- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Rethinking Valuation After Jefferies Flags Overvaluation and Execution Risks

Reviewed by Kshitija Bhandaru

Shares of SolarEdge Technologies (SEDG) slipped after Jefferies reiterated a cautious outlook on the stock, highlighting concerns about overvaluation and potential challenges in the company’s execution over the next few years.

See our latest analysis for SolarEdge Technologies.

SolarEdge’s share price has struggled to gain momentum this year, with most recent moves reflecting heightened investor caution rather than optimism. While the stock’s latest 1.4% year-to-date share price return suggests some underlying resilience, its total shareholder return over both three and five years is still negative. This hints that the market remains wary about the company’s path forward amid execution and valuation risks.

If Jefferies’ caution has you rethinking your strategy, this could be a great moment to broaden your investing perspective and see what’s happening among fast growing stocks with high insider ownership.

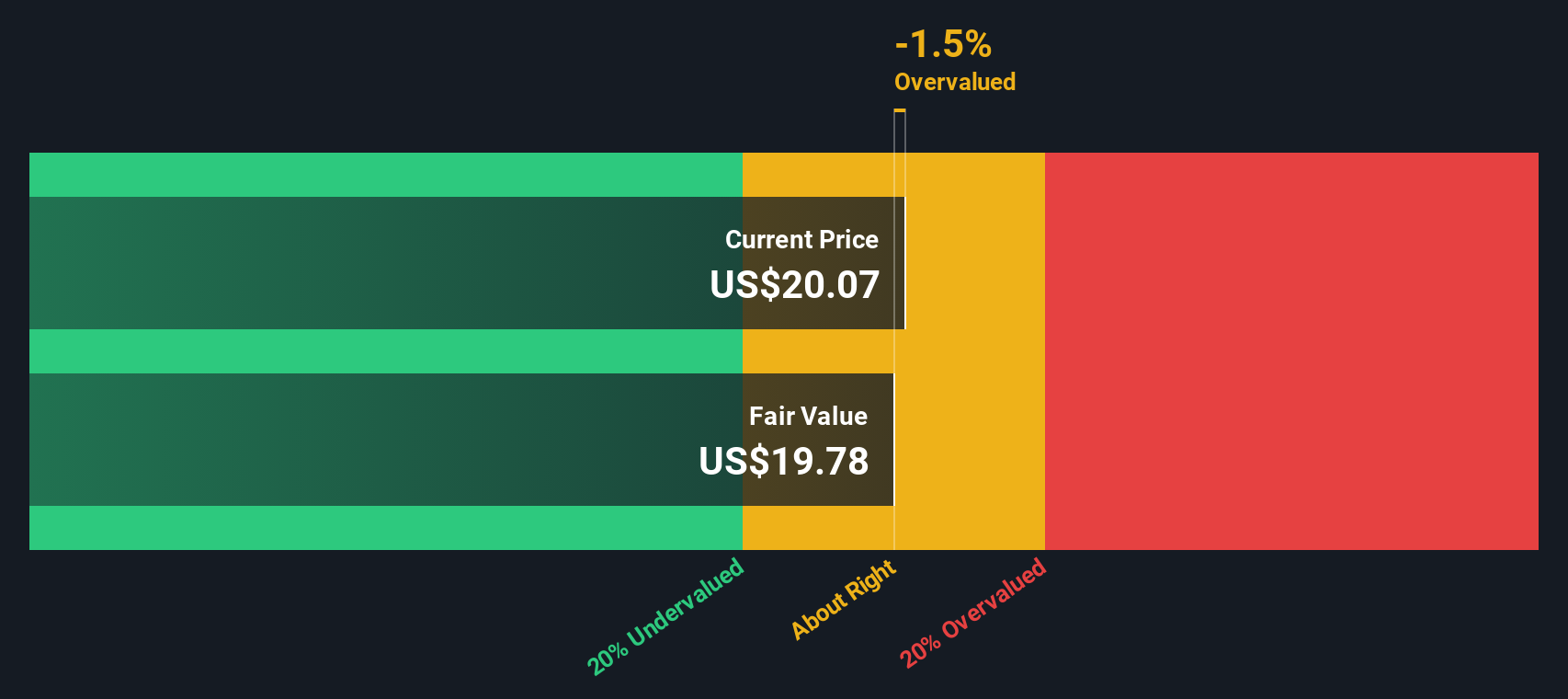

With analysts split on whether SolarEdge’s recent declines represent an attractive entry point or a sign of more pain ahead, investors now face a critical question: is the stock undervalued, or is the market simply pricing in all the growth risks?

Most Popular Narrative: 54.7% Overvalued

Despite the latest close coming in at $36.24, the most widely followed narrative estimates fair value at just $23.42 per share. This significant gap reflects deep divisions over SolarEdge's future. The disconnect highlights a valuation notably higher than analysts’ consensus outlook and brings into focus the core debates about growth and profitability.

The rally in SolarEdge's stock appears to be pricing in robust future revenue growth driven by U.S. policy support (extension of manufacturing and storage credits). Risks are rising as the elimination of the 25D residential solar tax credit is expected to cause a substantial drop in U.S. residential demand in 2026, only partially offset by third-party owned (TPO) shifts, potentially constraining topline growth.

What’s fueling this bold outlook? The narrative is built on future growth bets that rely on market-shifting policies, ambitious expansion in battery storage, and a leap in profitability. But what assumptions are pushing analysts to set valuations so far below the market price? Click to uncover the projections that could change the story for SolarEdge.

Result: Fair Value of $23.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerated policy support and a rapid rebound in commercial demand could boost SolarEdge’s prospects. This could challenge concerns around long-term growth risks.

Find out about the key risks to this SolarEdge Technologies narrative.

Another View: What Does the DCF Model Say?

While analysts see SolarEdge as overvalued using traditional measures, the SWS DCF model suggests a different outcome. According to our DCF, the shares are currently priced 47.3% below fair value. Could the market be missing future growth, or are the risks understated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SolarEdge Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SolarEdge Technologies Narrative

If you see the story differently or want to dive into your own research, you can quickly craft your own SolarEdge narrative in just a few minutes with Do it your way.

A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to get ahead of the market by using hand-picked screens that put today’s most promising opportunities directly at your fingertips. Why settle for yesterday's picks when you could be tracking tomorrow’s winners?

- Accelerate your financial growth by spotting opportunities among these 896 undervalued stocks based on cash flows fueled by strong fundamentals and attractive valuations.

- Boost your portfolio stability with these 19 dividend stocks with yields > 3% offering consistent yields above 3 percent and reliable income potential.

- Tap into the future of medicine by evaluating these 31 healthcare AI stocks at the forefront of artificial intelligence and healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives