- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

Benign Growth For SkyWater Technology, Inc. (NASDAQ:SKYT) Underpins Stock's 26% Plummet

The SkyWater Technology, Inc. (NASDAQ:SKYT) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 30%, which is great even in a bull market.

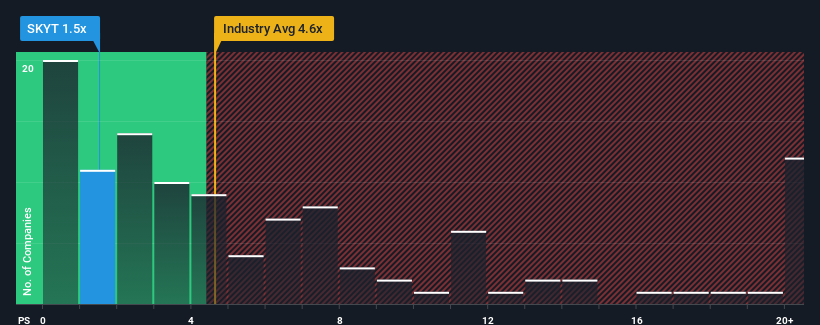

Following the heavy fall in price, SkyWater Technology's price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the wider Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4.4x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for SkyWater Technology

What Does SkyWater Technology's Recent Performance Look Like?

SkyWater Technology could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SkyWater Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SkyWater Technology?

SkyWater Technology's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 111% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.7% each year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 25% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that SkyWater Technology's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

SkyWater Technology's P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of SkyWater Technology's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for SkyWater Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026