- United States

- /

- Semiconductors

- /

- NYSE:ONTO

Will New Product Demand and Advanced Packaging Momentum Change Onto Innovation's (ONTO) Narrative?

Reviewed by Sasha Jovanovic

- Onto Innovation recently reported third-quarter 2025 earnings reflecting US$218.19 million in sales and US$28.22 million in net income, with performance supported by new product qualifications and advanced packaging momentum.

- Ongoing projects with high-bandwidth memory customers and strong guidance for the upcoming quarter suggest that Onto Innovation is poised to expand its presence in the AI and advanced semiconductor markets.

- We'll explore how Onto Innovation's upbeat outlook, underpinned by significant new product demand, impacts its investment narrative and future prospects.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Onto Innovation Investment Narrative Recap

To be an Onto Innovation shareholder, you need to believe in a sustained wave of AI-driven demand for advanced packaging and semiconductor process control, which the company aims to capture through its technology portfolio. The latest quarterly results confirmed upbeat guidance for the next quarter, and while the business expects a significant Q4 rebound from new product adoption, the single largest short-term risk remains the possibility of customer spending delays in AI and memory markets. The company’s current momentum appears supportive, but any slowdown in customer ramp or weaker-than-expected spend could materially challenge the near-term thesis.

Among recent announcements, management’s guidance for fourth-quarter revenue of US$250 million to US$265 million and GAAP diluted EPS of US$0.85 to US$1.00 stands out as most relevant, reflecting management's view of a strong sequential turnaround built on newly qualified products and advanced packaging programs. Key orders and shipments for the latest generation Dragonfly and 3Di systems suggest that customer validation is translating into actual demand, tying directly to the main growth catalyst investors are watching.

Yet, in contrast to these positive signals, investors should also be alert to the ongoing risk of concentrated exposure to just a handful of key customers in...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.4 billion in revenue and $311.2 million in earnings by 2028. This requires 11.0% yearly revenue growth and a $111.3 million increase in earnings from the current $199.9 million.

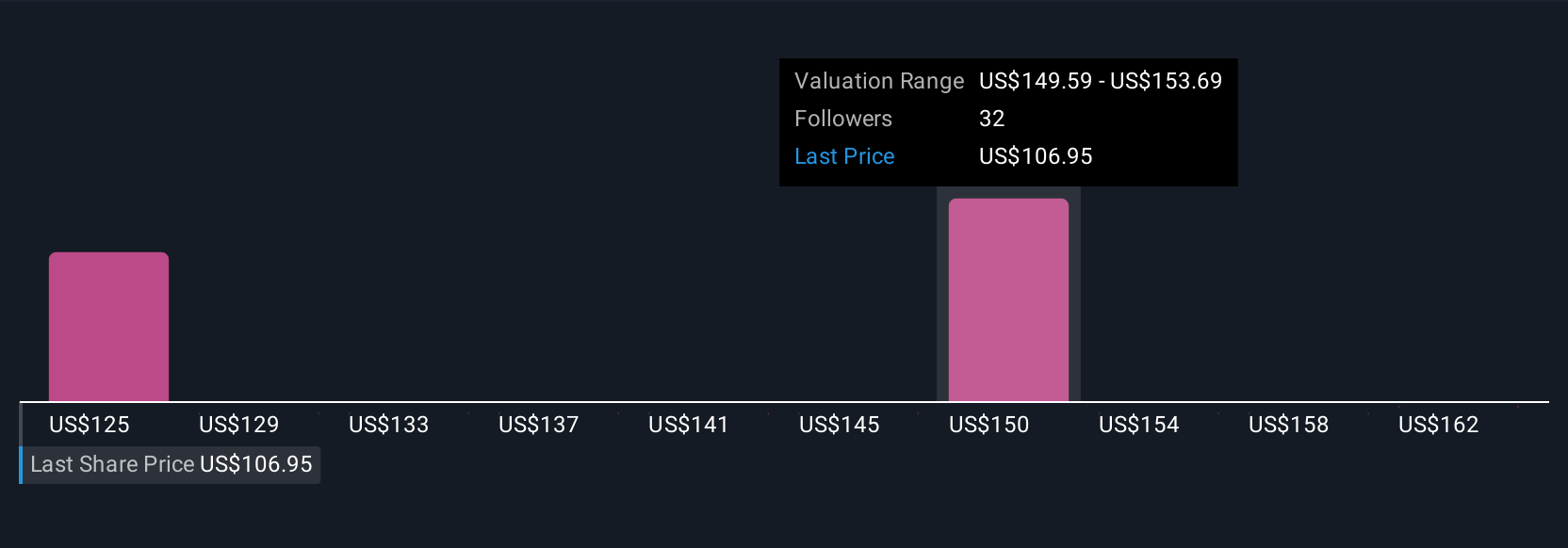

Uncover how Onto Innovation's forecasts yield a $149.38 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted three fair value estimates for Onto Innovation ranging from US$132 to US$149.38. While some see near-term growth drivers, concentrated customer risk could weigh on future results so explore several viewpoints.

Explore 3 other fair value estimates on Onto Innovation - why the stock might be worth 5% less than the current price!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives