- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (TXN): Assessing Valuation After Q3 Beat, Dividend Hike, and Cautious Outlook

Reviewed by Simply Wall St

Texas Instruments (TXN) just beat Wall Street’s expectations for its third quarter, posting solid revenue growth and announcing a fresh dividend increase. However, the company’s cautious outlook for the coming quarter signals some headwinds.

See our latest analysis for Texas Instruments.

Despite upbeat third-quarter results and a 4% dividend hike, Texas Instruments shares fell sharply following the latest report, closing at $170.71 after a 5.6% one-day drop. The company’s year-to-date share price return of -8.69% reflects a market growing more cautious in light of soft Q4 guidance and a slower than usual chip sector rebound. Still, its 3- and 5-year total shareholder returns of 18.3% and 37.4% show TI’s long-term performance remains solid, even as near-term momentum fades.

If you’re looking for other movers in the tech and semiconductor space, now is the perfect moment to see who’s leading the charge with See the full list for free.

With shares off their highs and guidance painting a cloudy short-term picture, investors may be asking whether Texas Instruments is now undervalued and poised for a rebound, or if the market is accurately pricing in the company’s future growth prospects.

Most Popular Narrative: 15.9% Undervalued

Texas Instruments’ most widely followed analyst narrative sees the stock’s fair value at $203.06, which is well above the last close of $170.71. This sets up a compelling case that focuses on growth drivers extending far beyond the recent quarterly volatility.

Strategic investment in U.S.-based 300mm wafer fabs and a diversified global manufacturing footprint uniquely position TI to benefit from evolving supply chain localization and customer preferences for geopolitically resilient suppliers. This advantage is likely to help win incremental business, strengthen preferred supplier status, and improve long-term gross margins and pricing power.

What is the key force behind this bullish valuation narrative? A bold mix of future growth projections, rising margins, and strategic global positioning. Want to uncover the actual financial targets and assumptions that drive such a big gap to the current share price? The answer is in the full story.

Result: Fair Value of $203.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around global trade tensions and intensifying competition in analog chips could threaten Texas Instruments’ margins and growth thesis in coming quarters.

Find out about the key risks to this Texas Instruments narrative.

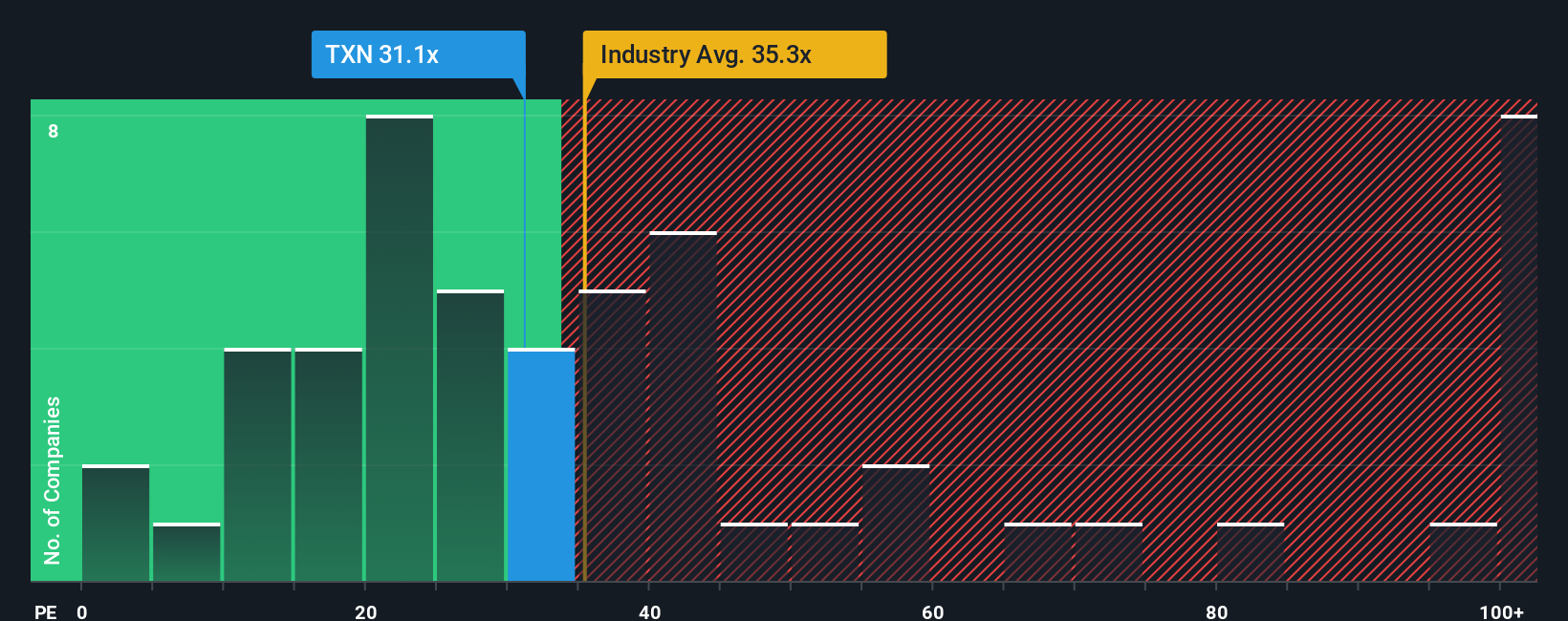

Another View: Checking the Numbers Against Peers

Looking at Texas Instruments through its price-to-earnings ratio, the shares trade at 30.9x, which is lower than the US semiconductor industry average of 37.2x and the peer average of 31.9x. Notably, this is still below the fair ratio of 33.8x that the market could trend toward if optimism returns. This gap means the stock offers relative value, yet with potential risks if industry sentiment worsens. Which perspective should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Instruments Narrative

If you have a different perspective or prefer to dig into the numbers on your own terms, shaping your own Texas Instruments narrative takes just a few minutes. Do it your way

A great starting point for your Texas Instruments research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't sit on the sidelines when top opportunities could be within reach. Tap into the power of the Simply Wall Street Screener and transform your portfolio with new, data-backed picks tailored for forward-focused investors.

- Start earning more from your portfolio by unlocking higher yields with these 17 dividend stocks with yields > 3%, which delivers strong returns well above the market average.

- Experience rapid growth potential by targeting these 26 AI penny stocks, where innovative companies are driving the biggest leaps in artificial intelligence.

- Get ahead of Wall Street by spotting value gaps among these 875 undervalued stocks based on cash flows, ideal for investors seeking stocks priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives