- United States

- /

- Semiconductors

- /

- NYSE:JKS

Is U.S. Energy Storage Milestone Altering The Investment Case For JinkoSolar (JKS)?

Reviewed by Simply Wall St

- Earlier this month, JinkoSolar Holding commissioned 21.6 MWh of energy storage systems for three Distributed Energy Infrastructure projects in Massachusetts under the state's SMART program.

- This accomplishment highlights JinkoSolar's ability to deliver advanced, integrated energy storage solutions that enhance grid resilience and support local clean energy goals in the U.S. market.

- Now, we'll explore how JinkoSolar's successful energy storage deployment could influence its investment outlook, particularly around U.S. market growth.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

JinkoSolar Holding Investment Narrative Recap

For investors considering JinkoSolar Holding, belief in the ongoing global transition to renewable energy is central, along with confidence that the company can capture growing opportunities in U.S. clean energy markets. While the successful commissioning of energy storage systems in Massachusetts reinforces JinkoSolar’s position in integrated renewables, the immediate impact on the biggest short-term catalyst, recovery in U.S. shipments and improved profitability, may be limited as market pressures and policy uncertainties remain significant near-term risks.

Among recent developments, the company’s groundbreaking work with high-efficiency Tiger Neo modules in Spain stands out. This aligns with JinkoSolar’s focus on expanding its solar and storage projects internationally to boost revenue and margin performance, key factors that could help address supply challenges and price fluctuations affecting earnings.

However, despite these technical wins, it’s important for investors to be aware that ongoing policy uncertainties in the U.S. solar market could still impact JinkoSolar’s recovery, especially if...

Read the full narrative on JinkoSolar Holding (it's free!)

JinkoSolar Holding's outlook anticipates CN¥123.3 billion in revenue and CN¥1.4 billion in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 14.1% and a CN¥3.3 billion earnings increase from the current earnings of CN¥-1.9 billion.

Exploring Other Perspectives

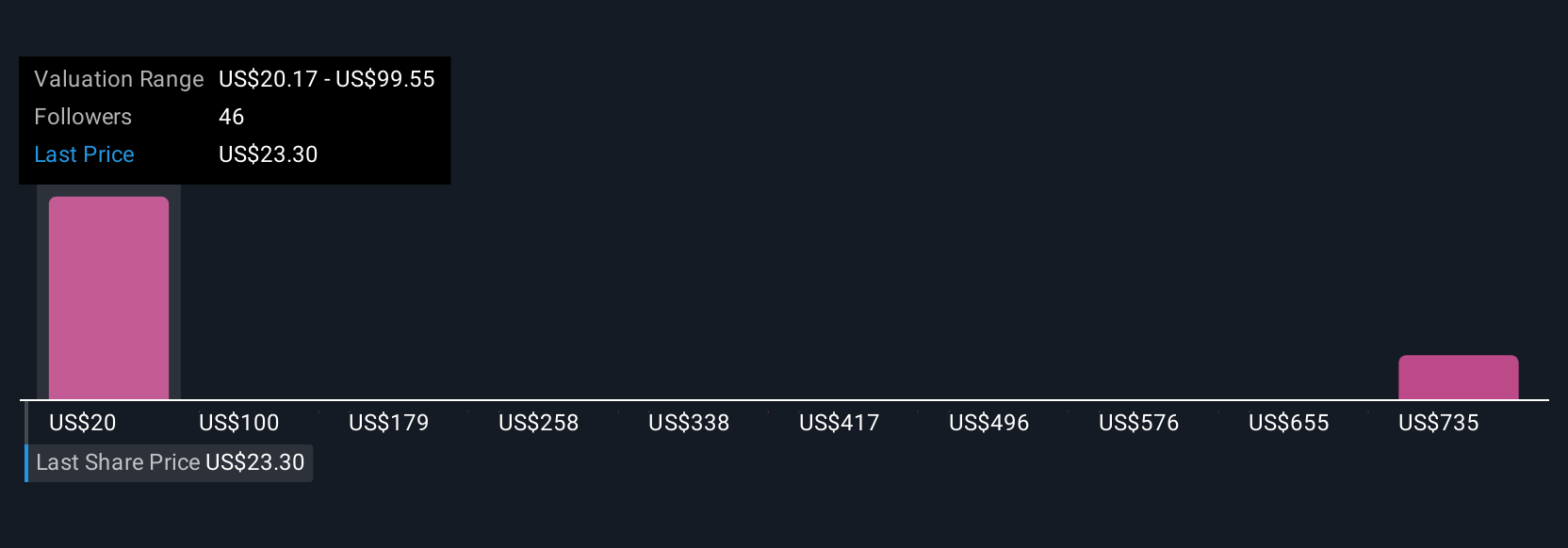

The Simply Wall St Community contributed four fair value estimates for JinkoSolar ranging from US$20.17 to US$813.11 per share. With US trade policies and tariffs in focus, your assumptions about future US market access play a big role in how you view the company, explore several perspectives before deciding for yourself.

Build Your Own JinkoSolar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JinkoSolar Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JinkoSolar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JinkoSolar Holding's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives