- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Does QUALCOMM’s AI and Automotive Expansion Justify Its 7% Weekly Share Price Surge?

Reviewed by Bailey Pemberton

- Curious if QUALCOMM is still a smart buy or if the recent buzz is just noise? You are not alone. There is a lot to unpack about what this stock is really worth.

- The share price has made headlines lately, climbing 7.1% in just the last week and up 17.7% year-to-date, impressing both short-term traders and long-term holders.

- These price swings are happening against a backdrop of major news, like QUALCOMM’s latest product launches and fresh partnerships in the AI and automotive sectors. Such announcements are fueling speculation that the company could play a bigger role in tomorrow’s connected world.

- Right now, QUALCOMM scores a 4 out of 6 on our valuation framework, hinting that it may still offer decent value. We will dig into what each valuation metric says about the company, but stick around. The best way to analyze QUALCOMM’s true worth might surprise you at the end.

Find out why QUALCOMM's 11.9% return over the last year is lagging behind its peers.

Approach 1: QUALCOMM Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those back to today's value. This process helps investors understand what QUALCOMM could reasonably be worth based on its ability to generate cash in the coming years.

QUALCOMM currently reports Free Cash Flow of approximately $11.25 billion. Looking ahead, analysts forecast that its cash flows will grow, with Simply Wall St extrapolating that by 2029, Free Cash Flow could reach around $17.44 billion. Since analysts typically provide estimates up to five years out, projections beyond that are derived from in-house models. The trend, however, indicates continued growth, albeit at a slower pace.

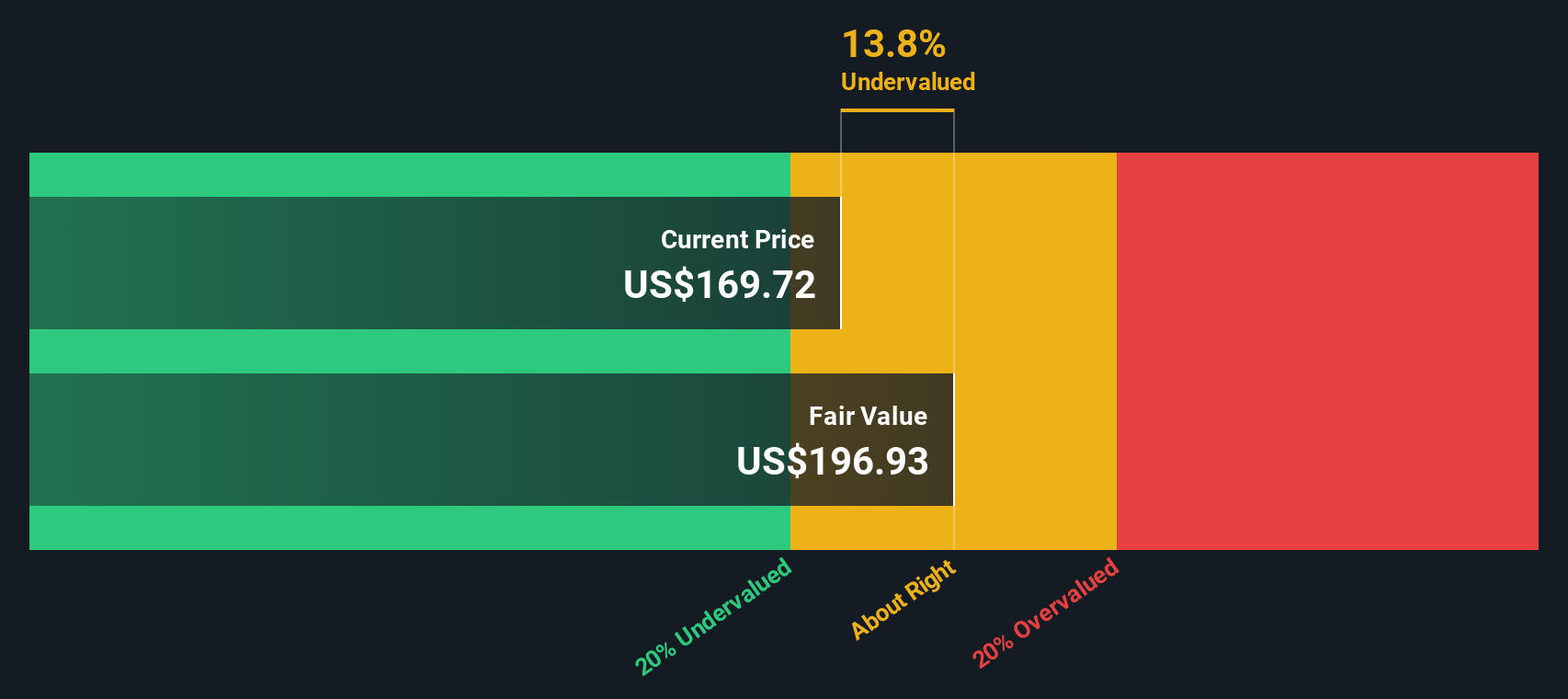

Based on this model, QUALCOMM's estimated intrinsic value is $213.82 per share. Compared to the current market price, the DCF analysis suggests QUALCOMM is trading at a 15.4% discount. This indicates the stock is undervalued according to projected cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests QUALCOMM is undervalued by 15.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: QUALCOMM Price vs Earnings (PE)

For profitable companies like QUALCOMM, the Price-to-Earnings (PE) ratio is a time-tested way of weighing up value. The PE ratio tells investors how much they are paying for each dollar of earnings, making it especially relevant when the focus is on consistent profitability and growth.

Growth expectations and risk both shape what a “normal” or “fair” PE ratio looks like. High-growth companies or those with steady, predictable earnings can justify higher PE ratios, while riskier or slow-growth businesses usually trade at lower multiples. It is your way of checking if optimism about future profits is already priced in, or if there is still room to run.

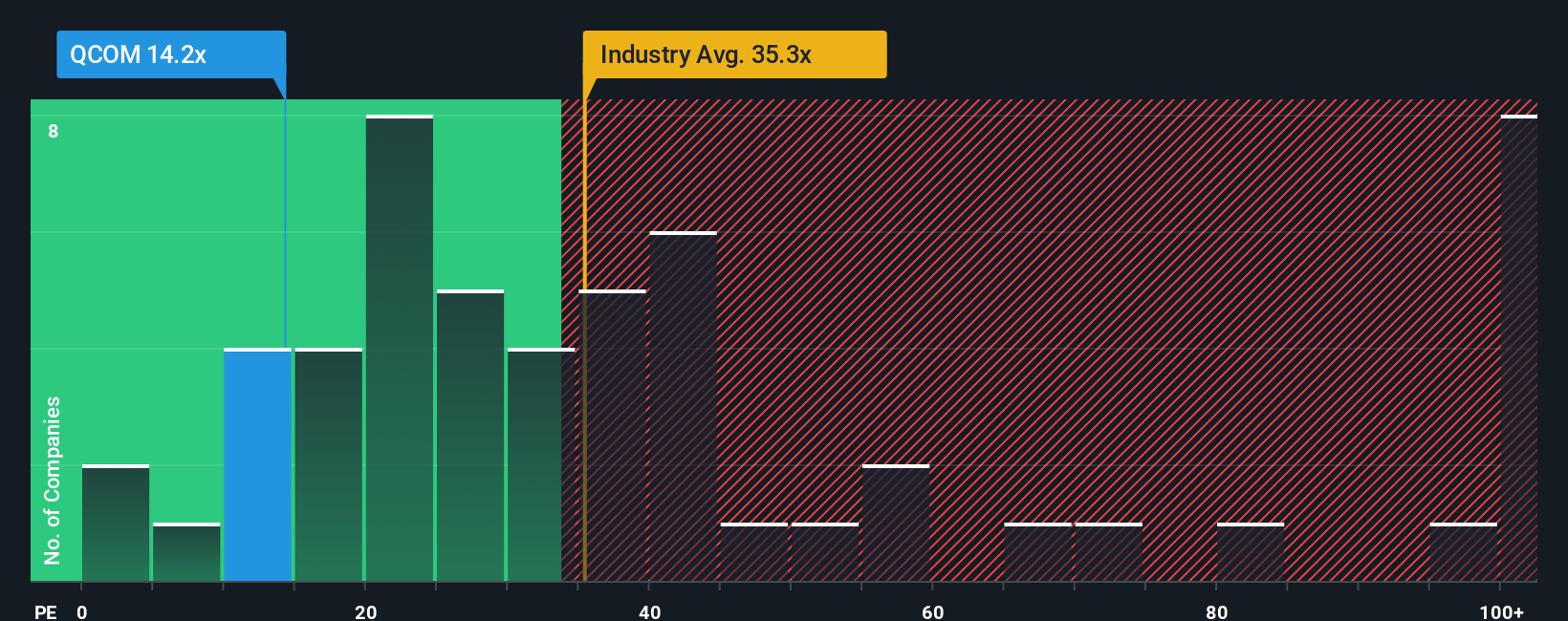

Currently, QUALCOMM trades at a PE of 16.8x. For context, the semiconductor industry average sits at 36.1x, and the average for QUALCOMM’s direct peers is an eye-popping 67.4x. QUALCOMM’s PE stands out for being much lower than these benchmarks, which immediately suggests the market may be cautious or underestimating its prospects.

Simply Wall St’s proprietary "Fair Ratio" refines this further. It is a smarter benchmark that tailors a fair PE considering QUALCOMM’s unique blend of earnings growth, profit margins, scale, and risk profile, not just peer groupings or broad industry numbers. This approach offers a more nuanced picture tailored to QUALCOMM’s real fundamentals.

The Fair Ratio for QUALCOMM is 29.0x, well above the current 16.8x. Because QUALCOMM’s actual PE is materially below the Fair Ratio, this supports the view that QUALCOMM is undervalued when you account for its growth, profitability, and risk-adjusted outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your QUALCOMM Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a concise story that connects your view about a company, such as its growth drivers or competitive threats, to your chosen financial assumptions like future revenue, earnings, and fair value estimates.

Narratives bridge the gap between what you believe and what the numbers say by linking your qualitative perspective on QUALCOMM with a custom forecast and an actionable fair value. They are easy to create and share right inside Simply Wall St’s Community page, where millions of investors exchange their personal takes on what drives a company’s true worth.

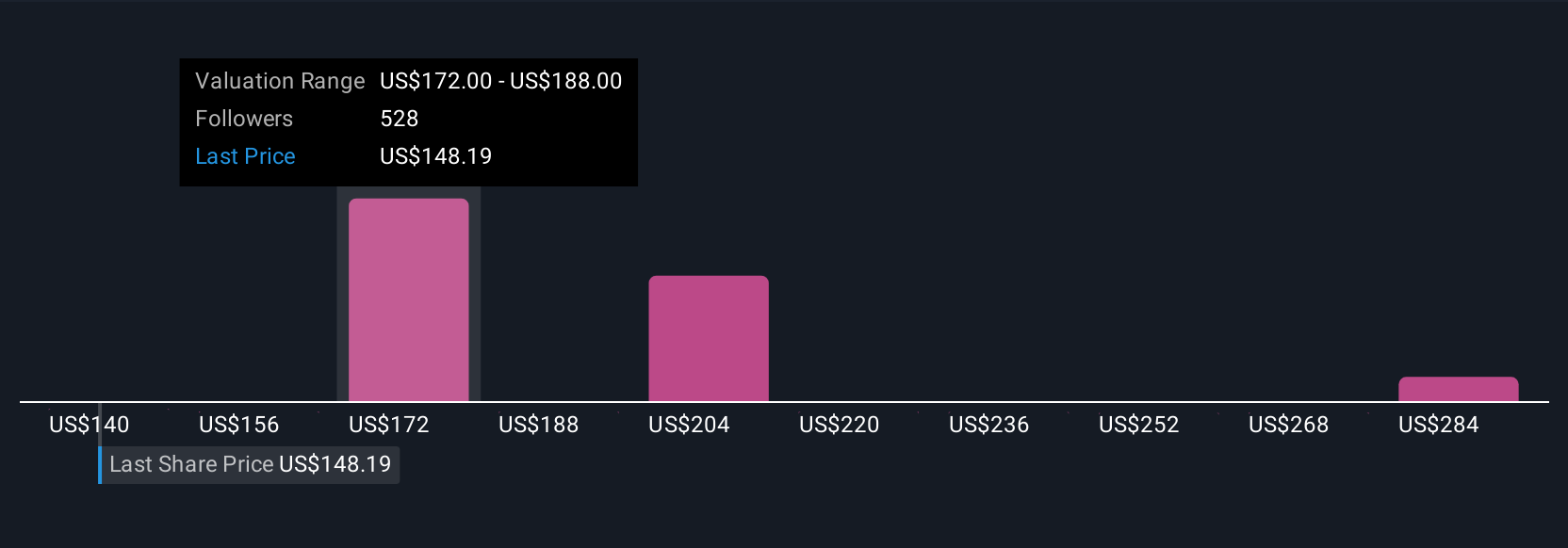

By comparing each Narrative’s Fair Value to the current share price, Narratives make it simple to spot whether now is the right time to buy, hold, or sell based on your unique outlook.

Because they auto-refresh in real time when new news or earnings are released, Narratives help keep you ahead of the curve as markets shift.

For example, some investors see QUALCOMM as worth up to $300 per share on the strength of rapid AI and automotive expansion, while others set fair value at just $140 due to regulatory and competitive risks.

For QUALCOMM, however, we'll make it really easy for you with previews of two leading QUALCOMM Narratives:

- 🐂 QUALCOMM Bull Case

Fair Value: $300.00

Undervalued by 39.7%

Revenue Growth Rate: 20.08%

- QUALCOMM delivered a record-breaking start to FY2025, with $11.7 billion revenue (up 18% year over year) and 24% EPS growth, propelled by strong handset, automotive (up 61%), and IoT (up 36%) segments.

- The company leads in Edge AI, embedding on-device AI in hardware through strategic deals with Meta, Microsoft, and Amazon. This powers long-term growth across smartphones, PCs, and IoT.

- Automotive revenues have hit record highs, with a $45 billion design win pipeline. This reinforces QUALCOMM’s bright outlook across AI, next-generation PCs, and connected vehicles.

- 🐻 QUALCOMM Bear Case

Fair Value: $179.67

Overvalued by 0.7%

Revenue Growth Rate: 2.64%

- QUALCOMM’s diversification into AI, automotive, and industrial IoT is projected to support margins and broaden its revenue base, but analysts see limited upside as much of the growth is already priced in.

- Analyst consensus assumes modest revenue and earnings growth, declining profit margins, and an 11% higher price target versus the current share price. There are warnings of risk from intensifying competition, regulatory scrutiny, and heavy reliance on cyclical smartphone segments.

- Bullish analysts highlight new AI and data center wins as well as international contracts as catalysts. Bears caution that strong execution and proof over several quarters will be necessary to justify higher valuations.

Do you think there's more to the story for QUALCOMM? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion