- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

What Do Recent Gains Mean for Skyworks Solutions Stock in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Skyworks Solutions’ stock right now? You are definitely not alone. After all, it has been a bit of a roller coaster ride lately. In the past week alone, shares jumped 8.9%, giving investors a reason to look twice. Still, if you take a step back and look at a longer timeline, things appear more complicated. The stock is down 14.8% since the start of the year and has fallen a substantial 20.7% over the last 12 months. The five-year track shows a 43.2% drop, even as the tech industry landscape keeps shifting and investor risk appetite evolves. Some of these moves can be traced to broader shifts across semiconductor companies, as markets continually reassess growth opportunities versus supply chain pressures and global demand uncertainties.

Given all this, the big question is whether Skyworks Solutions offers genuine value at current levels, or if it is just a classic value trap. On that front, there is some good news: the company earns a value score of 4 out of 6 based on standard checks for undervaluation. That is no small feat in today’s market, especially for a tech name. But how do these different valuation yardsticks stack up? Let us take a closer look at the methods that analysts and investors rely on. Later, I will share an even more insightful perspective on what the numbers really mean for your decision.

Why Skyworks Solutions is lagging behind its peers

Approach 1: Skyworks Solutions Discounted Cash Flow (DCF) Analysis

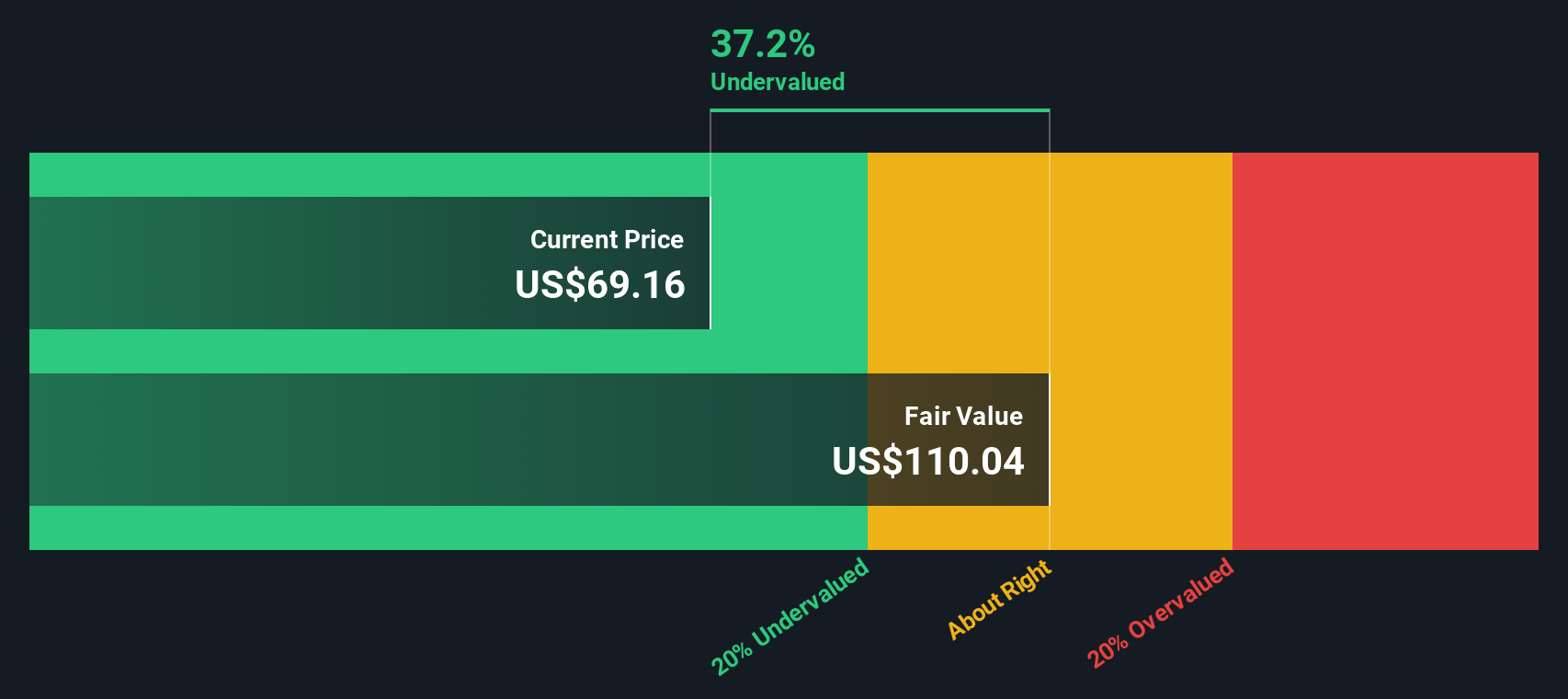

The Discounted Cash Flow (DCF) model helps investors estimate the underlying value of a business by projecting its future free cash flows and discounting those amounts back to today’s dollars. In the case of Skyworks Solutions, analysts start with the company’s latest Free Cash Flow (FCF), which stands at $1.36 billion. Forecasts suggest a mix of growth and fluctuations in the coming years, with analyst estimates covering up to five years. For the period beyond this, projections are extrapolated by Simply Wall St and anticipate FCF reaching about $1.74 billion in ten years’ time. All these cash flow figures refer to United States dollars.

Combining these future cash flows and discounting them results in an estimated intrinsic value of $110.39 per share for Skyworks Solutions. With the DCF calculation indicating the stock trades at a 31.8% discount to this fair value, the analysis suggests that SWKS shares are currently undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Skyworks Solutions is undervalued by 31.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Skyworks Solutions Price vs Earnings

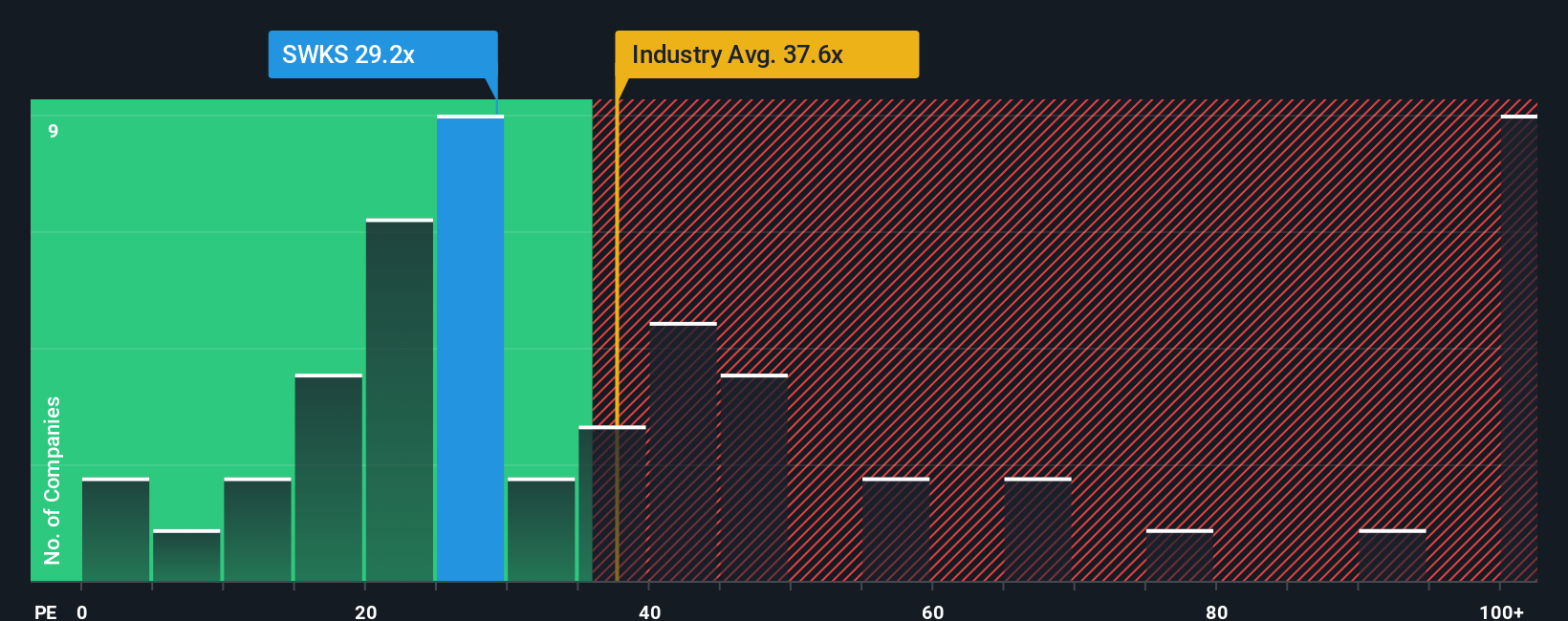

When it comes to evaluating profitable companies like Skyworks Solutions, the Price-to-Earnings (PE) ratio remains one of the most important and widely used valuation metrics. The PE ratio helps investors assess how much they are paying for each dollar of earnings, making it especially relevant for companies with established and consistently positive profits.

It is worth noting that the "normal" or "fair" PE ratio for a business depends heavily on expectations around future growth and perceived risks. High-growth companies typically command higher PE multiples due to optimism about expanding profits. Those with less certain growth or higher risk profiles tend to trade at lower multiples.

Skyworks Solutions currently trades at a PE ratio of 28.2x. This is below the average for its semiconductor industry peers, which sits at 35.9x. In fact, the average PE among its closest peers is even higher at 59.7x. However, Simply Wall St uses a proprietary metric called the "Fair Ratio" to provide a more tailored benchmark. The Fair Ratio, calculated at 24.5x for Skyworks, accounts for factors like the company’s own growth prospects, profit margins, risk profile, industry, and market capitalization. This method is more precise than simply looking at generic industry numbers because it customizes the valuation benchmark to the company’s specific characteristics.

Comparing Skyworks Solutions’ actual PE ratio (28.2x) with its Fair Ratio (24.5x) suggests that the stock is trading a touch above what would be considered fair value by this measure. This indicates it is slightly overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skyworks Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a powerful, story-driven approach to investing where you connect your perspective about a company’s future with your assumptions for its revenue, profit margins, and fair value. This puts the numbers in context with the bigger picture of where you think the business is heading.

On Simply Wall St’s Community page, Narratives are an easy-to-use tool available to millions of investors. They help you state your view (such as, “AI and automotive growth will boost Skyworks’ profitability”) and then forecast what this story means for future earnings, margins, and ultimately, what you believe is the company’s fair value.

What makes Narratives truly valuable is how they link your story to a financial forecast, which you can then compare directly with Skyworks Solutions’ current share price. This makes it easier to see whether now looks like a buying or selling opportunity. Plus, Narratives update automatically as news or earnings are released, ensuring your investment thesis evolves with the latest information.

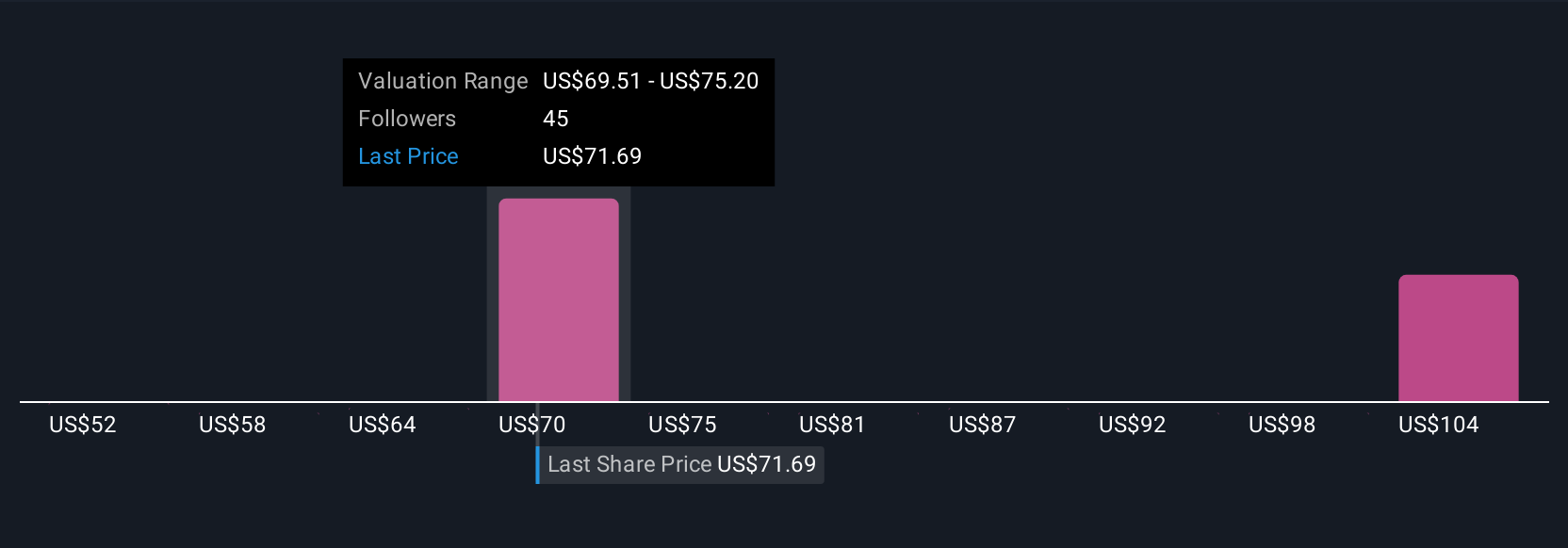

Consider Skyworks Solutions: Some investors’ Narratives point to expansion in AI and IoT justifying a bullish $106 price target; others are concerned about customer concentration and competition, supporting a more cautious $58 value. Narratives let you decide which story aligns best with your view.

Do you think there's more to the story for Skyworks Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Designs, develops, manufactures, and markets semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives