- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Do Teradyne’s Partnerships Justify Its 42% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if Teradyne stock is a hidden bargain or simply priced for perfection? Let’s dig into what actually drives its value.

- Teradyne’s shares have been on a tear this year, up 41.7% year-to-date and boasting a 63.8% gain over the past twelve months.

- News has recently centered on Teradyne’s expansion into next-generation testing for semiconductor and automation markets, highlighting partnerships and technology launches. These developments have fueled optimism around its long-term prospects and may help explain the stock’s strong run.

- But when we put Teradyne through our 6-point valuation check, it scores 0 out of 6 for being undervalued. Here is how we arrive at that, along with a smarter way to look at Teradyne’s true worth.

Teradyne scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Teradyne Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to their value today. For Teradyne, the DCF approach incorporates both analyst forecasts and extended projections for the next ten years.

Teradyne’s latest reported Free Cash Flow stands at $485.6 Million. Based on analyst and market estimates, this figure is projected to rise significantly in coming years, with free cash flow expected to reach $1.23 Billion by 2029. The model used is a 2-Stage Free Cash Flow to Equity method, which combines explicit analyst estimates for the next five years and then extrapolates further growth assumptions thereafter.

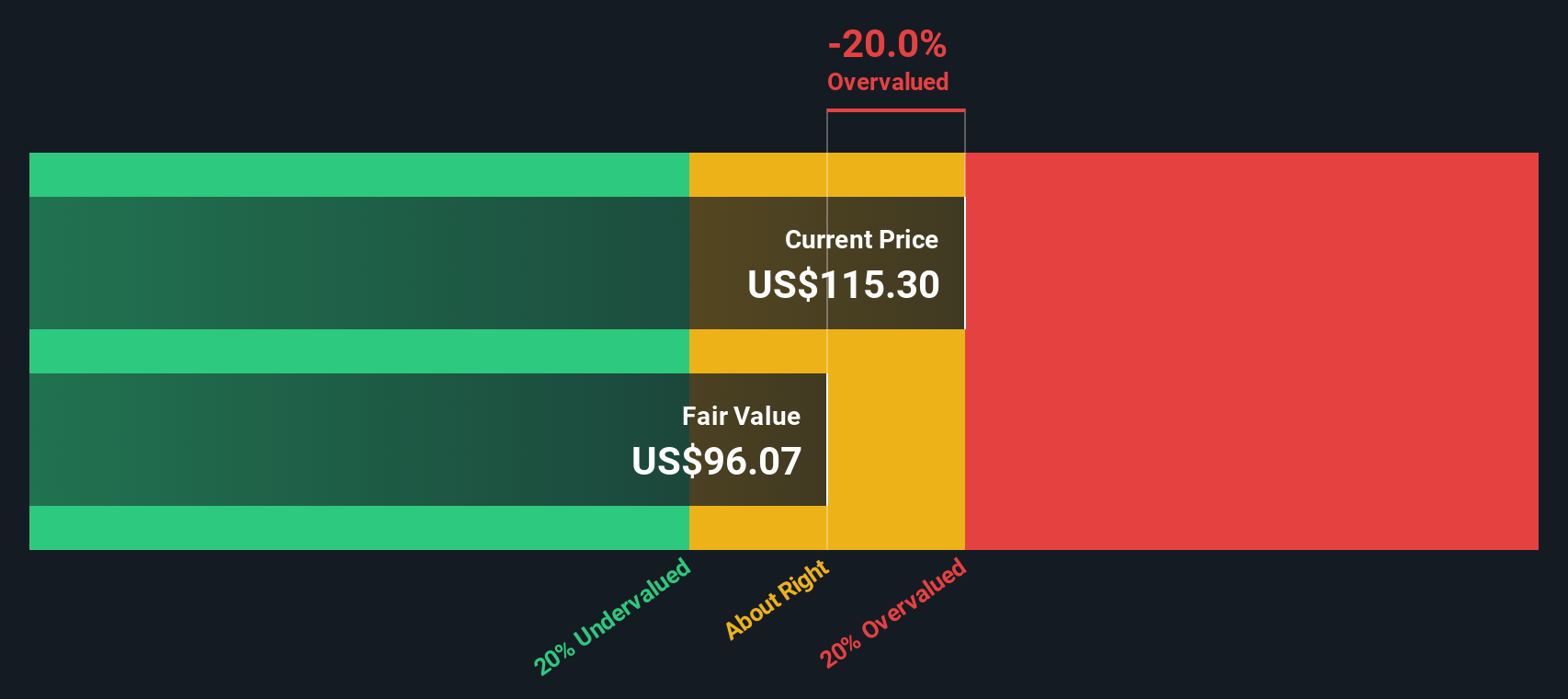

After running Teradyne’s projections through the DCF, the estimated fair value comes out to $107.51 per share. Compared to its current market price, this implies the stock is trading at a 66.9% premium. It is significantly overvalued relative to its own projected cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teradyne may be overvalued by 66.9%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Teradyne Price vs Earnings (PE Ratio)

For profitable companies like Teradyne, the Price-to-Earnings (PE) ratio is a widely accepted valuation metric because it directly relates a company's stock price to its underlying earnings. The PE ratio helps investors understand how much they are paying for each dollar of a company's current profits.

Of course, what is considered a “normal” or “fair” PE ratio depends on expectations for future growth and the degree of risk investors are willing to take on. Companies with stronger growth prospects or more stable earnings often command higher PE ratios, while those facing uncertainty or sluggish growth tend to trade at lower multiples.

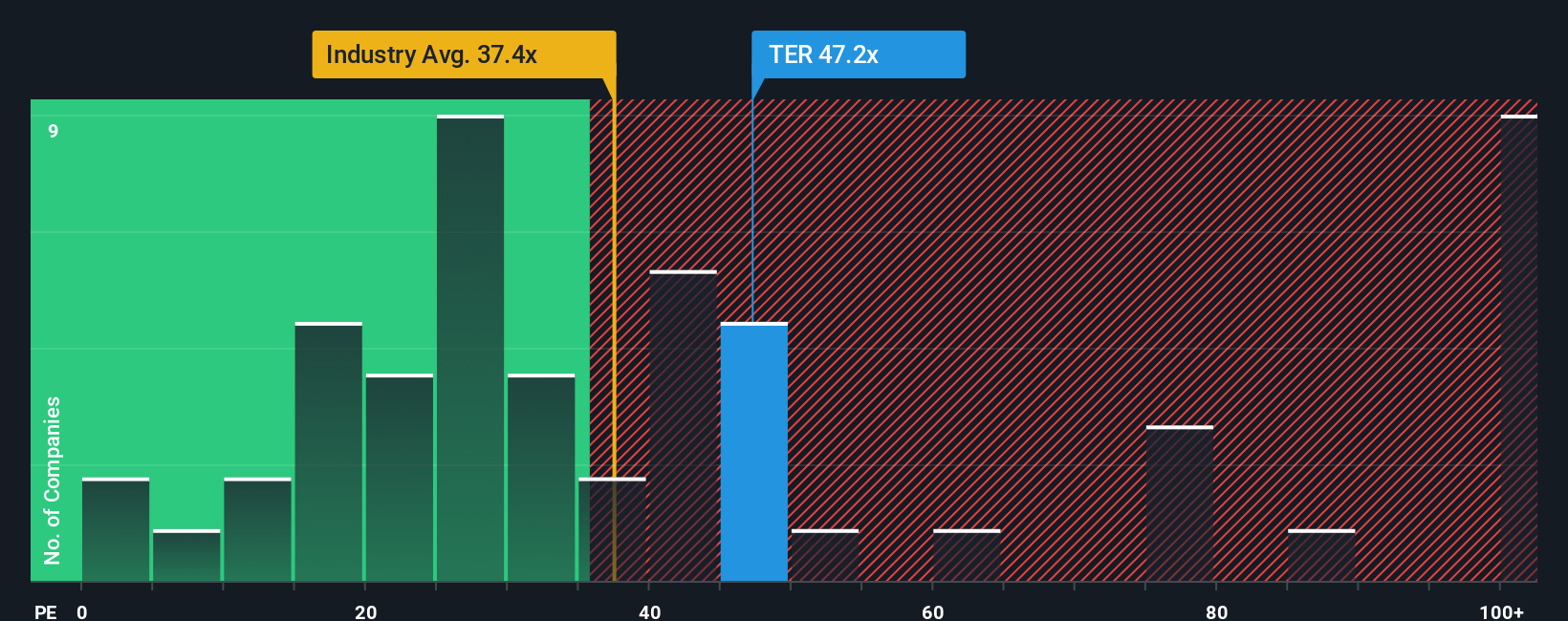

Right now, Teradyne is trading at a PE ratio of 63.4x. That is well above the semiconductor industry average of 35.8x and also higher than the average for its peer group at 31.2x. At first glance, this premium valuation might seem extreme, especially when compared across the sector and its direct peers.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Teradyne, that fair PE ratio is 38.4x. Unlike standard peer or industry comparisons, the Fair Ratio is designed to factor in crucial variables like profit growth, risk profile, profit margins, market capitalization and the industry Teradyne operates in. It brings more context and nuance to the valuation conversation, offering a more accurate benchmark for what the company should be worth in the current environment.

Since Teradyne’s actual PE ratio (63.4x) is meaningfully higher than its Fair Ratio (38.4x), the stock appears to be overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teradyne Narrative

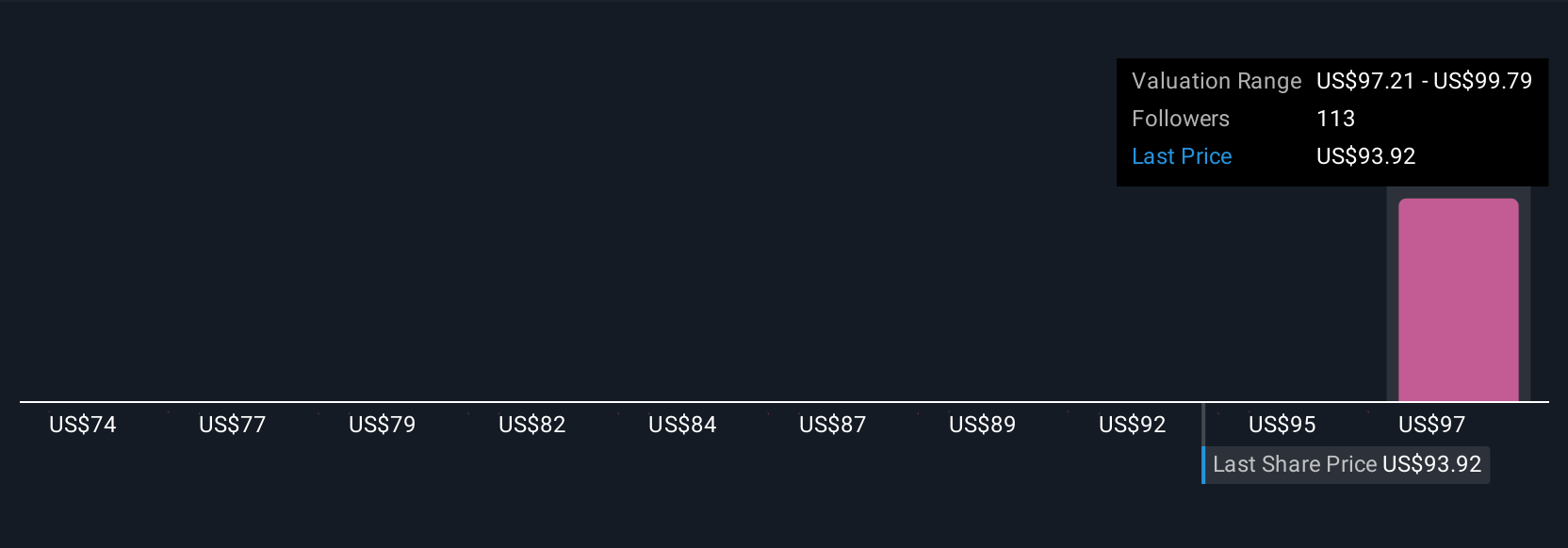

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple story you create about a company, explaining your expectations for its future, from revenue growth to changing margins, and the fair value you believe that story justifies.

Rather than just crunching numbers, Narratives connect your unique perspective on Teradyne with a full financial forecast and a calculated fair value. It’s an easy tool available for everyone on Simply Wall St’s Community page, where millions of investors share and adjust their investment stories in real time.

Narratives empower you to decide when to buy or sell by comparing what you think Teradyne is truly worth to the current market price. Since they're automatically updated when the company releases new earnings, launches products, or when news impacts the industry, your view stays relevant and dynamic.

For example, one investor might believe Teradyne’s AI testing and robotics growth justifies a $205 price target, while another anticipates macro risks will hold the stock back toward $85. Narratives allow you to express and update your outlook, making every investment decision personal and clear.

Do you think there's more to the story for Teradyne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.