- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Stock Up 13% Despite Q4 Earnings Decline

Reviewed by Simply Wall St

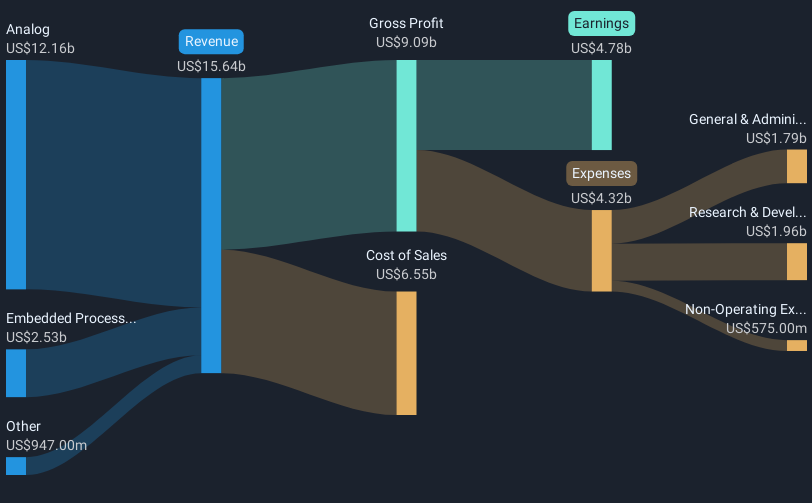

Texas Instruments (NasdaqGS:TXN) experienced a significant 13% price move over the last week, catching considerable market attention. This came amid several key corporate updates. The company announced its fourth-quarter earnings on January 23, revealing a decline in sales and net income compared to the previous year, impacting investor sentiment. Despite this, Texas Instruments maintained a robust buyback initiative, repurchasing 2.75 million shares in Q4 2024. Furthermore, the filing of a new shelf registration on February 14 allows the company flexibility in capital raising, potentially appealing to investors looking for strategic growth. In a broader market context, while major indices like the Dow and Nasdaq faced weekly declines, TXN’s distinct corporate activities seemed to resonate positively with investors, perhaps contrasting with the market’s generally cautious sentiment due to factors like the UnitedHealth probe and declining indexes.

Click to explore a detailed breakdown of our findings on Texas Instruments.

Over the past five years, Texas Instruments' shares have delivered a total return of 107.23%, reflecting robust overall performance. Despite recent challenges, such as reporting decreases in net income and sales in 2024, several factors have likely contributed to this longer-term performance. Notable among these is the company's ongoing commitment to returning value to shareholders through substantial share buybacks, repurchasing more than 44.58 million shares, which has supported the share price by reducing supply. Additionally, innovation in product lines, such as integrated automotive chips, has helped maintain competitive advantage and market presence.

Texas Instruments has also strategically positioned itself for future growth through initiatives like the $1.6 billion investment under the U.S. CHIPS and Science Act to develop new wafer fabs, aligning with broader industry trends and government support. However, in the past year, TXN's returns lagged behind the US Semiconductor industry, which saw a return of 41.3%, although it did outperform the broader US Market's 20.8% return.

- Analyze Texas Instruments' fair value against its market price in our detailed valuation report—access it here.

- Uncover the uncertainties that could impact Texas Instruments' future growth—read our risk evaluation here.

- Are you invested in Texas Instruments already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives