- United States

- /

- Semiconductors

- /

- NYSE:DQ

Evaluating Daqo New Energy (NYSE:DQ): Is There More Value After the Recent Three-Month Rally?

Reviewed by Kshitija Bhandaru

Daqo New Energy (NYSE:DQ) has been catching some attention lately as investors analyze its recent stock performance, which includes meaningful gains over the past three months. With volatility in the solar sector, there is increasing curiosity about what is next for DQ.

See our latest analysis for Daqo New Energy.

After surging nearly 30% over the last three months, Daqo New Energy’s recent share price rally stands out, especially given the ongoing volatility in the solar industry. While the 1-year total shareholder return sits just under 30% and the longer-term picture after three and five years remains negative, the current momentum suggests investors are warming to the stock’s growth prospects and shifting risk perceptions.

If Daqo’s momentum has you on the lookout for what else is gaining traction, this could be the right time to discover fast growing stocks with high insider ownership

But with shares climbing and recent results in the spotlight, the big question is whether Daqo New Energy is trading at a bargain or if markets have already factored in the company’s growth. Could there still be a buying opportunity?

Most Popular Narrative: 3.9% Undervalued

Daqo New Energy’s latest consensus narrative puts its fair value at $26.58, just above the last close of $25.55. This spotlights a delicate price edge as investors analyze short-term volatility alongside long-term growth potential.

Recent regulatory interventions by Chinese authorities to curb irrational competition and enforce sales above production costs are expected to stabilize polysilicon prices and improve industry profitability. These changes could directly support future revenue and margins for Daqo.

Curious how key policy changes and bold growth assumptions shape this narrative’s optimistic outlook? The consensus relies on rapid industry transformation and a significant shift in Daqo’s financial prospects. Want to learn the pivotal numbers and debate fueling this projected value? Discover the major drivers that could influence Daqo’s next chapter inside the full narrative.

Result: Fair Value of $26.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry oversupply and Daqo’s recurring operating losses could quickly undermine this upbeat outlook if conditions do not improve as expected.

Find out about the key risks to this Daqo New Energy narrative.

Another View: What Does Our DCF Model Say?

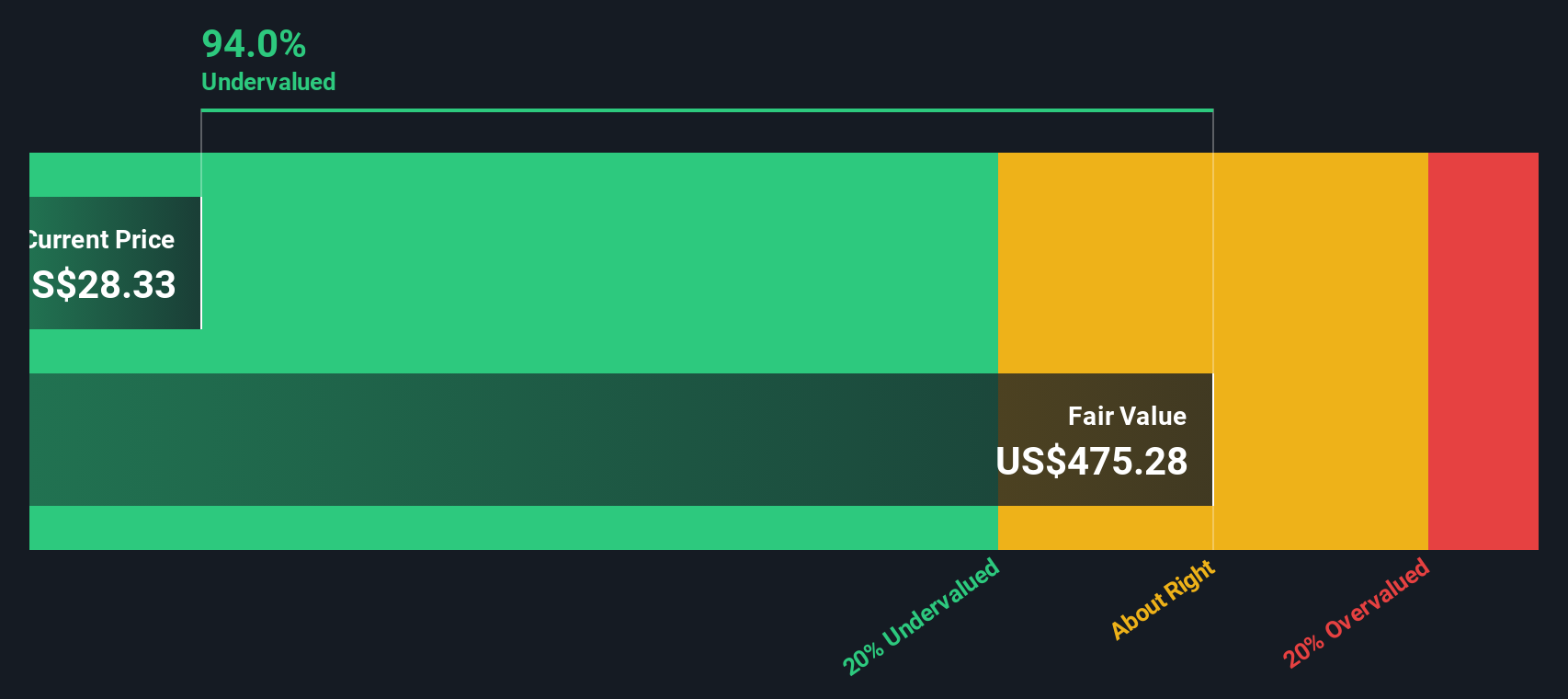

Looking beyond traditional valuation ratios, the SWS DCF model paints an eye-opening picture. Daqo New Energy’s shares are trading more than 90% below our estimated fair value of $464.26. This signals a potential deep undervaluation, or are there long-term uncertainties the market sees that the model does not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daqo New Energy Narrative

If these analyses do not match your views or you want to draw your own conclusions, you can build a custom assessment faster than you might think. Do it your way

A great starting point for your Daqo New Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just watch from the sidelines when untapped investment trends are driving opportunity. Spark your strategy by targeting emerging winners and robust potential with tailored stock lists.

- Earn higher yields and steady income by tapping into these 18 dividend stocks with yields > 3% with payouts above 3%.

- Capitalize on innovation by selecting these 25 AI penny stocks that are powering the artificial intelligence revolution across industries.

- Grow your portfolio’s value with confidence by acting on these 891 undervalued stocks based on cash flows identified for strong fundamentals and market mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DQ

Daqo New Energy

Manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026