- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

How Texas Instruments' (TXN) Leadership Transition Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 16, 2025, Texas Instruments announced that longtime chairman Rich Templeton will retire as executive chairman and board member on December 31, 2025, with current president and CEO Haviv Ilan set to assume the chairman role in January 2026.

- This carefully planned leadership transition signals the company’s emphasis on continuity and board confidence in Ilan, whose 26-year tenure spans wide-ranging executive roles at Texas Instruments.

- We'll examine how this leadership succession may influence Texas Instruments' long-term outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Texas Instruments Investment Narrative Recap

Investors who believe in Texas Instruments’ future generally focus on its leadership in analog and embedded chips for industrial and automotive markets, as well as its track record of innovation and shareholder returns. The well-planned CEO-to-chairman transition is designed for continuity, and is not expected to materially impact near-term catalysts such as automotive and industrial demand, nor does it shift the biggest risk, which is ongoing commoditization and cyclical pressure in core segments.

Among TI’s recent announcements, the new collaboration with Tobii Autosense and D3 Embedded stands out. This partnership showcases TI technology at the center of an advanced driver and occupant monitoring solution for carmakers. While this highlights the company’s opportunity in expanding automotive markets, it does not change the core risk of underutilized capacity if anticipated demand does not materialize as expected.

Yet, investors should also be aware that mounting competition and capital spending could...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' outlook anticipates $22.3 billion in revenue and $7.9 billion in earnings by 2028. This requires annual revenue growth of 10.1% and a $2.9 billion increase in earnings from the current $5.0 billion.

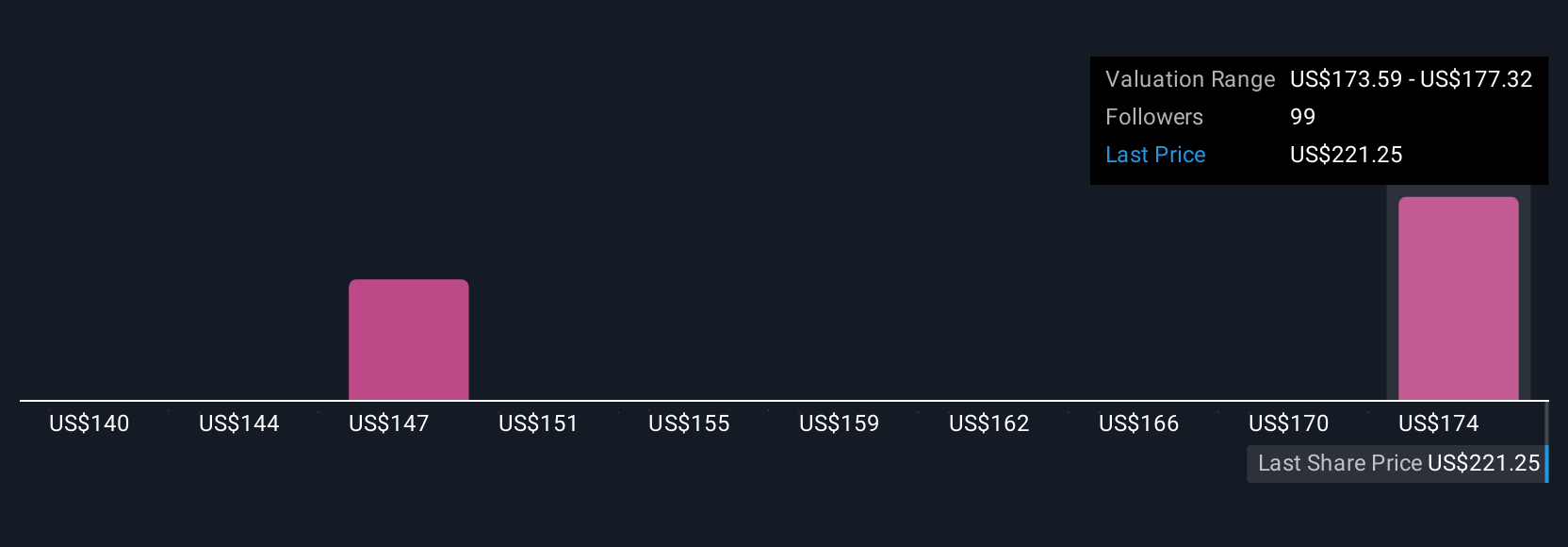

Uncover how Texas Instruments' forecasts yield a $203.06 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Some of the lowest analyst estimates before this leadership change were forecasting Texas Instruments to grow revenue to US$20.2 billion by 2028, but with profit margins slipping. These more pessimistic views highlight the possibility of tighter regulatory requirements and higher costs, and remind you that risks may shift after such major leadership transitions. Consider how your expectations compare and explore several viewpoints as you weigh what’s next for Texas Instruments.

Explore 7 other fair value estimates on Texas Instruments - why the stock might be worth as much as 15% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion