- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

Qorvo (QRVO): Evaluating Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Qorvo.

Qorvo’s latest share price surge to $97.42 caps off a strong run, with momentum clearly building this year as evidenced by a 39.7% year-to-date share price return. Despite lingering volatility reflected in a modest 1-year total shareholder return of -3.1%, investors appear to be increasingly optimistic about Qorvo’s long-term prospects and fundamentals as the broader semiconductor sector regains favor.

If you're weighing fresh opportunities on the back of Qorvo’s recent rally, it’s an ideal moment to discover See the full list for free.

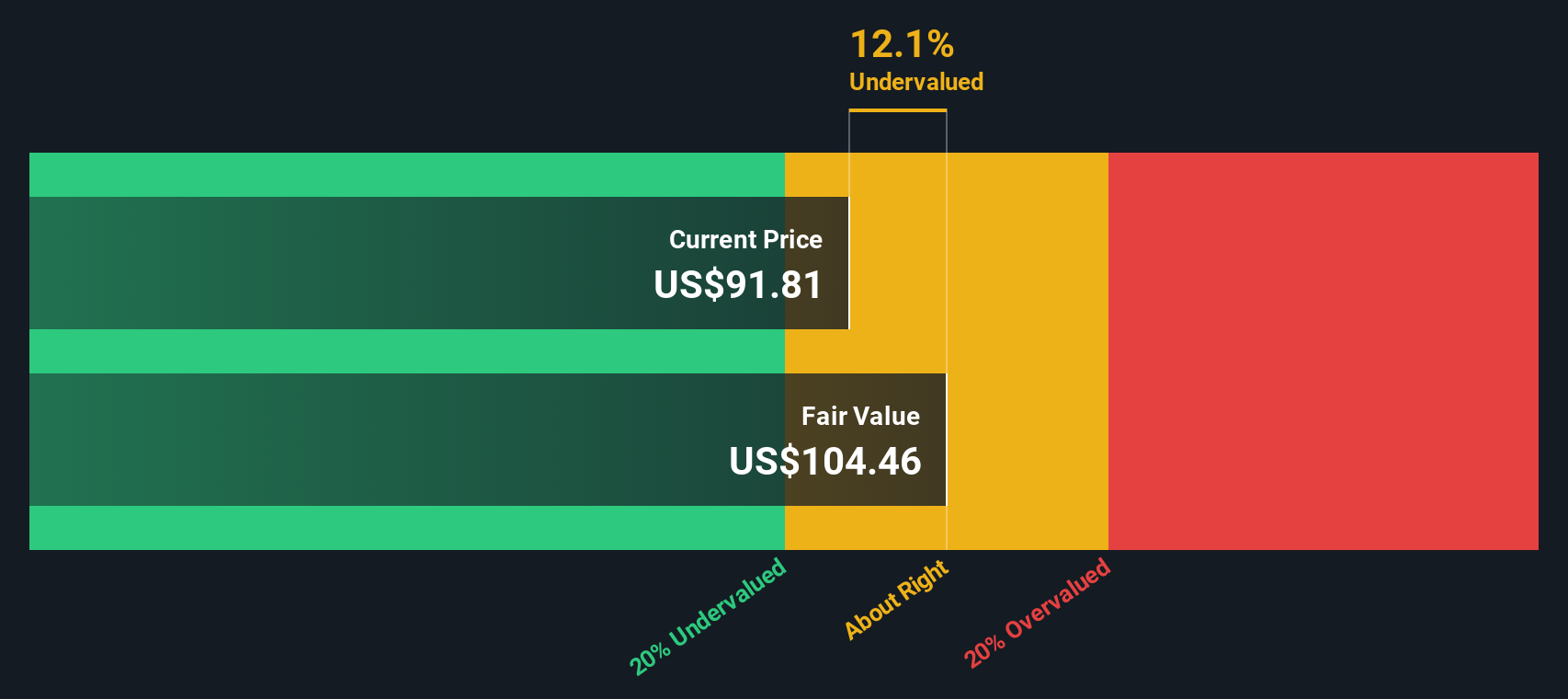

With recent gains largely matching analyst expectations and modest improvements in revenue and earnings, the question for investors is whether Qorvo remains undervalued, or if the market has already priced in its future growth potential.

Most Popular Narrative: Fairly Valued

With Qorvo's $97.29 fair value nearly matching the last closing price of $97.42, the focus shifts to the assumptions supporting this balance. Pay close attention to the reasoning analysts use to justify this figure.

Qorvo is set to benefit from accelerating adoption and content expansion tied to the rollout of 5G and future 6G networks, as evidenced by strong design wins in flagship smartphones, Wi-Fi 7/8 deployments, and persistent efforts to increase RF content per device. These factors directly support multi-year revenue growth and margin expansion.

Interested in the growth strategy that supports this high valuation? The central narrative highlights record earnings and a forward-looking profit multiple comparable to leading technology companies. What are the forecasts for how rapidly Qorvo will transform its margins and revenue? You’ll need to review the full data set and methodology driving this fair value to assess its validity.

Result: Fair Value of $97.29 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in diversification or overreliance on a key customer could quickly introduce volatility and challenge Qorvo’s outlook.

Find out about the key risks to this Qorvo narrative.

Another View: Discounted Cash Flow Perspective

Looking through the lens of the SWS DCF model, Qorvo is currently trading about 5% below its estimated fair value of $102.81. This suggests there may be more upside than analysts’ consensus targets imply. Can this intrinsic value signal remain robust against market swings and operational challenges?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qorvo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qorvo Narrative

If you have your own perspective or want to dive deeper into the data, it only takes a few minutes to construct your own narrative. Do it your way.

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while others seize new opportunities. Find your next standout stock pick with unique screeners built for smart investors like you.

- Boost your portfolio stability and income by checking out these 21 dividend stocks with yields > 3%, which features companies with attractive yields and track records of reliable payouts.

- Spot trailblazers in artificial intelligence by exploring these 26 AI penny stocks and see which innovators are shaping tomorrow’s technology landscape.

- Stay ahead of the curve and uncover hidden bargains with these 868 undervalued stocks based on cash flows, an ideal tool for finding quality stocks trading below their potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives