- United States

- /

- Semiconductors

- /

- NYSE:DQ

Revenue Downgrade: Here's What Analysts Forecast For Daqo New Energy Corp. (NYSE:DQ)

The analysts covering Daqo New Energy Corp. (NYSE:DQ) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

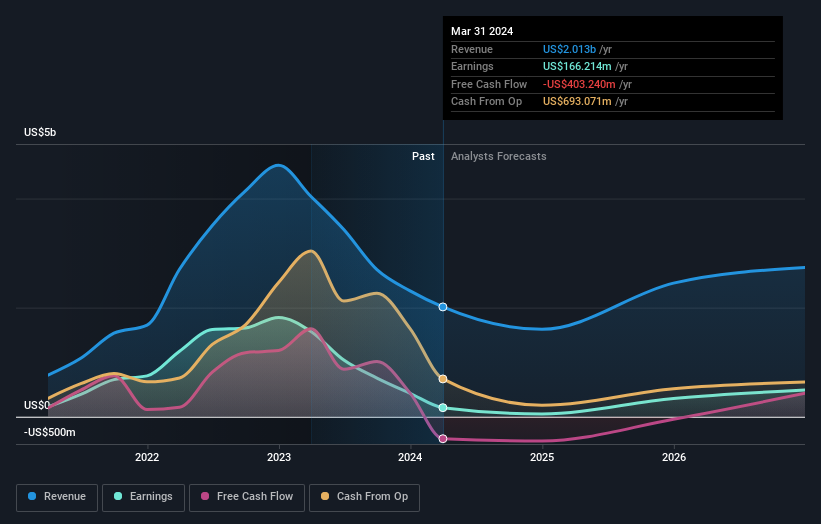

Following the latest downgrade, the nine analysts covering Daqo New Energy provided consensus estimates of US$1.6b revenue in 2024, which would reflect a painful 20% decline on its sales over the past 12 months. Statutory earnings per share are anticipated to plunge 70% to US$0.77 in the same period. Before this latest update, the analysts had been forecasting revenues of US$1.9b and earnings per share (EPS) of US$0.77 in 2024. So there's been a clear change in analyst sentiment in the recent update, with the analysts making a substantial drop in revenues and reconfirming their earnings per share estimates.

View our latest analysis for Daqo New Energy

The average price target was steady at US$23.41 even though revenue estimates declined; likely suggesting the analysts place a higher value on earnings.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Daqo New Energy's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 26% by the end of 2024. This indicates a significant reduction from annual growth of 42% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 18% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Daqo New Energy is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Daqo New Energy's revenues are expected to grow slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Daqo New Energy after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Daqo New Energy analysts - going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DQ

Daqo New Energy

Manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.