- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Semtech Corporation's (NASDAQ:SMTC) 34% Price Boost Is Out Of Tune With Revenues

Semtech Corporation (NASDAQ:SMTC) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 66%.

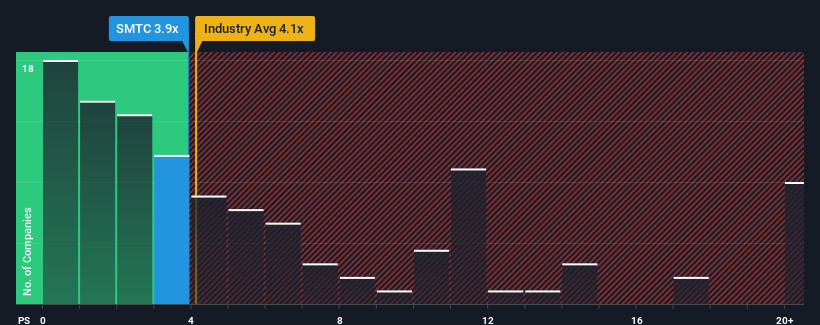

Even after such a large jump in price, it's still not a stretch to say that Semtech's price-to-sales (or "P/S") ratio of 3.9x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in the United States, where the median P/S ratio is around 4.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Semtech

What Does Semtech's Recent Performance Look Like?

Semtech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Semtech will help you uncover what's on the horizon.How Is Semtech's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Semtech's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 21% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 21% over the next year. Meanwhile, the rest of the industry is forecast to expand by 44%, which is noticeably more attractive.

In light of this, it's curious that Semtech's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Semtech's P/S?

Semtech's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Semtech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Semtech is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives