- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

How Qorvo’s (QRVO) Strong Quarter and Restructuring Efforts Could Shape Its Investment Case

Reviewed by Sasha Jovanovic

- Qorvo recently announced strong second-quarter fiscal 2026 results, surpassing both adjusted earnings and revenue estimates due to healthy demand in its Advanced Cellular Group and High Performance Analog segments.

- Management highlighted a restructuring initiative in the Connectivity and Sensors Group aimed at boosting profitability, while issuing an upbeat revenue and earnings outlook for the next quarter.

- With restructuring in focus, we'll examine how Qorvo's improved outlook and operational changes could influence its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Qorvo Investment Narrative Recap

For Qorvo shareholders, the core investment thesis remains centered on the company’s ability to capture long-term growth driven by wireless connectivity expansion, advanced cellular, and analog content gains, while successfully managing current revenue concentration risks. The recent quarterly results, while positive, do not materially change the most important short-term catalyst: ramping revenue diversification in new segments. However, heavy reliance on a single large customer and potential execution challenges in diversification still represent the business’s most significant near-term risks.

Of the recent company announcements, the planned acquisition by Skyworks Solutions stands out as especially relevant. While shareholder approval and regulatory reviews are still pending, this proposed deal introduces a new layer of uncertainty and could influence how investors view Qorvo’s near-term execution, synergy expectations, and risk profile, particularly as it relates to the company’s ability to deliver on current restructuring and profitability targets.

By contrast, investors should also be alert to how customer concentration risk, especially with one customer accounting for 41% of revenue, could affect both short-term results and longer-term stability if demand shifts or the relationship changes...

Read the full narrative on Qorvo (it's free!)

Qorvo's narrative projects $4.1 billion revenue and $480.9 million earnings by 2028. This requires 4.4% yearly revenue growth and a $400.1 million earnings increase from $80.8 million today.

Uncover how Qorvo's forecasts yield a $101.74 fair value, a 18% upside to its current price.

Exploring Other Perspectives

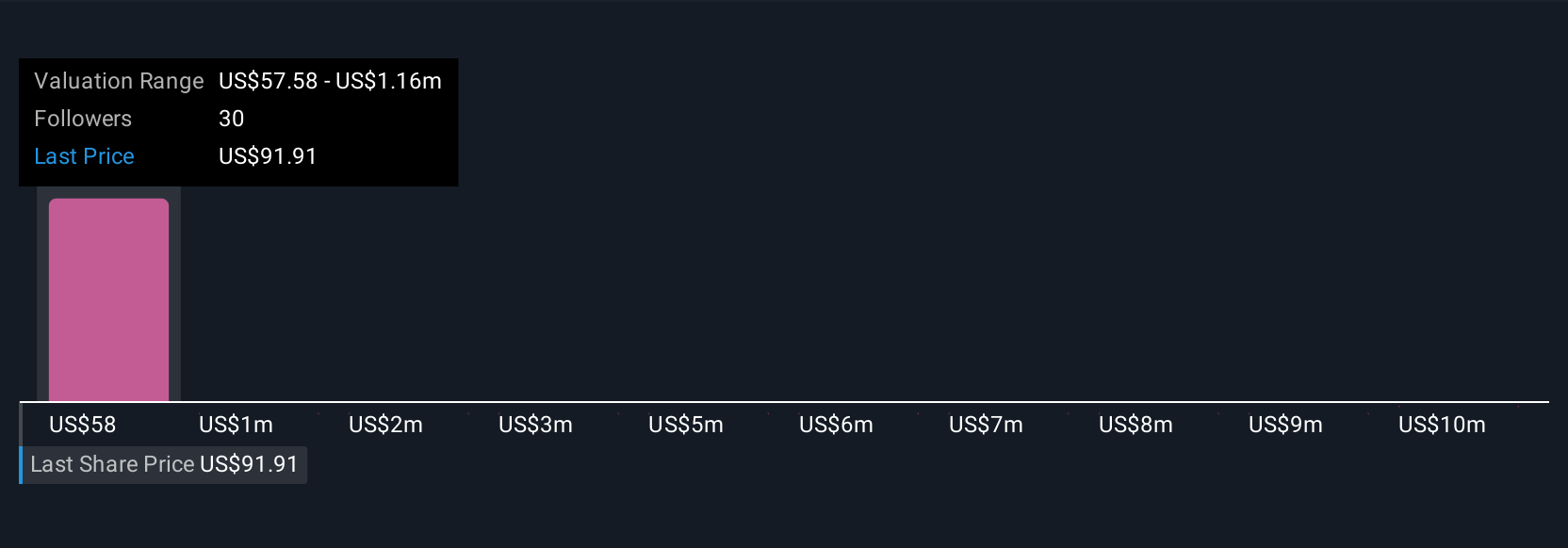

Four members of the Simply Wall St Community estimate Qorvo's fair value between US$57.58 and US$130, highlighting significant dispersion. While many see earnings growth potential as a catalyst, you can review their varied reasoning for a fuller picture.

Explore 4 other fair value estimates on Qorvo - why the stock might be worth as much as 51% more than the current price!

Build Your Own Qorvo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qorvo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qorvo's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026