- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Can Teradyne's 24% Rally Continue After Latest Semiconductor Sector Momentum?

Reviewed by Bailey Pemberton

If you have been eyeing Teradyne, you are in good company. Many investors are debating whether now is the right moment to dive in, hold steady, or step aside entirely. After all, the last month saw the stock surge an impressive 23.6%, even after a slight dip of 2.5% over the past week. Zooming out, the long-term numbers are even more eye-catching. Over the past three years, Teradyne has returned 95.3%, and over five years, 56.3%. That kind of outperformance suggests more than just luck, possibly reflecting the company’s ability to adapt as the testing and automation industries evolve.

Of course, market enthusiasm can sometimes get ahead of itself. Teradyne’s year-to-date and one-year returns hover near 11%, signaling steady growth but also raising the question of whether future gains are already baked into the current price of $141.03. Investors have noticed the stock’s strong rebound in step with positive news around automation demand and semiconductor sector momentum. Still, any number of risks and opportunities could shape where it goes from here, making valuation analysis especially important.

If you are wondering whether Teradyne is undervalued, consider this: the company currently scores a 0 out of 6 across standard valuation checks. Not the strongest start for a deep value investor hoping for bargains. But valuation is more nuanced than just a score. Next, let’s break down the most common valuation approaches, and stick around for my top insight on what really matters as you gauge Teradyne’s upside potential.

Teradyne scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Teradyne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and then discounting them back to today’s dollars. This approach is widely used by analysts because it focuses on cash the business can actually generate for shareholders.

For Teradyne, the current Free Cash Flow stands at $608.75 million. Analysts have projected steady growth in cash flows, with free cash flow expected to rise to $1.09 billion by 2029. After analysts’ predictions end in year five, Simply Wall St extrapolates cash flows further, reflecting confidence in ongoing expansion. Over the next ten years, free cash flow is estimated to keep growing, underscoring faith in Teradyne’s long-term prospects.

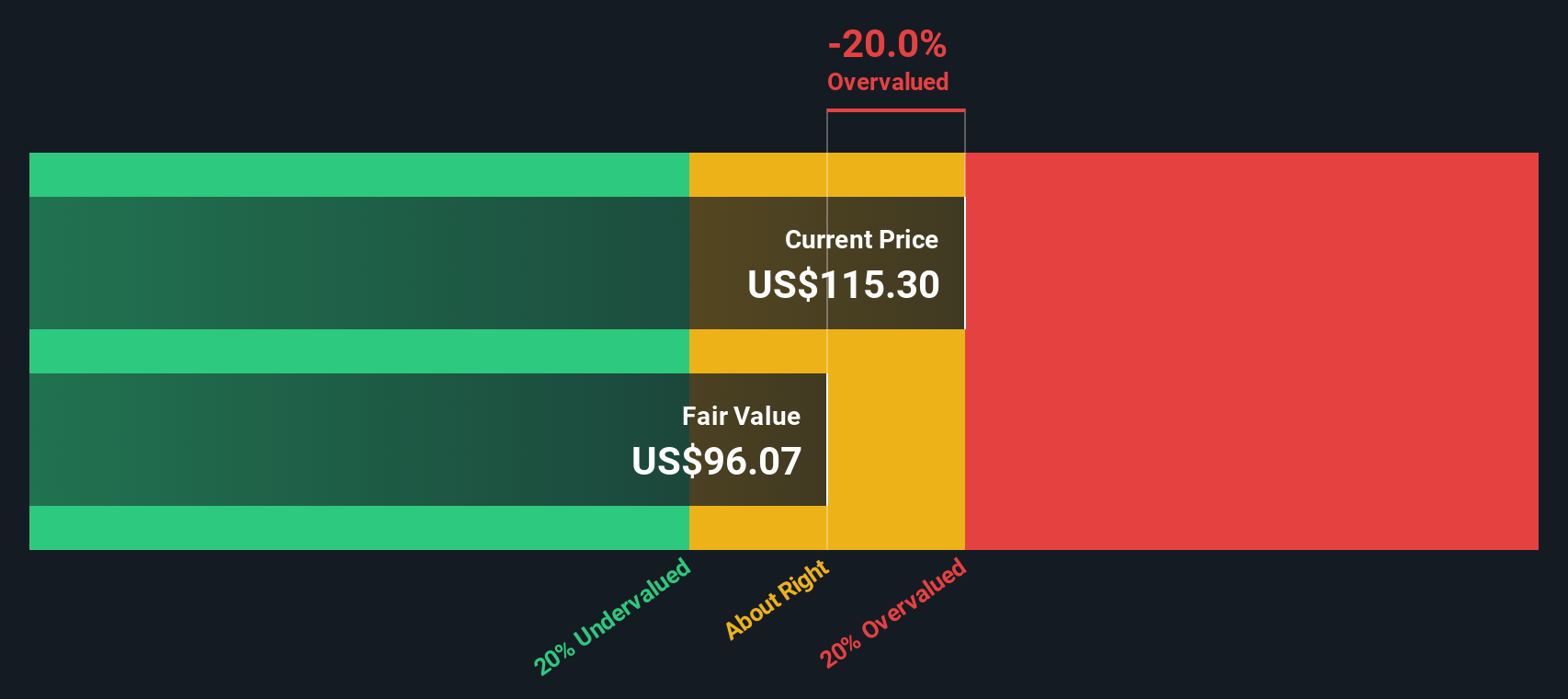

Using these cash flow projections, the DCF model calculates an estimated fair value for Teradyne’s shares at $96.58. With today’s stock price at $141.03, this suggests the stock is currently trading at a 46% premium to its intrinsic value. In short, the DCF approach signals that Teradyne appears overvalued according to these long-range cash flow estimates.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teradyne may be overvalued by 46.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Teradyne Price vs Earnings

The price-to-earnings (PE) ratio is widely used for valuing profitable companies like Teradyne because it directly ties a company’s share price to its current earnings. This offers a snapshot of what investors are willing to pay for each dollar of profit. It is especially insightful for firms with steady profits and transparent earnings growth, as is the case for Teradyne.

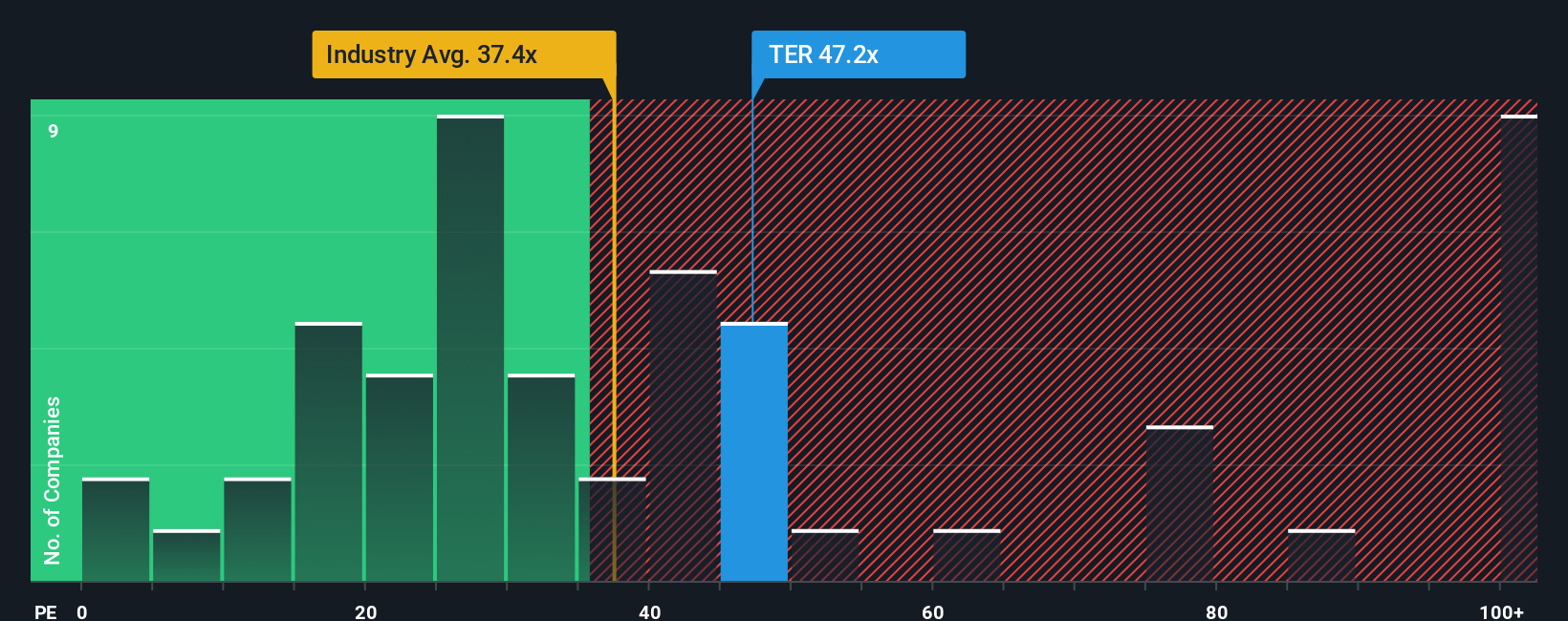

What counts as a “normal” or “fair” PE ratio depends on how quickly investors expect a company to grow its earnings, as well as the perceived risks involved. Fast-growing, lower-risk businesses usually command higher PE ratios compared to those with slower prospects or more uncertainty. For Teradyne, its current PE ratio is 47.8x. This is noticeably higher than the semiconductor industry average of 35.9x and also above the average for similar peers, which is 37.6x.

Simply Wall St introduces the concept of a “Fair Ratio” to provide a tailored benchmark for valuation. The Fair Ratio is determined by a blend of factors unique to the company, such as expected earnings growth, profit margins, its specific industry, market cap, and underlying risks. Unlike a basic industry or peer comparison, the Fair Ratio gives a nuanced and company-specific yardstick for what the PE ratio should be. For Teradyne, the Fair Ratio works out to 34.3x. Comparing this to its current PE of 47.8x reveals that the stock trades at a sizeable premium, reflecting high expectations or potential over-optimism about future growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teradyne Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful tool that lets you connect your personal view about where a company like Teradyne is headed, with your estimates of future revenue, earnings, and margins. This approach effectively turns your story into a data-driven forecast and a unique fair value. Narratives make investing more approachable by transforming numbers into stories that reflect what you believe in, not just what the consensus says.

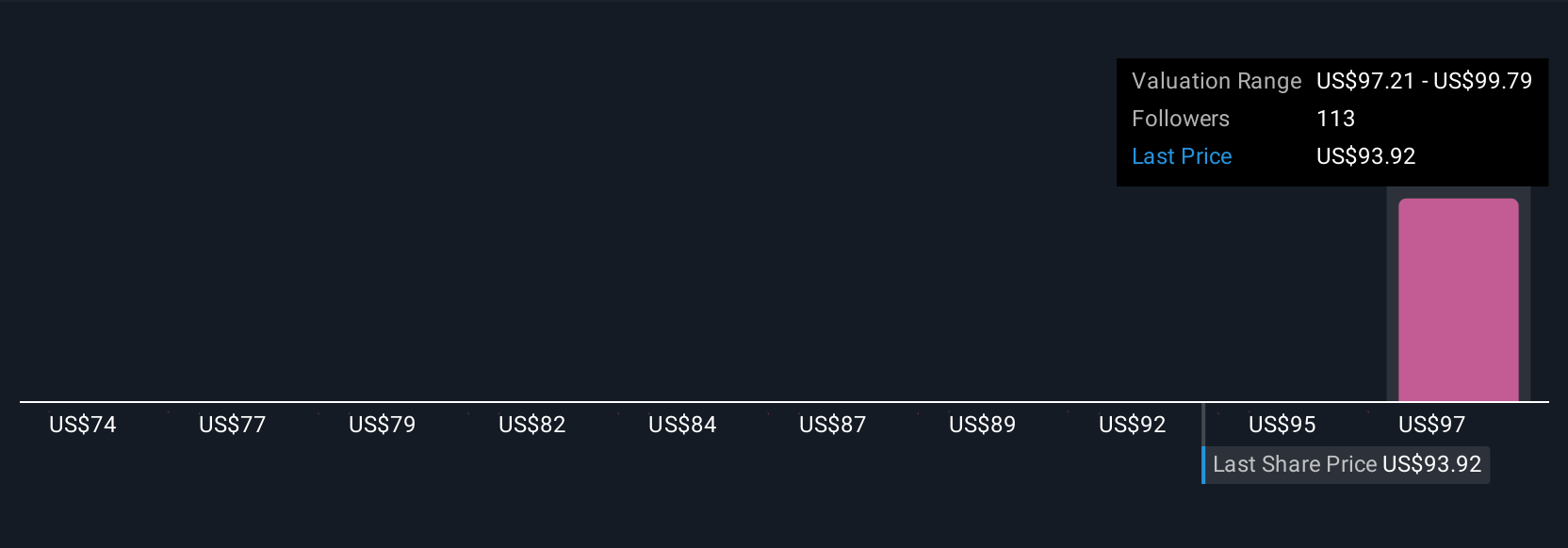

Available for millions of investors on Simply Wall St’s Community page, Narratives help you decide exactly when to buy or sell by comparing your own calculated fair value to the current market price. Unlike static models, Narratives are constantly updated with the latest company news, earnings reports, and market shifts, keeping your analysis relevant over time. For example, one Teradyne Narrative may expect rapid growth fueled by AI and robotics, giving a bullish fair value as high as $133.00. Meanwhile, another may be more cautious given tariff risks, settling on a fair value as low as $85.00. Narratives let you explore these possibilities and decide which outlook fits your perspective best, all in a single dynamic platform.

Do you think there's more to the story for Teradyne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives