- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

Is Now the Right Moment for Qorvo After a 32% Rally in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Qorvo’s stock and wondering whether it’s time to buy, hold, or wait it out, you’re not alone. After a bumpy year with shares down 7.0% over the past 12 months and still off by nearly 28% from five years ago, it’s natural to question what comes next. Yet, year-to-date, Qorvo is up an impressive 32.0%, with a relatively flat -1.3% over the last 30 days and almost no movement this past week. These numbers paint a picture of a stock that’s both recovering and recalibrating. This story is driven in part by industry tailwinds and shifting investor sentiment rather than just quarterly headlines.

Recent developments in the broader semiconductor space, including supply chain stabilization and renewed optimism for future demand, have brought Qorvo back into the spotlight. While these trends alone don’t explain every twitch in the share price, they contribute to a sense that risk perceptions are evolving and that the company may have more room to surprise than many think. It is precisely this mix of past underperformance and recent momentum that has many investors taking a second look at the stock’s true value.

On paper, Qorvo’s official “value score” stands at just 1 out of 6, meaning it is currently undervalued in only one of the six main checks we use to analyze a stock’s worth. But as we dig deeper into these valuation methods—and consider how well they capture the real drivers of long-term performance—we may discover that there’s a more nuanced, even more revealing way, to judge opportunities like Qorvo’s. Let’s break down what the numbers and ratios are really saying, before exploring the approach that goes beyond the checklists.

Qorvo scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Qorvo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them to today's dollars. This provides a present-day valuation rooted in expected future performance. For Qorvo, analysts look at Free Cash Flow (FCF) as a key measure of its financial health and growth prospects.

Currently, Qorvo generates $583 million in FCF, reflecting its ability to convert revenue into cash available for shareholders. Analyst estimates, combined with Simply Wall St projections, extend these numbers up to 2035, with FCF projected to rise to approximately $1.05 billion in a decade. Only the next five years are based on multiple analyst sources. The remaining period reflects extrapolated expectations using historical trends.

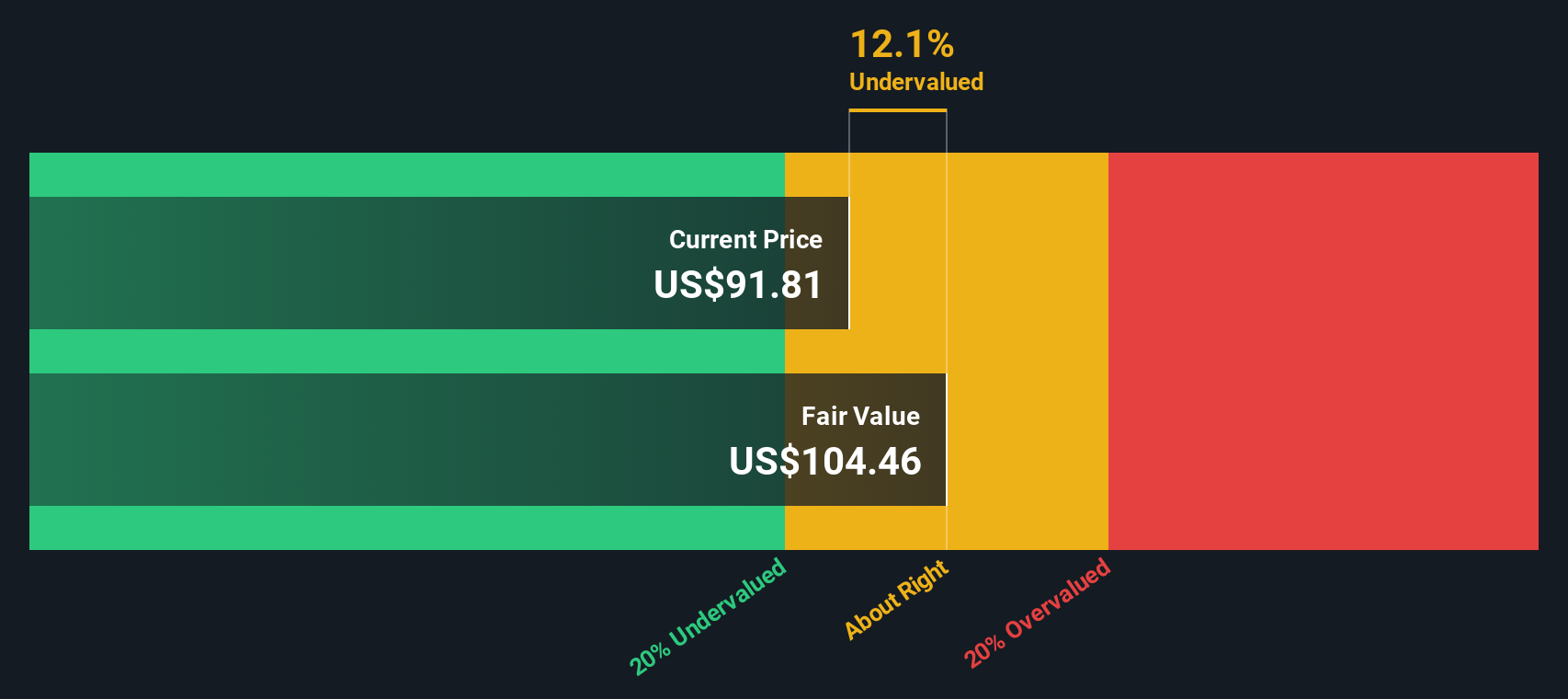

Based on these cash flow projections and the discounting process, Qorvo’s estimated intrinsic value comes to $102.95 per share. This means, compared to the current market price, the stock is considered to be about 10.6% undervalued according to the DCF model. Such a discount suggests a meaningful opportunity for investors if the company can realize these future cash flows as anticipated.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Qorvo is undervalued by 10.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Qorvo Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most useful metrics for valuing profitable companies like Qorvo, as it expresses what investors are willing to pay today for a dollar of current earnings. Profitable businesses can be meaningfully compared against their own history, industry peers, and the market using this ratio.

What is considered a "normal" or fair PE ratio depends on how fast the company is expected to grow, its risk profile, and broader market conditions. Generally, higher expected growth or lower risk justifies a higher PE, while slower growth or greater uncertainty leads to a lower PE being reasonable.

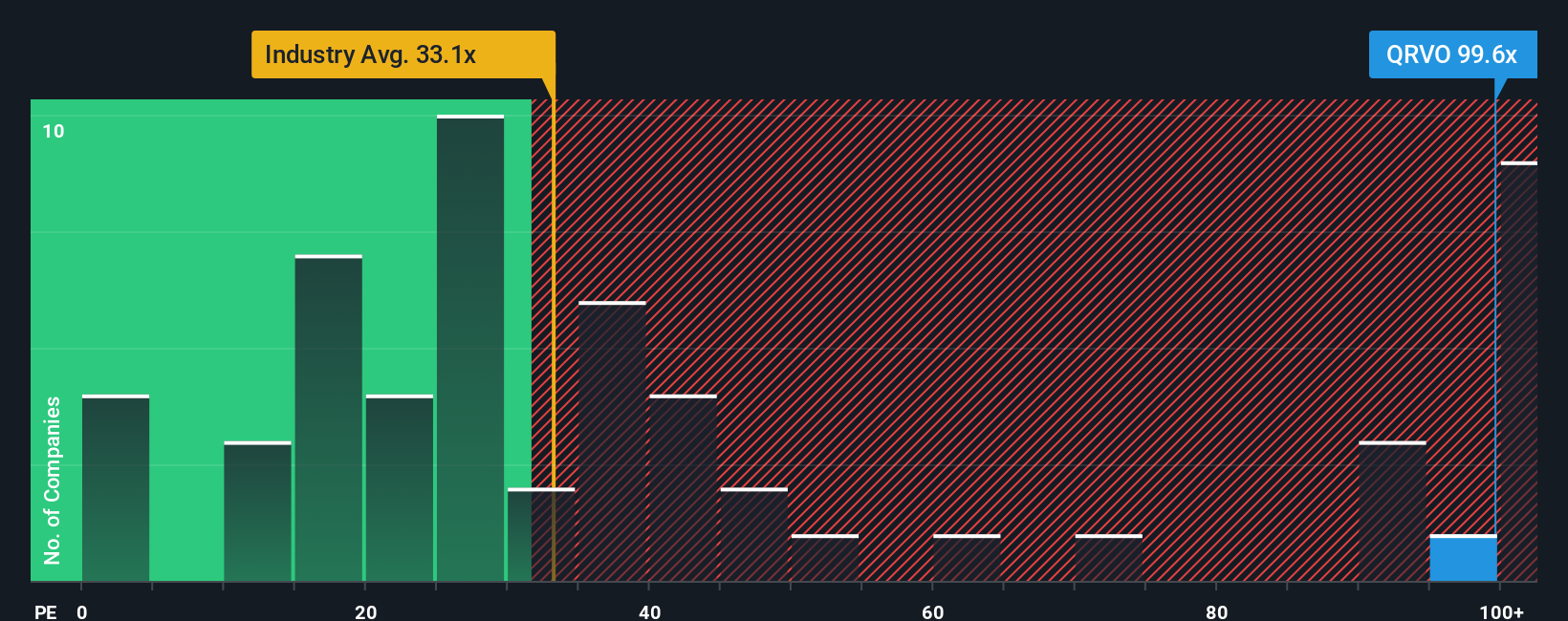

Qorvo currently trades at a PE ratio of 105.6x, which is significantly higher than both the semiconductor industry average of 36.1x and the average of its peers at 29.8x. At first glance, this high multiple might suggest the stock is expensive compared to the sector. However, Simply Wall St's "Fair Ratio" takes the analysis further by weighing factors such as Qorvo’s earnings growth, risk, profit margins, industry, and market capitalization to determine what would make sense for this specific company. For Qorvo, the Fair Ratio is 36.1x, almost identical to the industry average but well below its current level.

Because Qorvo’s actual PE is much higher than its Fair Ratio, the stock appears overvalued on this measure, even after accounting for its specific growth prospects and risk profile. This indicates buyers are likely paying a significant premium today relative to current earnings strength.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Qorvo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story behind the numbers, capturing how you see a company's future by outlining your assumptions about its revenue, margins, growth drivers, and risks, and rolling all of that into a financial forecast and a fair value estimate. Rather than relying solely on standard ratios, Narratives let you clearly connect what you believe about a company to the numbers you expect it to deliver. This approach turns your perspective into a concrete investment plan.

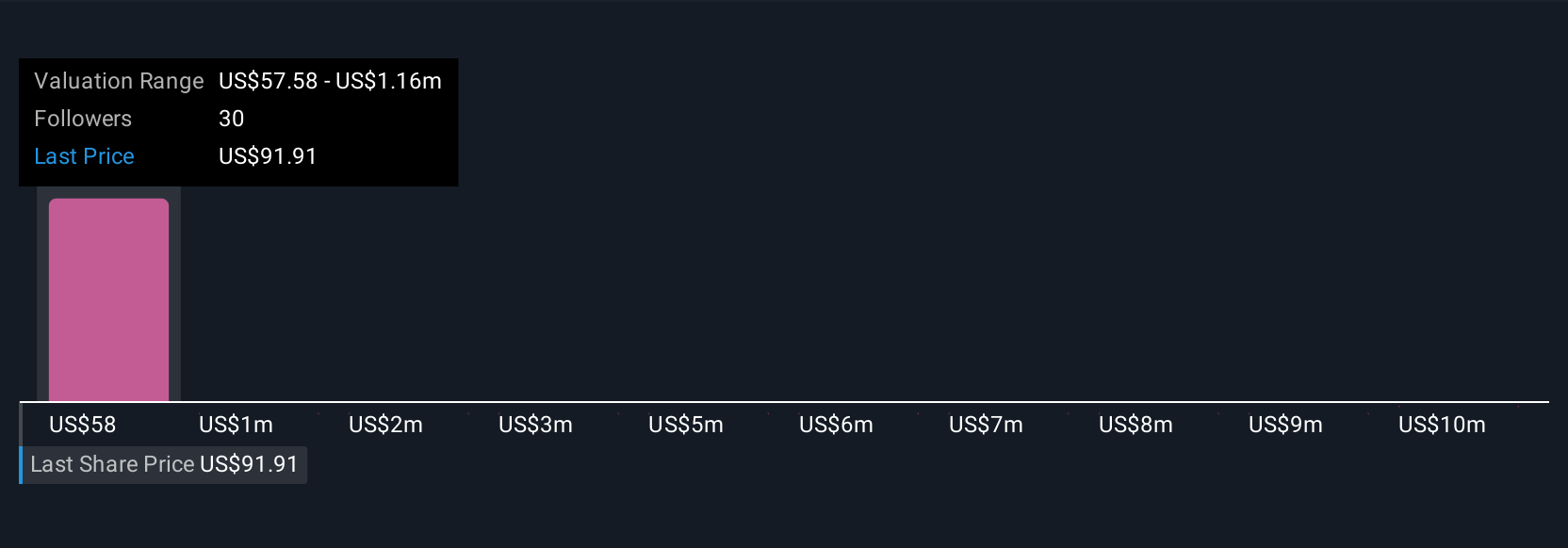

Narratives are easy and accessible on Simply Wall St, used by millions of investors in the Community page, where you can test, share, and compare your outlook for Qorvo. They help you decide when to buy or sell by showing how your Fair Value stacks up against the current Price. In addition, they update dynamically when new news or earnings are released, keeping your analysis fresh. For Qorvo, some investors have a bullish narrative built on the boom in wireless adoption and higher margins, resulting in a Fair Value as high as $128. Others see the risks of customer concentration and volatile demand, and estimate a Fair Value closer to $70. Your Narrative is your competitive edge, so make it count.

Do you think there's more to the story for Qorvo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives