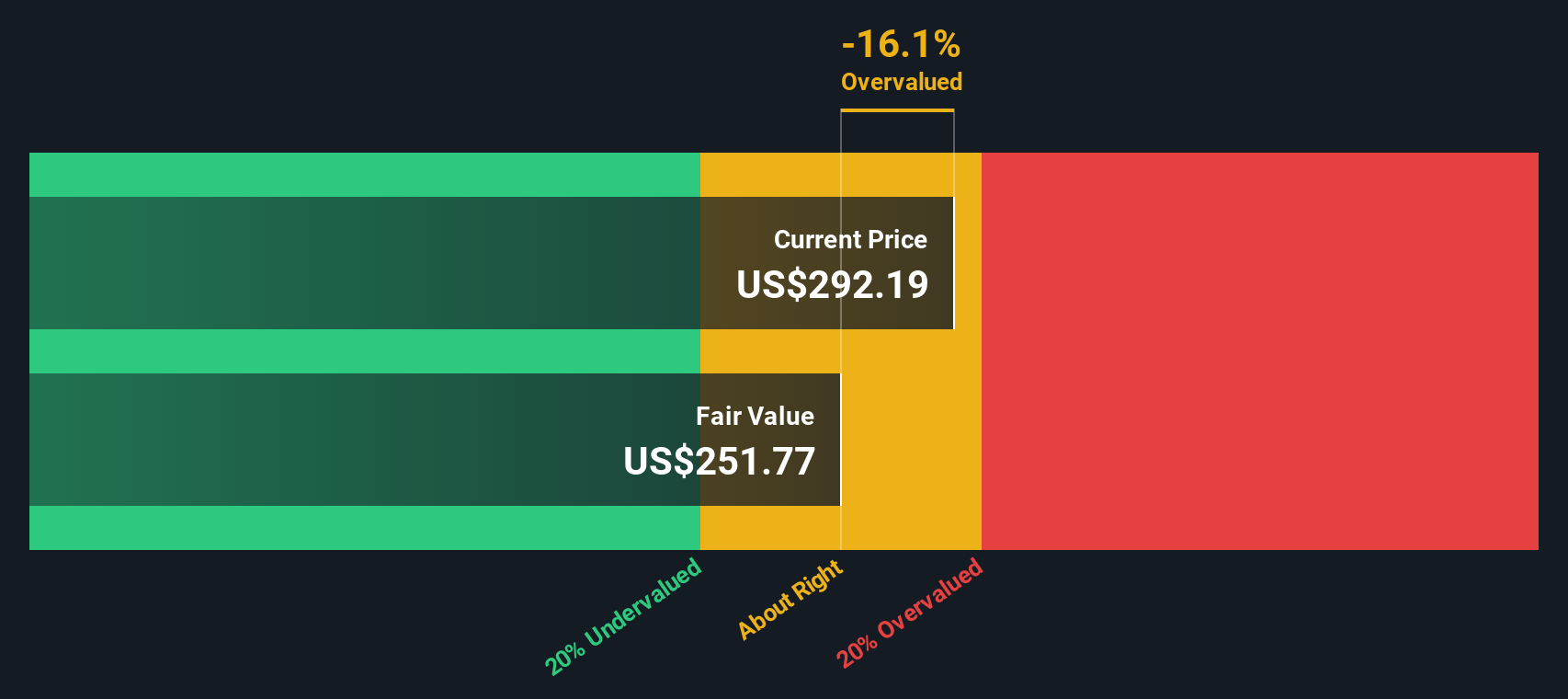

With shares hovering near record highs and a strong track record of growth, investors are left wondering if Taiwan Semiconductor Manufacturing is trading at a rare discount or if future gains are already priced in by the market.

Most Popular Narrative: 6.5% Undervalued

According to oscargarcia’s widely followed narrative, Taiwan Semiconductor Manufacturing’s fair value is set notably higher than its recent $289.96 close. This suggests there is still some headroom left before reaching what the narrative considers full value. The story focuses on the company’s scale, AI-driven growth trajectory, and disciplined capital deployment as driving factors for this estimate.

TSMC is the central pillar of the global semiconductor ecosystem, powering the AI revolution with unmatched scale, cutting-edge process technology, and disciplined execution. With record profits, dominant client base, and massive expansion underway, both in Taiwan and abroad, it stands as a low-risk way to own the AI infrastructure wave. Although geopolitical and trade risks loom, its moat, margins, and market position offer a rare combination of growth, profitability, and stability.

Want to know why this valuation is turning heads? It is all about jaw-dropping earnings momentum, industry-leading margins, and enormous expansion bets that could reshape TSMC’s profit profile. See what bold numbers this narrative is built on and why investors are buzzing.

Result: Fair Value of $310 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, geopolitical friction and higher operating costs from global expansion could still challenge TSMC’s growth story. These factors may present potential risks for investors.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: SWS DCF Model Offers a Cautious Take

Our SWS DCF model provides a different perspective and estimates Taiwan Semiconductor Manufacturing's fair value at $220.08. This suggests the current price may be outpacing long-term cash flow fundamentals, raising the question of whether the recent optimism could expose investors to a downside surprise.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiwan Semiconductor Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If these viewpoints do not quite match your take, you can dive into the data and quickly craft your own unique narrative in just a few minutes. Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on the next big opportunity. Use the Simply Wall Street Screener and put top-rated stocks and creative strategies at your fingertips.

- Boost your income potential by starting with these 15 dividend stocks with yields > 3%, offering attractive yields above 3% for stronger portfolio cash flow.

- Get ahead of market trends and tap into these 25 AI penny stocks, shaping the future with groundbreaking artificial intelligence breakthroughs.

- Supercharge your returns by targeting value with these 927 undervalued stocks based on cash flows, based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success