- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

What Do Recent SKYT Insider Sales Reveal About Management’s Confidence During Expansion?

Reviewed by Sasha Jovanovic

- Earlier this month, Director Loren A. Unterseher and affiliated entities sold US$3.26 million in SkyWater Technology shares through a pre-arranged Rule 10b5-1 trading plan, while the company reported a second-quarter 2025 earnings per share of US$0.21 below forecasts and revenue also missing projections.

- These insider share sales occurred shortly after disappointing quarterly results, raising new questions about management’s outlook and confidence as SkyWater undertakes ambitious expansion efforts.

- To understand the impact of this insider selling, we’ll examine how it affects confidence in SkyWater Technology’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SkyWater Technology Investment Narrative Recap

For investors, being a SkyWater Technology shareholder often means believing in the company's role as a key supplier for secure, US-based chip manufacturing, fueled by ambitious expansion efforts and partnerships like the Infineon agreement. The recent insider selling following a weak earnings report does not appear to materially shift the main near-term catalyst, the integration of Fab 25, though it could amplify attention to short-term risks, notably margin compression and integration setbacks as the company absorbs its largest acquisition yet.

Among recent announcements, the expanded license agreement with Infineon Technologies stands out as particularly important. This deal supports SkyWater’s revenue visibility and enhances its strategic value to the US semiconductor supply chain, acting as a potential anchor for growth, even as integration risks and volatile earnings pose challenges to the investment case.

By contrast, persistent margin pressures tied to the acquisition and operational ramp should be on every investor’s radar, especially if...

Read the full narrative on SkyWater Technology (it's free!)

SkyWater Technology's narrative projects $804.6 million revenue and $113.6 million earnings by 2028. This requires 40.6% yearly revenue growth and a $130.1 million increase in earnings from -$16.5 million today.

Uncover how SkyWater Technology's forecasts yield a $13.20 fair value, a 27% downside to its current price.

Exploring Other Perspectives

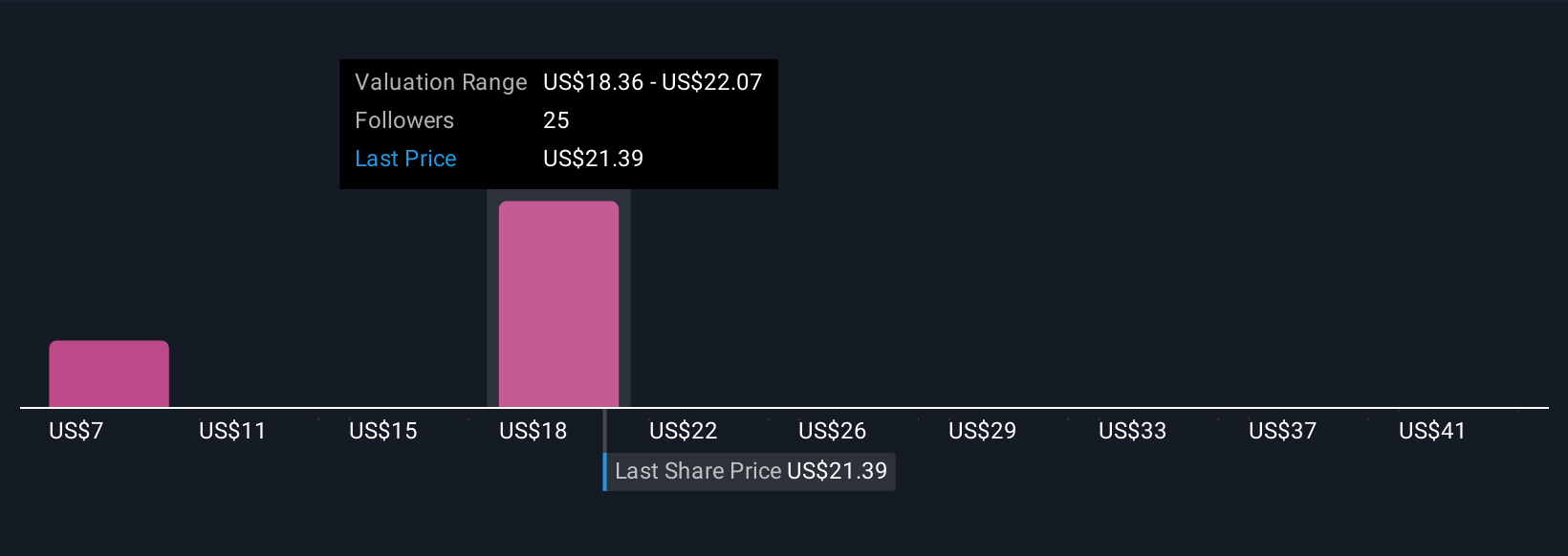

Four Simply Wall St Community fair value estimates for SkyWater Technology range from US$11.70 to US$44.30, highlighting significant divergence in expectations. Some analysts remain focused on whether SkyWater’s large-scale Fab 25 integration will mitigate longer-term balance sheet pressures or compound them, making it useful to explore several alternate viewpoints before deciding how to interpret the company’s trajectory.

Explore 4 other fair value estimates on SkyWater Technology - why the stock might be worth 35% less than the current price!

Build Your Own SkyWater Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWater Technology research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free SkyWater Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWater Technology's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026