- United States

- /

- Semiconductors

- /

- NasdaqGS:RMBS

Rambus (RMBS) Valuation: Assessing Shares After Strong Q3 Revenue Growth and Fresh Guidance

Reviewed by Simply Wall St

Rambus (RMBS) shares saw renewed attention following the company’s third-quarter earnings announcement. The report revealed a sizeable jump in revenue from last year, as well as new guidance for the fourth quarter.

See our latest analysis for Rambus.

After surging on its strong third-quarter revenue beat and new guidance, Rambus shares staged an impressive run, climbing 8.3% in a single day and contributing to a massive 51% share price return over the past ninety days. The stock’s momentum has shifted into high gear this year, with a remarkable 103% year-to-date share price return and an outstanding 88% total shareholder return over the past twelve months. This makes it one of the most notable outperformers in the semiconductor space.

If Rambus’s acceleration sparked your curiosity, you might want to see what’s happening among other high-growth innovators. Now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With the recent rally fueled by rising revenues and new guidance, the question now is whether Rambus shares are still trading at an attractive value, or if the market has already factored in all the company’s future growth potential.

Most Popular Narrative: 6.3% Undervalued

With Rambus closing at $108.61 and the most widely followed narrative suggesting a fair value of $115.88, the story points to shares still trading below what many consider justified given revenue momentum and positive sector tailwinds.

The upcoming industry transition to MRDIMM technology, slated for full-scale adoption beginning in the second half of 2026, will significantly increase the silicon content per module. Rambus is well-positioned to benefit from this shift, which could materially expand its addressable market and drive multi-year revenue growth.

Want to know what’s fueling this optimistic price tag? Analysts are betting on rising revenues, expanding margins, and an earnings target that signals confidence. The forecast hinges on a future profit multiple more often reserved for tech giants. Find out what bold assumptions power this striking fair value.

Result: Fair Value of $115.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, emerging competition and delays in new product adoption could dampen Rambus’s growth story, particularly if market dynamics shift unexpectedly.

Find out about the key risks to this Rambus narrative.

Another View: Market Multiples Paint a Different Picture

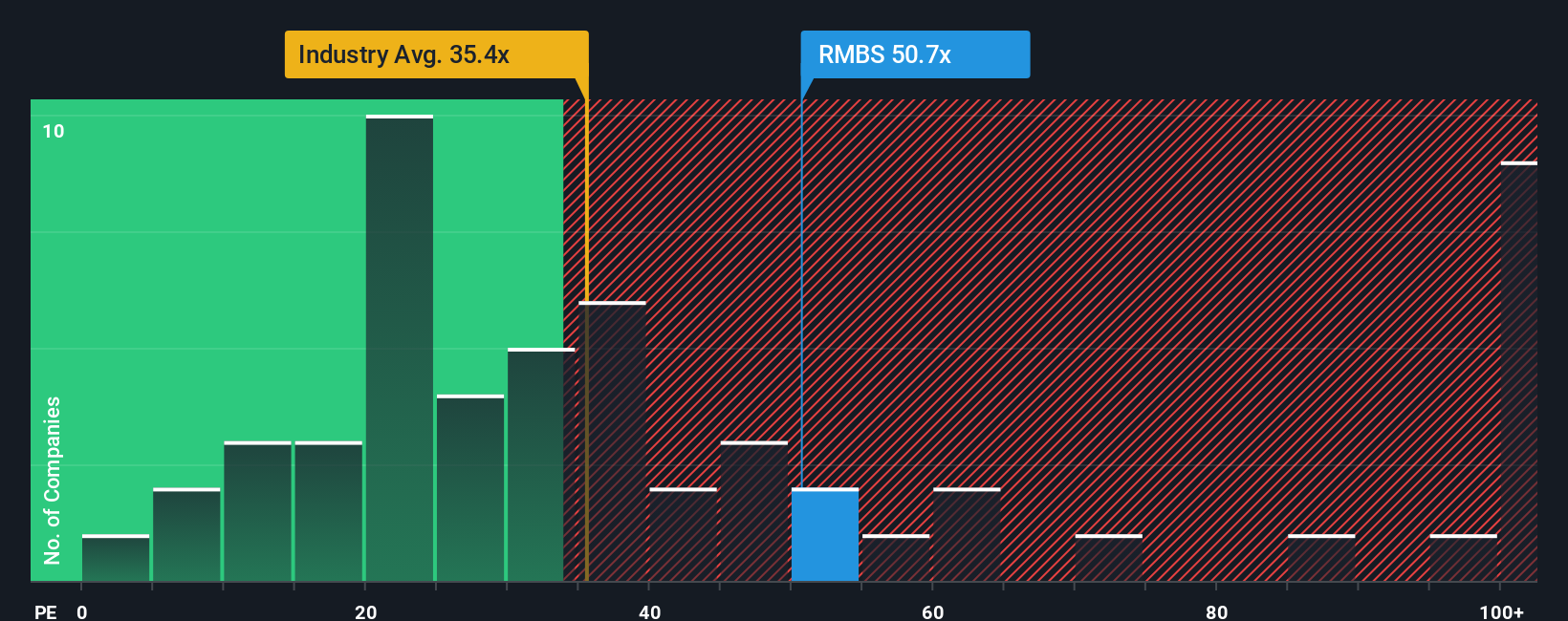

While the popular narrative pegs Rambus as undervalued, a look at its price-to-earnings ratio raises some caution. Rambus trades at 51.1 times earnings, which is considerably higher than both the peer average of 35.9x and the industry average of 36.9x, as well as the fair ratio of 31.3x. This premium could indicate greater valuation risk if expectations change. Does the excitement about future growth justify paying a higher price today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rambus Narrative

If you want to draw your own conclusions or challenge the current consensus, it only takes a few minutes to build your own view from the data. Do it your way.

A great starting point for your Rambus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities with Simply Wall Street’s free screener. Smart investors never limit themselves, so why should you? See what else could spark your portfolio’s growth before the market catches on.

- Snap up income potential with these 20 dividend stocks with yields > 3% and target companies boasting attractive yields above 3%.

- Get ahead of the AI curve by tracking innovation leaders via these 26 AI penny stocks and spot the next big mover in artificial intelligence.

- Tap into disruptive technology trends by following these 27 quantum computing stocks as they push boundaries in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RMBS

Rambus

Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives