- United States

- /

- Semiconductors

- /

- NasdaqGS:UCTT

Ultra Clean Holdings (UCTT): Losses Worsen, Challenging Bullish Revenue Growth Narratives

Reviewed by Simply Wall St

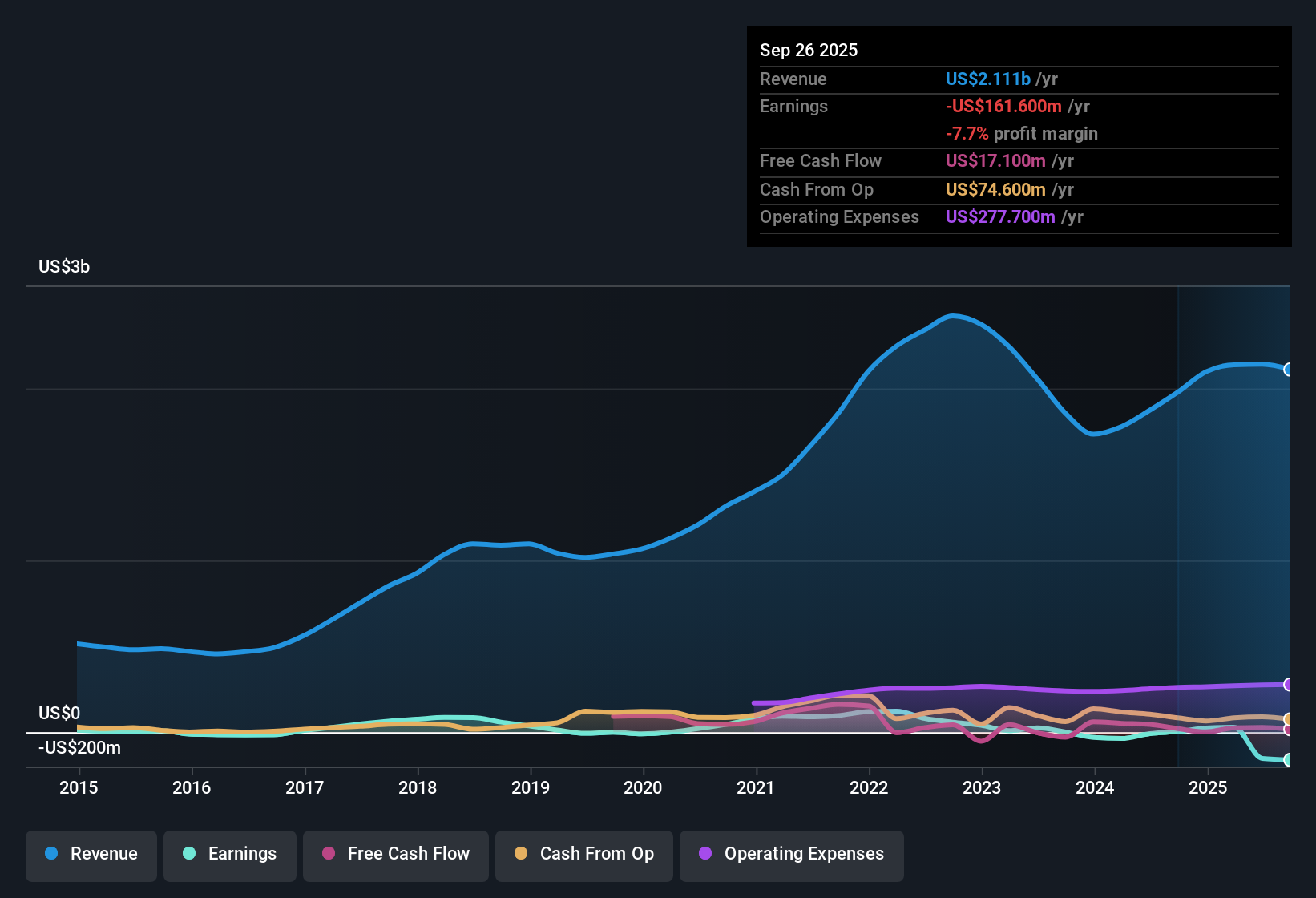

Ultra Clean Holdings (UCTT) reported persistent unprofitability this quarter, with annual losses having grown rapidly at a rate of 62% per year over the last five years. Despite the red ink, revenue is forecast to rise by 10.6% per year, just above the broader US market’s 10.2% outlook. The company’s price-to-sales ratio of 0.6x stands well below both peers and the semiconductor industry average. For investors, robust revenue growth and relative valuation might offer reasons for optimism, but ongoing bottom-line losses and margin pressure remain significant concerns.

See our full analysis for Ultra Clean Holdings.Next, we’ll set these headline numbers against the major narratives in the market to see which themes hold up and which get challenged by the latest results.

See what the community is saying about Ultra Clean Holdings

Heavy Losses Outpace Revenue Growth

- Annual losses have grown by 62% per year over the last five years, while revenue is merely forecast to grow 10.6% per year. This points to a widening gap between top-line expansion and the company's path to profitability.

- According to analysts' consensus view, persistent unprofitability is a significant concern despite new business wins and efforts at cost reduction.

- Expansion in advanced fab markets and AI-driven investment could drive long-term growth, but near-term progress is offset by ongoing margin pressure and the lack of a tangible move toward profitability.

- Cost reduction initiatives and organizational changes are expected to improve operational efficiency; however, their impact is yet to translate into a meaningful improvement in net margins or earnings.

- Curious how analysts think these losses shape Ultra Clean's future? See their detailed take in the consensus narrative. 📊 Read the full Ultra Clean Holdings Consensus Narrative.

Margin Compression Amid Cost Cuts

- Net profit margin stands at -7.1% today, and while it is projected to recover to 2.4% within three years, this still leaves Ultra Clean trailing typical semiconductor industry profitability.

- Analysts' consensus view notes margin improvements depend on ongoing cost reduction and vertical integration efforts.

- Consolidation, factory/site rationalization, and deployment of SAP systems are underway to improve margins, but recurring supply chain headwinds, particularly tariff costs, could continue to erode gains.

- Diversification, including new services and acquired business units, may stabilize revenue, though upside on profitability is likely to emerge only if operational improvements materialize as projected.

Share Price Lags Despite Deep Valuation Discount

- Ultra Clean trades at $28.59 with a price-to-sales ratio of 0.6x, far below peers (6.1x) and the broader semiconductor industry (5.2x), and also sits below its DCF fair value ($29.95). This suggests the market is cautious despite valuation signals.

- In the analysts' consensus narrative, the low valuation is a double-edged sword:

- Bulls may see upside as the share price is below DCF fair value and analyst price targets (both above $29.95), but bears highlight that heavy customer concentration, industry cyclicality, and a history of underperformance still cloud the path to a full recovery.

- Significant reliance on a small group of large customers and ongoing margin headwinds introduce risk that keeps sentiment muted, even as the stock appears "cheap" by sales multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ultra Clean Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? Take a few minutes to build your take and shape the story. Do it your way.

A great starting point for your Ultra Clean Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ultra Clean Holdings continues to face persistent losses, margin pressure, and limited signs of achieving consistent profitability. This remains the case even with its revenue growth and cost-cutting initiatives.

Seeking steadier returns and less volatility? Check out stable growth stocks screener (2122 results) to zero in on companies that deliver reliable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UCTT

Ultra Clean Holdings

Develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry in the United States and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives