- United States

- /

- Semiconductors

- /

- NasdaqGS:TSEM

Did You Miss Tower Semiconductor's (NASDAQ:TSEM) Impressive 102% Share Price Gain?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Tower Semiconductor Ltd. (NASDAQ:TSEM) stock is up an impressive 102% over the last five years. In the last week shares have slid back 4.4%.

See our latest analysis for Tower Semiconductor

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Tower Semiconductor actually saw its EPS drop 8.7% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We are not particularly impressed by the annual compound revenue growth of 1.2% over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

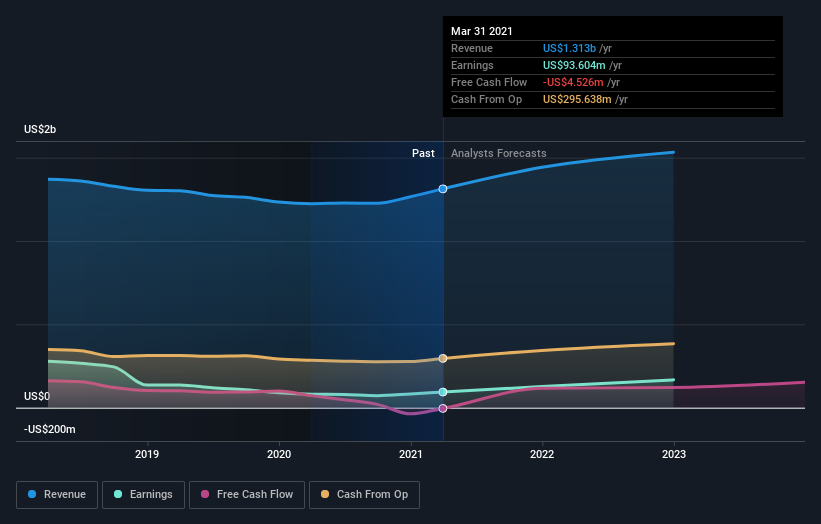

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Tower Semiconductor has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Tower Semiconductor

A Different Perspective

Tower Semiconductor shareholders are up 22% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 15% over half a decade It is possible that returns will improve along with the business fundamentals. Is Tower Semiconductor cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Tower Semiconductor better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Tower Semiconductor or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tower Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TSEM

Tower Semiconductor

An independent semiconductor foundry, provides technology, development, and process platforms for integrated circuits in the United States, Japan, rest of Asia, and Europe.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives