- United States

- /

- Semiconductors

- /

- NYSE:ONTO

Onto Innovation (ONTO): Assessing Valuation as Shares Rally 30% in One Month

Reviewed by Kshitija Bhandaru

See our latest analysis for Onto Innovation.

After a tough start to the year, Onto Innovation’s momentum has picked up dramatically, with a 29.8% one-month share price return driving renewed optimism despite a 35.3% decline in total shareholder return over the past year. Longer-term investors are still well ahead, supported by a remarkable 118% three-year total shareholder return. This suggests that recent volatility may be a pause within a much broader growth story.

If this upward swing has sparked your interest, it might be the perfect time to discover See the full list for free.

But with shares up so sharply, the key question now is whether Onto Innovation is trading below its true value or if the current price already reflects all expected future growth. This leaves investors wondering if there is more upside.

Most Popular Narrative: Fairly Valued

Onto Innovation's current share price of $135.11 is very close to the most popular narrative's fair value estimate of $133.75. This creates a tight valuation debate for investors.

The accelerating adoption of AI packaging and advanced 2.5D/3D logic architectures is driving a major step up in demand for Onto Innovation's next-generation Dragonfly systems. Strong customer pull and new applications are expanding both revenue and potential gross margin through higher ASPs and increased market share within leading-edge chip production.

Is a next-gen product cycle about to unlock multi-year growth and margin expansion? The narrative leans on future gains in key metrics yet to be revealed. What game-changing assumptions fuel this fair value? Explore and decide for yourself.

Result: Fair Value of $133.75 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower-than-expected demand rebound or ongoing geopolitical uncertainties could undermine the growth story and challenge bullish expectations for Onto Innovation.

Find out about the key risks to this Onto Innovation narrative.

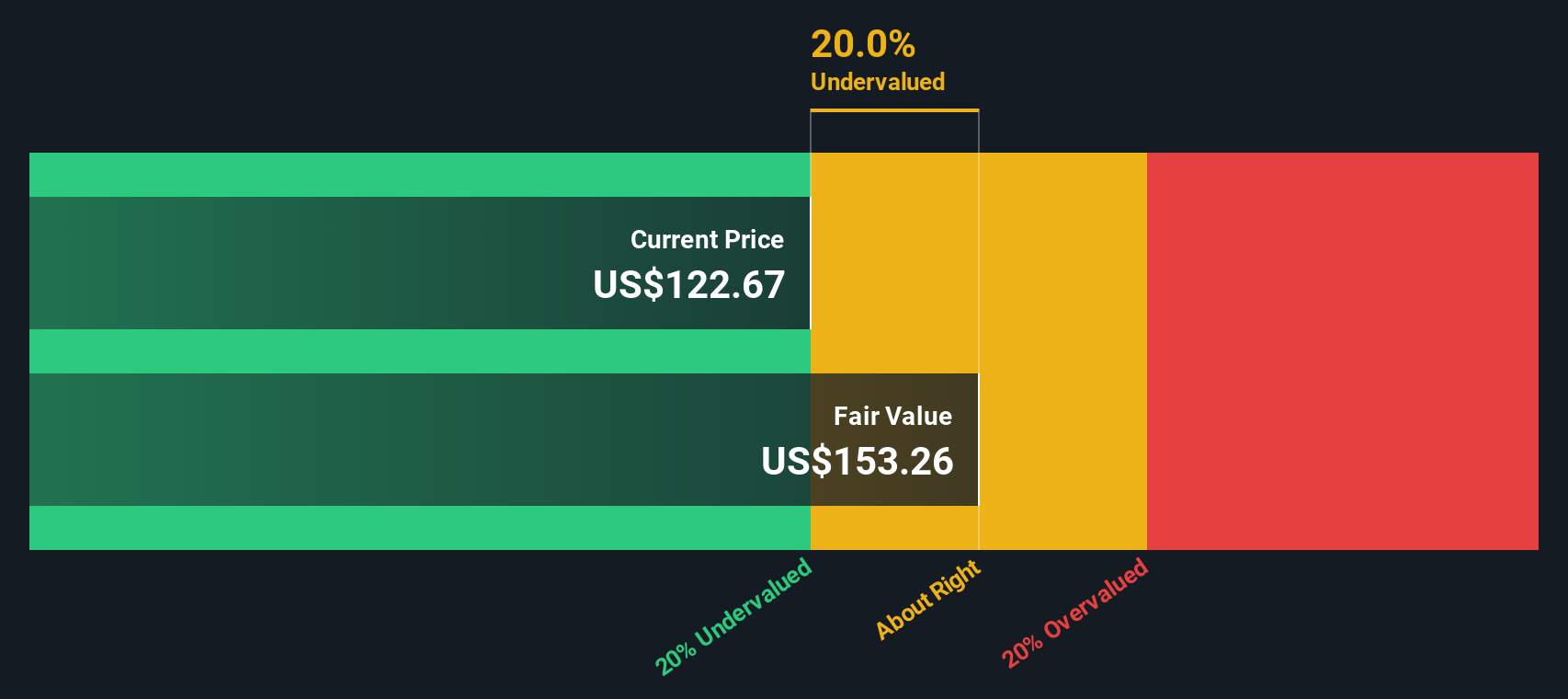

Another View: Our DCF Model Finds Undervaluation

While the most popular narrative sees Onto Innovation as fairly valued based on price-to-earnings, our SWS DCF model offers a different perspective. Using cash flow forecasts, the DCF model estimates Onto’s fair value at $150.59, which is around 10% above today’s share price. Could the market be missing future upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Onto Innovation Narrative

If you see things differently or want to dive into your own analysis, you can build a personal narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Onto Innovation.

Looking for more investment ideas?

Want to keep your portfolio ahead of the market? Smart investors seize new opportunities when they spot them, and Simply Wall Street’s screeners are packed with powerful ideas.

- Supercharge your long-term growth by targeting reliable return streams with these 19 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Ride the next technology wave and tap into the future of medicine by harnessing breakthroughs with these 32 healthcare AI stocks.

- Capture undervalued gems before the crowd catches on by zeroing in on these 897 undervalued stocks based on cash flows that are primed for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives