- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

Do Analyst Concerns Reveal a Deeper Challenge for SolarEdge Technologies' (SEDG) Path to Sustainable Profitability?

Reviewed by Sasha Jovanovic

- In recent days, analyst sentiment toward SolarEdge Technologies has remained cautious, with prominent firms expressing concerns about the company's path to profitability and its volume growth outlook through 2027.

- An important insight is that, despite benefiting from U.S. policy incentives and advancing its manufacturing strategy, SolarEdge faces persistent skepticism regarding its ability to turn these industry tailwinds into sustainable earnings.

- We’ll explore how analyst concerns about SolarEdge’s profitability trajectory and market share prospects inform the company’s current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, you need confidence that industry tailwinds such as U.S. manufacturing incentives and clean energy policies will translate into long-term profitability, despite analyst skepticism. The recent analyst downgrades and negative consensus ratings reinforce concerns about SolarEdge’s ability to regain market share and deliver positive earnings in the near term, but do not fundamentally alter the most important upcoming catalyst: market share stabilization via new U.S. manufacturing capacity. The main risk remains a possible lack of margin recovery as competitive pressures intensify.

Among the latest company updates, SolarEdge’s initiation of international shipments of American-made solar products stands out for its relevance. This move showcases an effort to take advantage of policy-driven demand and generate a clearer cost and supply advantage, which could help support volumes ahead of ongoing financial headwinds and negative earnings forecasts. Yet while this step addresses a future catalyst, the market reaction remains skeptical about its near-term impact.

In contrast, investors should also be aware of...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies is projected to reach $1.6 billion in revenue and $11.8 million in earnings by 2028. This outlook requires annual revenue growth of 20.6% and an earnings increase of $1.71 billion from the current loss of $-1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $23.42 fair value, a 35% downside to its current price.

Exploring Other Perspectives

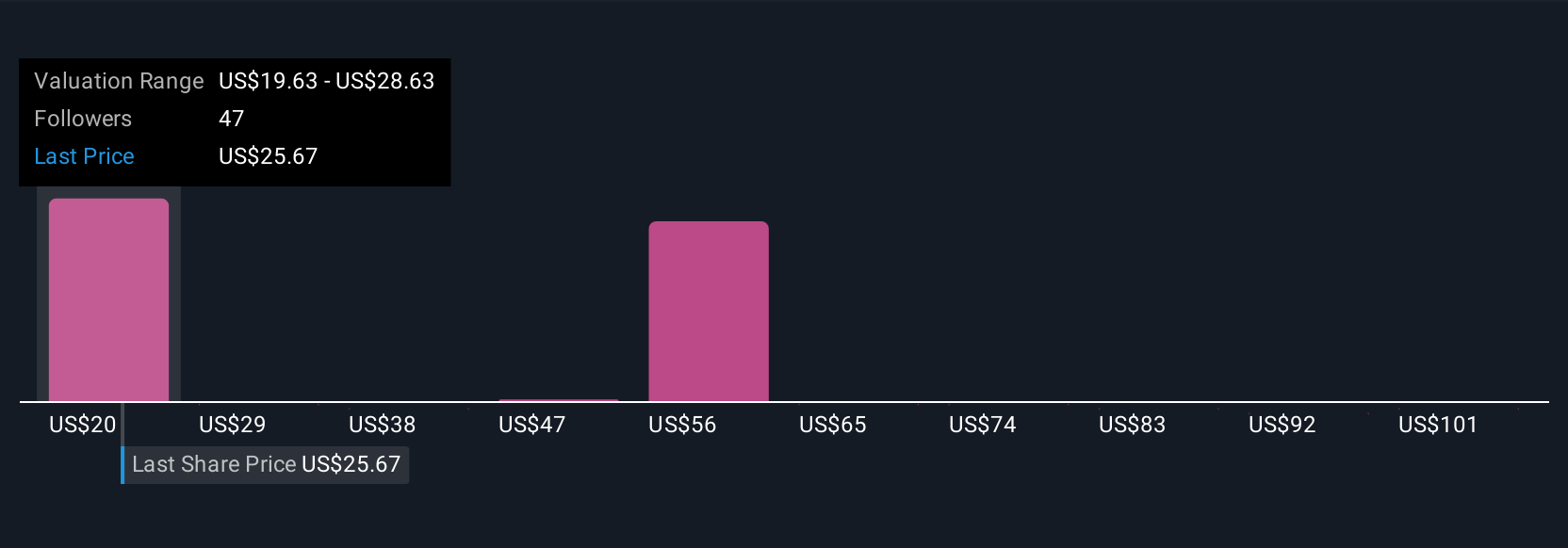

Seventeen members of the Simply Wall St Community assess SolarEdge’s fair value between US$21 and US$90.47 per share, showing broad disagreement. When you weigh this against renewed margin pressure flagged by analysts, it is clear that views on SolarEdge’s future performance can be sharply divided, explore a full range of alternative perspectives here.

Explore 17 other fair value estimates on SolarEdge Technologies - why the stock might be worth 42% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives