- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (NasdaqGS:SEDG) Projects Q2 Revenue Increase in Earnings Guidance

Reviewed by Simply Wall St

SolarEdge Technologies (NasdaqGS:SEDG) recently announced earnings results for the first quarter of 2025 alongside new revenue guidance for the upcoming quarter, projecting figures between $265 million and $285 million, signaling optimism despite a net loss of $99 million. Over the past week, SolarEdge's stock price saw a modest increase of 1.81%, aligning well with the broader market which climbed 2.2%. This suggests that the company's positive revenue guidance and improved year-over-year sales added weight to the broader market trend, despite ongoing investor concerns tied to broader economic factors such as tariffs and Federal Reserve movements.

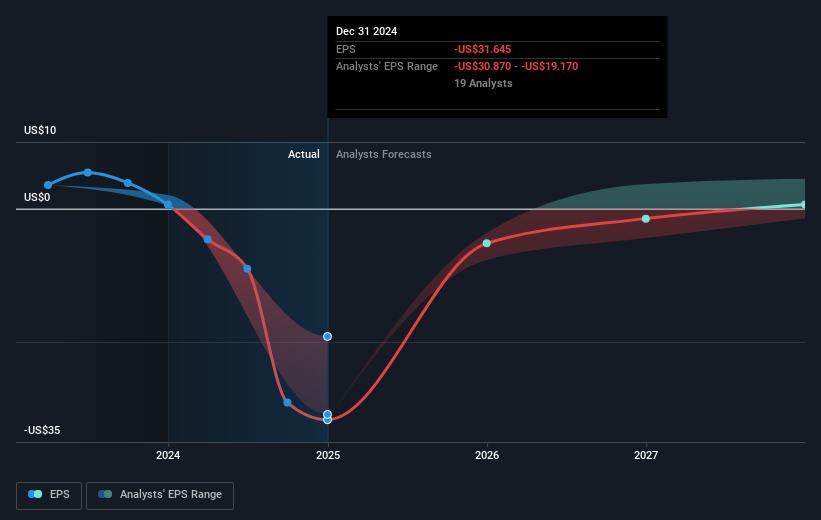

The recent release of revenue guidance by SolarEdge Technologies, forecasting US$265 million to US$285 million despite a net loss of US$99 million, highlights an optimistic outlook amid recent financial challenges. This news underscores the company's commitment to disciplined cash management and enhanced US manufacturing capabilities, which are expected to support free cash flow and net margins. Over the past year, SolarEdge shares have experienced a total shareholder return of 78.49% decline, reflecting a period of significant volatility. It's a marked divergence from the broader US market, which saw positive movement in the same timeframe. Furthermore, over the past year, SolarEdge underperformed relative to the US Semiconductor industry, which returned 8.4%.

The updated revenue projections, coupled with efforts to cut costs and ramp up US manufacturing, may contribute positively to future revenue and earnings forecasts. However, current analyst price targets, pegged at US$15.44, still present a potential appreciation of 16.9% from the current share price of US$12.84. Investors may find comfort in this upside potential, though it is essential to remain cautious given the company's recent underperformance. The company's strategic focus on regaining market share and navigating competitive pressures, especially from Chinese rivals, will be critical to achieving these forecasts and realizing the intended turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SolarEdge Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives