- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti (RGTI) Sinks 24.5 Percent After Widening Losses and Disappointing Q3 Results – Has the Story Changed?

Reviewed by Sasha Jovanovic

- Rigetti Computing recently reported third-quarter 2025 results, revealing US$1.95 million in sales and a net loss of US$200.97 million, both worse compared to the previous year.

- Despite ambitious technological plans and new government contracts, the earnings disappointed, raising fresh concerns about the company's ability to support ongoing development amid swelling losses.

- We'll explore how widening operating losses are shaping Rigetti's investment narrative and the implications for future profitability prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Rigetti Computing's Investment Narrative?

For anyone considering Rigetti Computing, the central belief has always been about high-stakes innovation: the company is working to commercialize quantum computing at scale, with a roadmap that targets building a 100-plus-qubit chiplet system soon and aggressive milestones through 2027. The recent quarterly update, featuring a sharp drop in revenue and a dramatic jump in net losses, has put that vision to the test. Despite a string of partnerships and government wins, the earnings miss and accelerating losses have shifted attention back to the company’s ability to finance and prove its technical roadmap in the short term. What once seemed a story driven by technological potential and major contracts now faces new and immediate questions around cash burn, share dilution risks, and when concrete commercial traction will appear. The latest earnings have intensified these financial concerns and sharply reduced shares, potentially reprioritizing risk for investors, at least until new results or project milestones change the tone again. On the other hand, persistent insider selling is an ongoing signal that shouldn’t be ignored by investors.

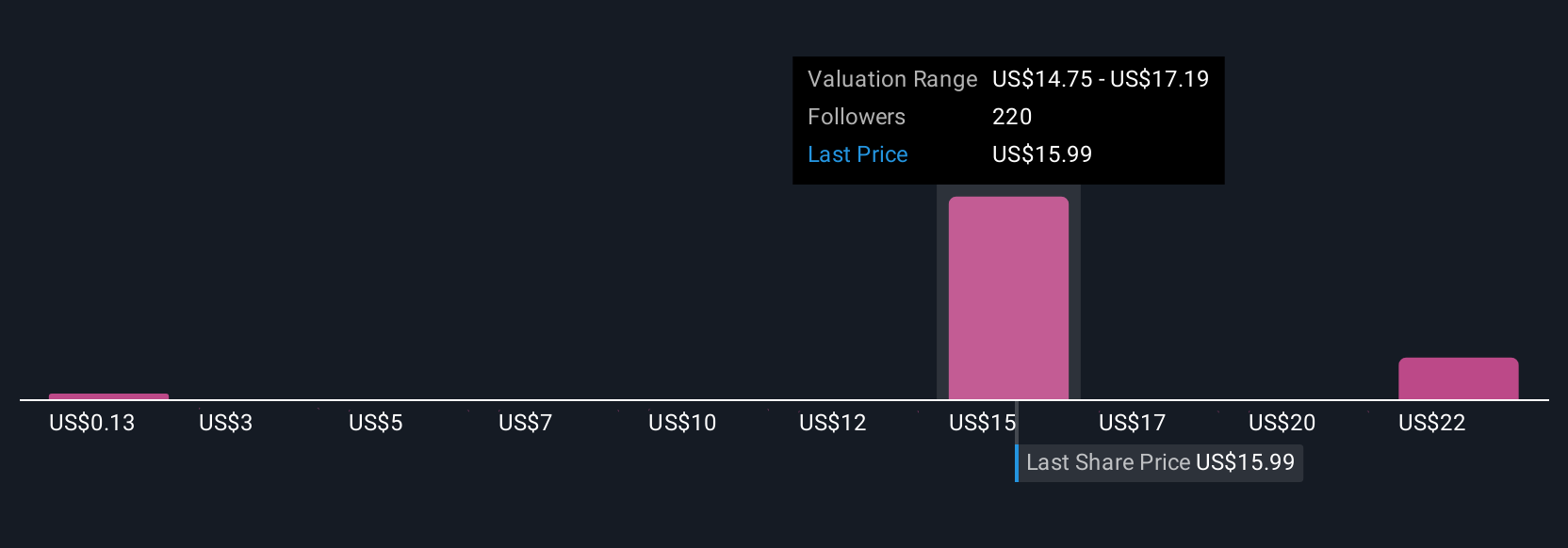

According our valuation report, there's an indication that Rigetti Computing's share price might be on the expensive side.Exploring Other Perspectives

Explore 49 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives