- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (QCOM) Reports Q3 Revenue Of US$10 Billion With Increased Earnings

Reviewed by Simply Wall St

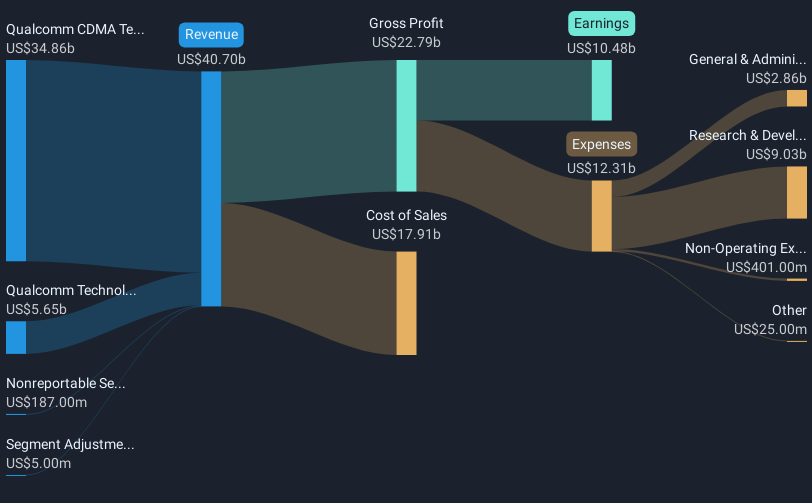

QUALCOMM (QCOM) recently announced strong third-quarter earnings, with revenue increasing to $10,365 million and net income rising to $2,666 million year-over-year. This financial performance was accompanied by a shareholder-friendly move as Qualcomm declared a quarterly dividend of $0.89 per share, adding appeal to long-term investors. Additionally, the company's move to appoint Christopher Young to its Board signifies a strategic push towards enhancing its management team. Amid a broader market backdrop where major indices have experienced robust earnings-driven gains, Qualcomm's stock price rose 18% last quarter, aligning with bullish trends seen in other tech stocks.

Buy, Hold or Sell QUALCOMM? View our complete analysis and fair value estimate and you decide.

QUALCOMM's recent announcement of strong third-quarter financial results, coupled with a quarterly dividend declaration, underlines its commitment to rewarding shareholders, aligning well with its strategic initiatives highlighted earlier. The appointment of Christopher Young to the Board may bolster management expertise in expanding sectors like automotive and IoT, potentially enhancing revenue streams and profitability. This strategic focus aligns with analyst expectations for revenue growth via initiatives targeting $22 billion in non-handset revenue by fiscal 2029, suggesting a positive trajectory for long-term earnings.

Over the past five years, QUALCOMM's total shareholder return was 58.85%, illustrating steady longer-term appreciation, especially when compared to its underperformance against the US market's 15.7% gain over one year. Relative to the semiconductor industry, which returned 39.1%, QUALCOMM lagged, indicating sector-specific challenges during the past year despite broader technological advancements.

In terms of financial projections, the recent developments may support QUALCOMM's ambition to deploy advanced Snapdragon platforms, further diversifying income sources, and boosting revenue growth prospects. The share price's current positioning at US$159.06, with an 8% discount to the consensus analyst price target of US$176.20, highlights market expectations of potential upside as these strategies unfold. However, fluctuations in global trade dynamics and competitive pressures remain considerations against these initiatives. The market's view of QUALCOMM's value in the longer term remains cautiously optimistic but underscored by the need for consistent operational execution.

The valuation report we've compiled suggests that QUALCOMM's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives