- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Is Samsung and Google's XR Headset Launch Shifting the Investment Case for Qualcomm (QCOM)?

Reviewed by Sasha Jovanovic

- Earlier this week, Samsung and Google announced the launch of the Galaxy XR mixed reality headset, featuring advanced passthrough vision, eye-tracking, hand tracking, and integration with Google's Gemini AI assistant as they aim to compete with Meta in the smart glasses arena.

- The debut of the Galaxy XR spotlights increasing momentum in the wearable and mixed reality market, an area closely tied to Qualcomm's core technology as a key component supplier for next-generation devices.

- We'll examine how Samsung and Google's push into XR wearables, leveraging Qualcomm hardware, could influence the company's investment outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

QUALCOMM Investment Narrative Recap

To be a Qualcomm shareholder today, you need to believe that the company can maintain its pivotal role in enabling next-generation technologies such as mixed reality, AI, and connected devices, while offsetting the risk posed by major customers like Apple reducing their reliance on Qualcomm chips. While the Galaxy XR launch underscores growing demand for advanced wearables powered by Qualcomm's hardware, this news does not appear to materially shift the most important near-term catalyst for the stock: sustained, profitable adoption of AI and XR devices across global markets; nor does it reduce the main risk of revenue loss from Apple’s in-house chip ambitions.

Among Qualcomm’s recent announcements, the affirmation of its $0.89 quarterly dividend is especially relevant. Regular dividend payments signal management’s confidence in the company’s steady cash generation, even as the business faces competitive pressure and transitions in key customer relationships highlighted by new device launches such as the Galaxy XR.

Yet, in contrast to the growth excitement, investors should be aware that risks tied to Apple’s looming licensing agreement expiration in 2027 could...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's outlook anticipates $46.9 billion in revenue and $12.2 billion in earnings by 2028. This implies a 2.7% annual revenue growth and a $0.6 billion increase in earnings from the current $11.6 billion.

Uncover how QUALCOMM's forecasts yield a $177.71 fair value, a 5% upside to its current price.

Exploring Other Perspectives

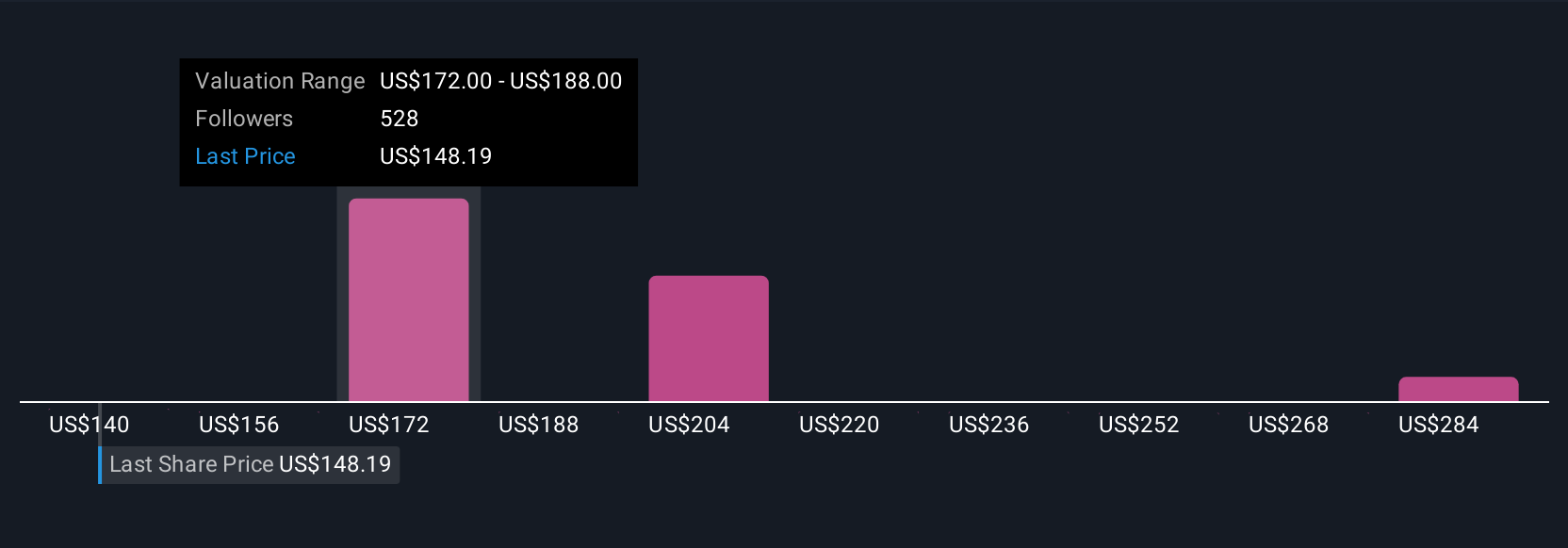

Thirty-one Simply Wall St Community fair value estimates for Qualcomm span from US$140 to US$300 per share, reflecting pronounced divergence among private investors. Staying competitive as major customers shift to in-house chips remains crucial to the company’s long-term outlook, so consider how sharply opinions can differ as you weigh these alternative views.

Explore 31 other fair value estimates on QUALCOMM - why the stock might be worth as much as 78% more than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion