- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing Third Quarter 2024 Earnings: EPS Beats Expectations, Revenues Lag

Rigetti Computing (NASDAQ:RGTI) Third Quarter 2024 Results

Key Financial Results

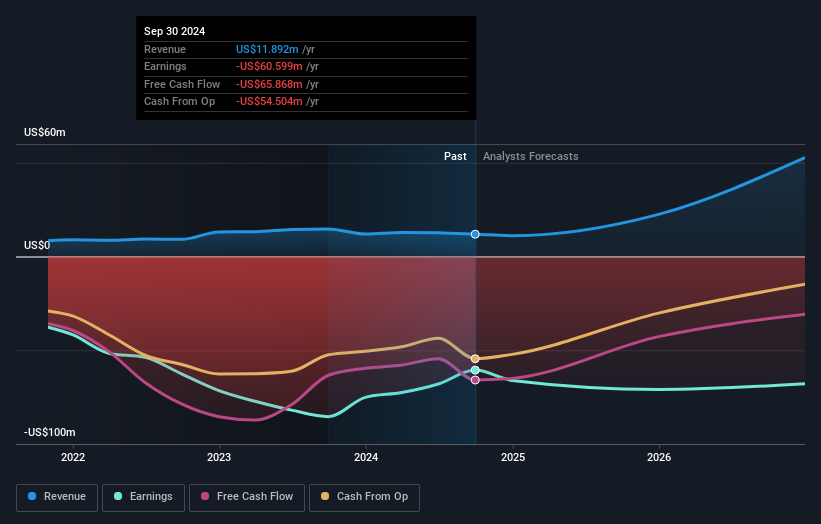

- Revenue: US$2.38m (down 23% from 3Q 2023).

- Net loss: US$14.8m (loss narrowed by 33% from 3Q 2023).

- US$0.079 loss per share (improved from US$0.17 loss in 3Q 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Rigetti Computing EPS Beats Expectations, Revenues Fall Short

Revenue missed analyst estimates by 30%. Earnings per share (EPS) exceeded analyst estimates by 14%.

Looking ahead, revenue is forecast to grow 55% p.a. on average during the next 3 years, compared to a 19% growth forecast for the Semiconductor industry in the US.

Performance of the American Semiconductor industry.

The company's shares are up 42% from a week ago.

Risk Analysis

You should always think about risks. Case in point, we've spotted 4 warning signs for Rigetti Computing you should be aware of, and 1 of them is concerning.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Investment Thesis: Olvi Oyj (OLVAS)

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.