- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

A Look at SolarEdge Technologies's Valuation as New Battery System Gains Traction in Germany

Reviewed by Simply Wall St

SolarEdge Technologies (SEDG) just marked its first commercial battery installations in Germany with the rollout of the new CSS-OD storage system. Demand has increased rapidly, with over 150 orders from PV installers in only a few weeks.

See our latest analysis for SolarEdge Technologies.

SolarEdge’s momentum has picked up alongside the positive demand signals for its new storage system. While short-term share price returns have been modest, the stock’s year-to-date jump of 139.7% stands out. However, the three- and five-year total shareholder returns remain deeply negative. This pattern suggests investors are revisiting the company’s prospects and recalibrating risk in light of stronger adoption and recent commercial milestones.

If this surge in clean energy innovation has you looking further afield, now’s the perfect chance to discover other high-potential tech and AI stocks making waves. See the full list for free.

With sentiment turning, the key question for investors is clear: is SolarEdge undervalued given its momentum, or is the recent rally a sign that the market is already pricing in the company’s future growth potential?

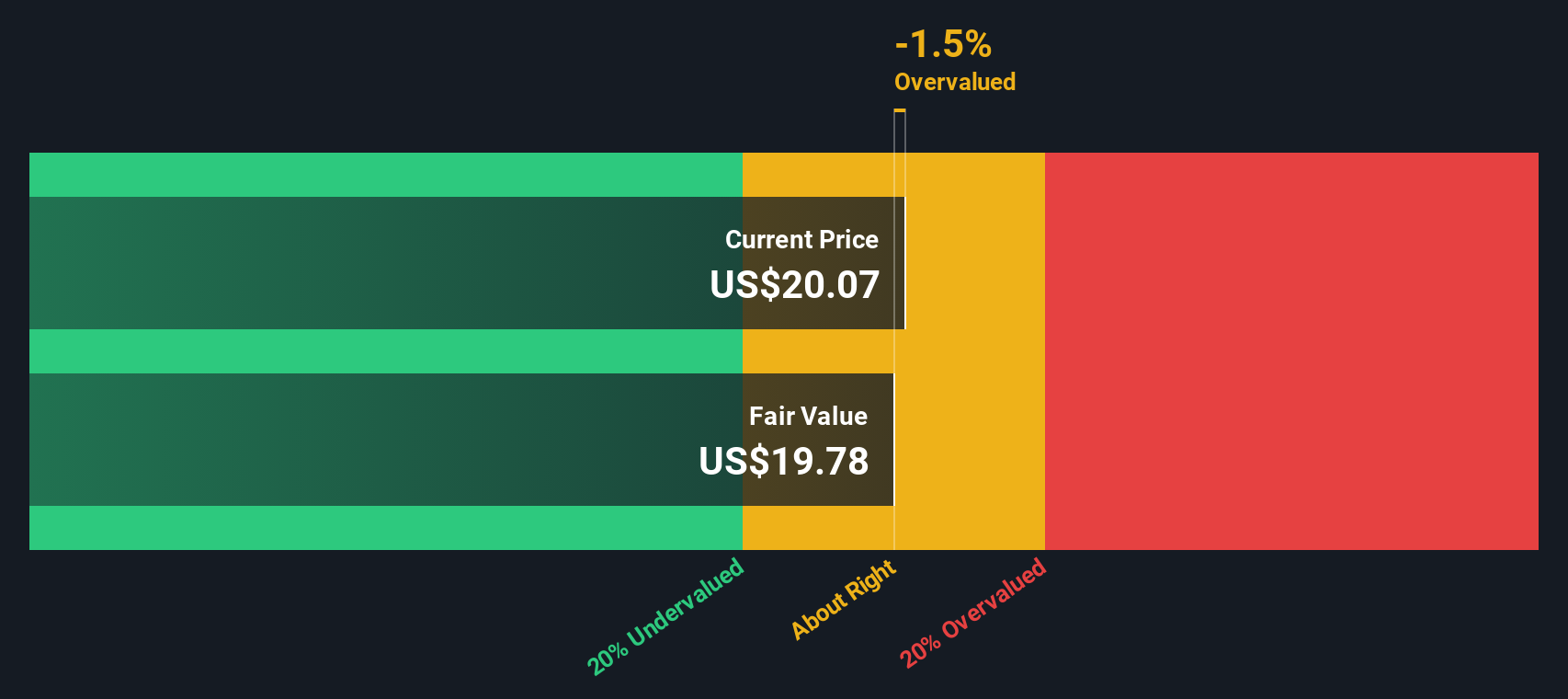

Most Popular Narrative: 6.8% Overvalued

Compared to its last close at $35.47, the most-followed narrative estimates SolarEdge Technologies’ fair value at $33.22, indicating a premium being paid by the market as expectations surge. Investors are watching whether ambitious growth assumptions will be met or if sentiment has moved too far ahead of fundamentals.

The rally in SolarEdge's stock appears to be pricing in robust future revenue growth driven by U.S. policy support (extension of manufacturing and storage credits). However, risks are rising as the elimination of the 25D residential solar tax credit is expected to cause a substantial drop in U.S. residential demand in 2026. This is only partially offset by third-party owned (TPO) shifts, which could potentially constrain topline growth.

Curious what bold moves this narrative is banking on? The fair value hinges on aggressive revenue projections, profitability swings, and a future market multiple that defies today’s reality. How do all the moving parts add up to this valuation? Uncover the full breakdown behind these surprising targets.

Result: Fair Value of $33.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. policy or surging battery adoption could spur renewed earnings momentum and challenge assumptions that SolarEdge's rebound cannot be sustained.

Find out about the key risks to this SolarEdge Technologies narrative.

Another View: Discounted Cash Flow Suggests Upside

While the market's favorite approach points to SolarEdge being overvalued, the SWS DCF model offers a challenge. According to our DCF estimate, SolarEdge’s shares are trading 8.6% below fair value, which suggests undervaluation. Is the market underestimating a potential turnaround, or are near-term risks still too great?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SolarEdge Technologies Narrative

If you want to test your own assumptions or see how the numbers stack up with your perspective, you can quickly craft a narrative to suit your own view. Do it your way

A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There's a world of opportunity beyond SolarEdge. Use the Simply Wall Street Screener and you could spot brilliant companies before they make headlines. Don’t wait while others get ahead.

- Uncover market gems with strong financials by tapping into these 3579 penny stocks with strong financials that stand out for disciplined growth and resilience in volatile markets.

- Tap into tomorrow's biggest tech trends by reviewing these 25 AI penny stocks set to benefit from major advances in artificial intelligence and automation.

- Start building generational wealth by searching through these 932 undervalued stocks based on cash flows that offer standout long-term upside potential based on real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.