- United States

- /

- Semiconductors

- /

- NasdaqGS:SLAB

A Look at Silicon Labs (SLAB) Valuation Following Launch of Advanced Series 3 Platform SoCs

Reviewed by Kshitija Bhandaru

Silicon Laboratories (SLAB) has just rolled out its Series 3 platform system-on-chips, the SiMG301 and SiBG301, now available to device makers worldwide. These new offerings provide multi-core processing, advanced wireless support, and the world’s first PSA Level 4 security certification.

See our latest analysis for Silicon Laboratories.

While excitement around Silicon Labs’ Series 3 platform launch has built momentum for the stock, the bigger story is in its longer-term trajectory. After some ups and downs, total shareholder return has reached 17% over the past year. This signals renewed optimism as the company sharpens its edge in IoT security and connectivity.

If this surge in innovation has you rethinking what’s possible in tech, here’s your cue to discover See the full list for free.

That raises a pivotal question for investors: does Silicon Labs' strong run and groundbreaking product rollout mean the stock is undervalued, or is the market already factoring in these future gains?

Most Popular Narrative: 10.7% Undervalued

Silicon Laboratories’ most followed narrative puts fair value at $150.44, about 10.7% above the last close of $134.28. This positions the stock as an intriguing opportunity for those tracking its long-term momentum and breakthrough product cycle.

Ongoing rollout of new, highly integrated, energy-efficient wireless platforms (Series 2 and Series 3) positions Silicon Labs to capture increased market share and supports higher ASPs. This is likely to drive top-line growth and gross margin improvement.

Want to know what drives this bold fair value? The narrative’s math hinges on one controversial forecast: a future profit surge and a market valuation multiple that stands well above industry norms. Curious which specific growth drivers justify this high number? The surprising assumptions might challenge everything you expect from a chipmaker’s outlook.

Result: Fair Value of $150.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and slower IoT adoption could threaten Silicon Labs’ premium margins. This could potentially undermine this optimistic valuation narrative.

Find out about the key risks to this Silicon Laboratories narrative.

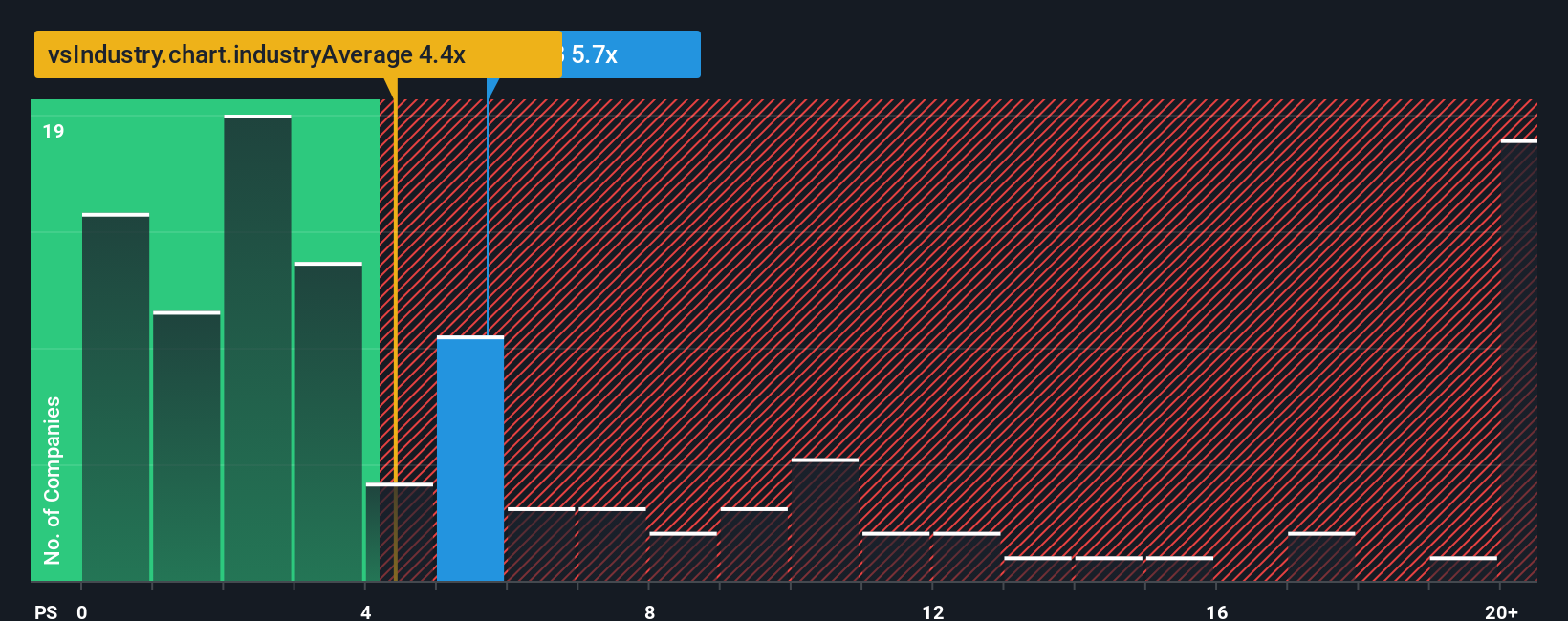

Another View: Market Multiples Suggest a Higher Bar

Taking a step back from narrative-driven forecasts, Silicon Labs currently trades at a price-to-sales ratio of 6.3x. This is higher than both the industry average of 4.9x and the peer average of 6x, and also above its estimated fair ratio of 5.5x. This means investors are paying a premium for the stock, which could signal higher expectations, or increased valuation risk, if growth assumptions do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silicon Laboratories Narrative

If these perspectives aren't quite your style or you like to dig into the numbers yourself, you can put together your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

Looking for more investment ideas?

Step ahead of the crowd and unlock new opportunities with highly targeted stock picks. Don’t miss your chance to find the next game changer—these handpicked screeners make it simple.

- Pursue stronger returns by accessing these 886 undervalued stocks based on cash flows based on real cash flow fundamentals. This can offer value where markets may have overlooked it.

- Tap into rapid growth trends and assess potential in breakthrough healthcare innovations through these 32 healthcare AI stocks.

- Capitalize on income by revealing these 19 dividend stocks with yields > 3%, which consistently yields over 3% for reliable, inflation-beating dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLAB

Silicon Laboratories

A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives