- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

The Bull Case For Synaptics (SYNA) Could Change Following Launch of Astra SL2600 Edge AI Processor – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this month, Synaptics Incorporated introduced the Astra SL2600 Series, a new family of multimodal Edge AI processors designed for a wide spectrum of IoT applications, from smart appliances to industrial automation and autonomous robotics.

- A key innovation is the integration of Google's RISC-V-based Coral NPU with dynamic operator support, alongside a developer-centric open-source toolkit, signaling Synaptics' intention to shape the next wave of cognitive IoT solutions.

- We'll examine how the launch of Astra SL2600, highlighting advanced Edge AI capabilities, may influence Synaptics' investment outlook and growth prospects.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Synaptics Investment Narrative Recap

Owning Synaptics stock requires belief in the company's ability to capitalize on the accelerating shift toward connected devices and AI-driven IoT solutions. The Astra SL2600 launch directly targets this growth opportunity; however, it does not materially shift the most critical short-term catalyst, successful scale-up in Core IoT design wins, or address the pressing risk around portfolio focus and execution in expanding the customer base beyond early stages. Among Synaptics' recent announcements, the introduction of the Veros Wireless Portfolio, including Wi-Fi 7 SoCs, is particularly relevant. Seamlessly integrating this connectivity with Astra SL2600’s Edge AI capabilities may support Synaptics’ efforts to differentiate within IoT and capture more value per customer, serving as a supporting catalyst to the new product family’s adoption. Yet, on the flip side, some investors may not fully appreciate the ongoing risks if Synaptics struggles to scale its sales channels or fails to gain organic traction in industrial IoT...

Read the full narrative on Synaptics (it's free!)

Synaptics' narrative projects $1.4 billion revenue and $199.2 million earnings by 2028. This requires 9.6% yearly revenue growth and a $247 million increase in earnings from -$47.8 million.

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

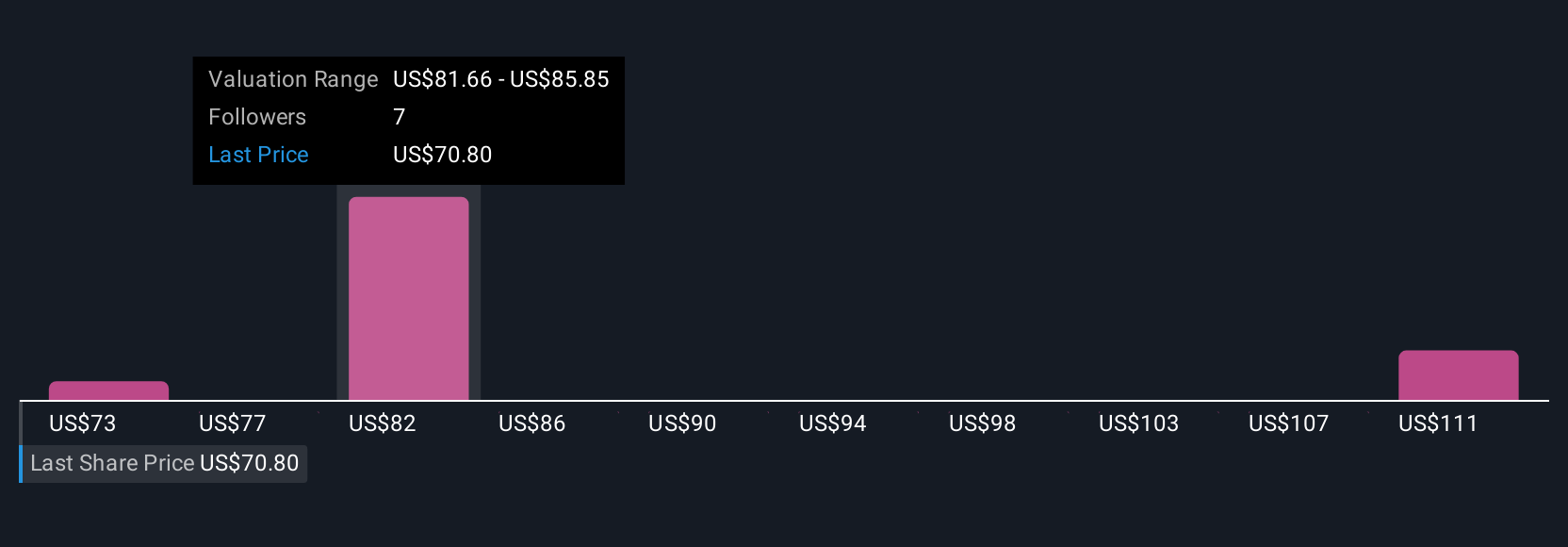

Five members of the Simply Wall St Community estimate Synaptics’ fair value from US$73.28 to US$115.17 per share. While many focus on product launches and technology partnerships, remember channel ramp-up execution remains a pivotal variable that could shape results.

Explore 5 other fair value estimates on Synaptics - why the stock might be worth as much as 62% more than the current price!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives