- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Assessing Skyworks Solutions After a 52% Five Year Slide and DCF Valuation Gap

Reviewed by Bailey Pemberton

- Wondering whether Skyworks Solutions is a bargain or a value trap at today’s price? You are not alone, and this article will walk through the numbers in plain English.

- Despite a modest 3.3% gain over the last 30 days, the stock is still down 26.9% year to date and 52.0% over 5 years. That suggests sentiment has been bruised even as short term traders test the waters again.

- Recent headlines have focused on shifting demand expectations in the smartphone and broader connectivity markets, as well as how suppliers like Skyworks are repositioning for AI adjacent and automotive opportunities. At the same time, analysts and investors have been reassessing chipmakers that are more exposed to cyclical handset trends than to the current AI infrastructure boom.

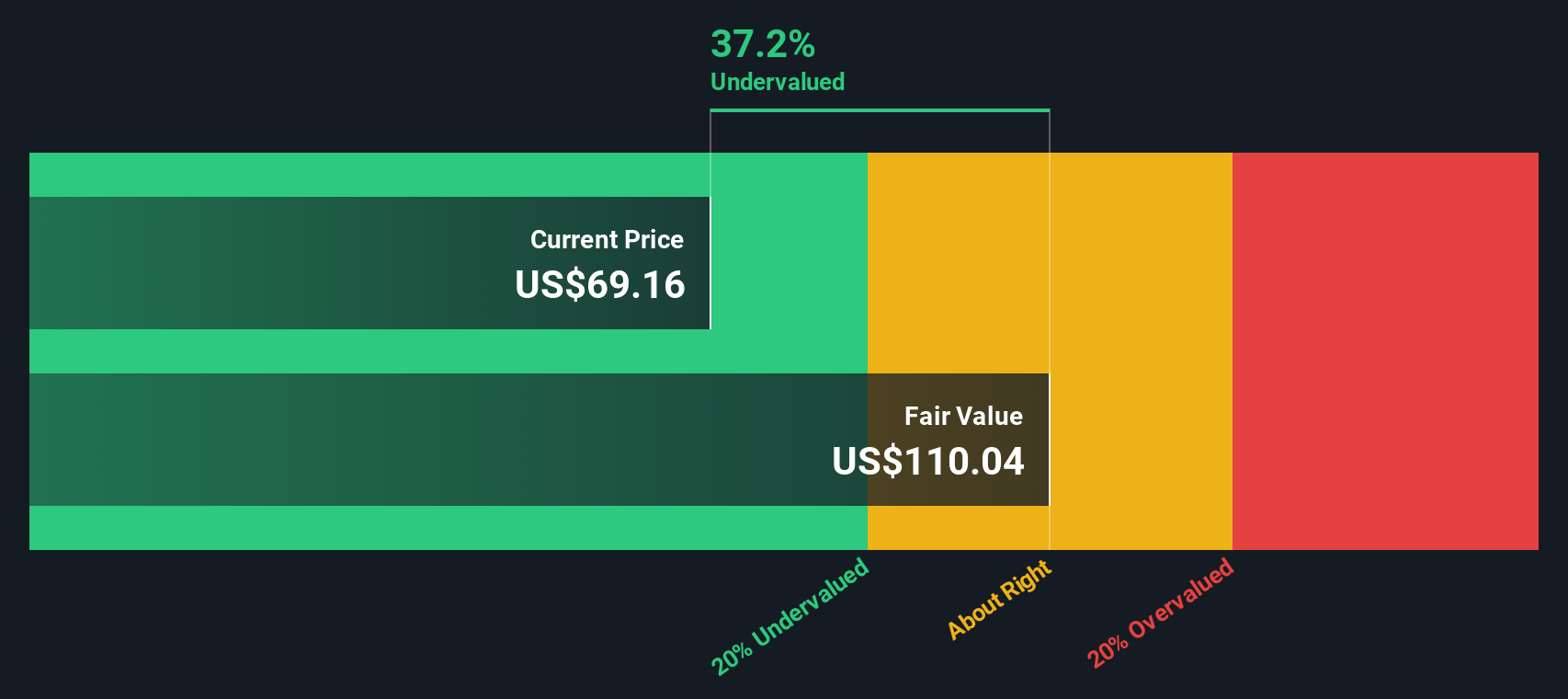

- Against that backdrop, Skyworks currently earns a 5/6 valuation score. That suggests it screens as undervalued on most of the key checks we use. Next, we will unpack what that score really means by looking at multiples, cash flow based fair value, and one often overlooked way to think about valuation that ties everything together.

Find out why Skyworks Solutions's -25.3% return over the last year is lagging behind its peers.

Approach 1: Skyworks Solutions Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to a present value using a required return. For Skyworks Solutions, the latest twelve months Free Cash Flow stands at about $1.10 billion, with analysts and internal estimates pointing to Free Cash Flow of roughly $1.42 billion by 2035 as the business gradually grows.

The near term projections out to 2030 are based on analyst estimates, while the later years are extrapolated from those trends. All of these projected cash flows are then discounted back using a 2 Stage Free Cash Flow to Equity model, which places more weight on the nearer years and assumes a more mature growth profile further out.

On this basis, the model arrives at an intrinsic value of about $88.93 per share, implying the stock trades at roughly a 27.3% discount to its estimated fair value. In other words, the DCF indicates that the market is pricing Skyworks below what its long term cash generation would support under the assumptions used in the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Skyworks Solutions is undervalued by 27.3%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Skyworks Solutions Price vs Earnings

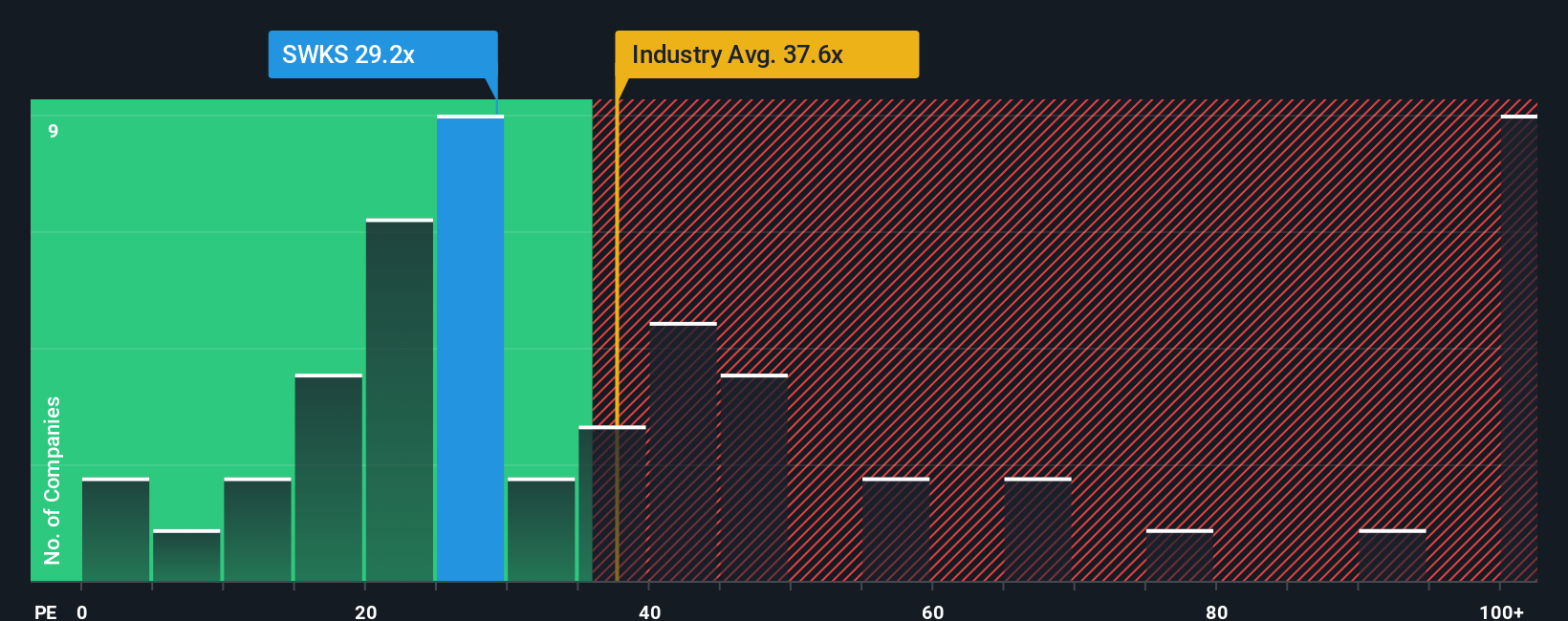

For profitable and relatively mature chipmakers like Skyworks, the Price to Earnings ratio is a practical way to judge valuation because it ties the share price directly to what the business is currently earning for shareholders. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher uncertainty argue for a lower one.

Skyworks currently trades on about 20.2x earnings, which sits well below the broader Semiconductor industry average of roughly 36.8x and the peer group average of around 41.6x. On the surface, that makes the stock look inexpensive compared with many listed chipmakers.

Simply Wall St goes a step further with its proprietary Fair Ratio. This estimates what a reasonable PE should be after factoring in Skyworks specific earnings growth outlook, margins, industry, market cap and risk profile. For Skyworks, this Fair Ratio is 24.6x, suggesting that, given its fundamentals, the stock arguably deserves a higher multiple than it currently commands. Because this measure is tailored to the company rather than based on broad peer or sector averages, it gives a more nuanced view of value and points to Skyworks trading at a discount on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skyworks Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you write the story behind your numbers. You can link your view of a company’s future revenue, earnings and margins to a forecast and then to a Fair Value. This allows you to compare that Fair Value with today’s share price to help you decide whether to buy or sell. The Narrative automatically updates when new news or earnings arrive. In the case of Skyworks Solutions, one investor might build a bullish Narrative around strong merger synergies, expanding automotive and IoT demand, and a Fair Value near the upper end of recent targets around $106. Another might create a more cautious Narrative that stresses handset dependence, competitive and regulatory risks, and a Fair Value closer to the lower end near $58. This gives you a clear, dynamic way to see how different stories lead to different valuations and decisions.

Do you think there's more to the story for Skyworks Solutions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Develops, manufactures, and markets analog and mixed-signal semiconductor products and solutions in the United States, Taiwan, China, South Korea, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion