- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (QCOM) Welcomes AI Expert Dr. Jeremy Kolter to Board of Directors

Reviewed by Simply Wall St

In a recent development, QUALCOMM (QCOM) appointed Dr. Jeremy Kolter to its Board of Directors, focusing on enhancing its AI capabilities. Over the last month, the company's stock price increased by 7%, a movement that reflects a positive market sentiment towards the tech sector, as highlighted by the rise in S&P 500 and Nasdaq indices. Executive changes at QUALCOMM, including Kolter's expertise in AI and a strategic shift in senior management, may have supported this upward trend. However, this move is consistent with broader tech stock rises, with Alphabet's market gains contributing to the overall positive sentiment.

Buy, Hold or Sell QUALCOMM? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The appointment of Dr. Jeremy Kolter to QUALCOMM's Board of Directors, emphasizing AI capabilities, could significantly influence the company's strategic direction. This focus on AI aligns with the company's ongoing initiatives to diversify into AI devices, automotive, and industrial IoT, all of which are part of QUALCOMM's broader strategy to reduce reliance on specific customers and sectors. Over the past five years, the company's total shareholder return, including share price and dividends, reached 60.06%, highlighting the potential benefits of its diversification efforts. However, recent one-year performance shows an underperformance compared to the US semiconductor industry, which saw a 46.1% return in the same period.

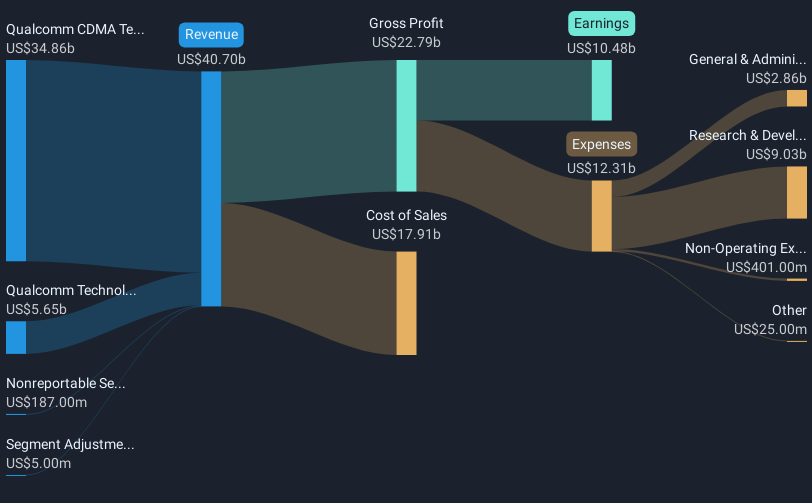

QUALCOMM's recent stock price increase by 7% over the last month reflects a positive reception to both the executive changes and the tech sector's overall momentum. The company's current share price of US$158.78 remains below the analyst consensus price target of US$177.71, indicating a potential upside of around 11.93%. Analysts forecast a modest annual revenue growth of 2.7% over the next three years, with earnings projected to reach US$12.2 billion by August 2028. Nonetheless, the company's ambitious plans are not without risks; a successful execution of its AI, IoT, and data center expansion could boost revenue and earnings, but any delays or geopolitical challenges may impact these forecasts. Dr. Kolter's expertise might provide the necessary leadership to navigate these complexities and leverage AI opportunities effectively.

Examine QUALCOMM's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion