- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Assessing Qualcomm (QCOM) Valuation After Its Recent Share Price Momentum Rebound

Reviewed by Simply Wall St

QUALCOMM (QCOM) has quietly outpaced the broader market over the past month, and that recent strength is catching investors attention as they reassess the chipmaker s long term earnings and growth trajectory.

See our latest analysis for QUALCOMM.

That strength comes after a solid stretch where QUALCOMM has delivered a 13.39 percent year to date share price return and a hefty 68.25 percent three year total shareholder return, suggesting momentum is gradually rebuilding around its growth story.

If QUALCOMM s recent move has you thinking more broadly about chips and connected devices, this could be a good moment to explore high growth tech and AI stocks for other potential standouts.

With QUALCOMM still trading below consensus targets despite solid profit growth, investors face a familiar dilemma: is this a rare chance to buy a 5G and AI enabler at a discount, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 9.2% Undervalued

With QUALCOMM last closing at $174.22 against a narrative fair value of $191.80, the storyline points to upside if its growth blueprint holds.

The analysts have a consensus price target of $177.715 for QUALCOMM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $140.0.

Want to see what is driving that gap between today’s price and potential upside? The narrative leans on steady revenue growth, robust margins, and a future earnings multiple that borrows from sector leaders. Curious which specific earnings and buyback assumptions underpin that valuation path, and how they stack up against today’s more modest growth outlook? The full story spells out the numbers behind that conviction.

Result: Fair Value of $191.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steadier earnings are not guaranteed. Smartphone cyclicality and rising in house chip efforts at major OEMs are both capable of derailing that optimistic path.

Find out about the key risks to this QUALCOMM narrative.

Another Lens on Value

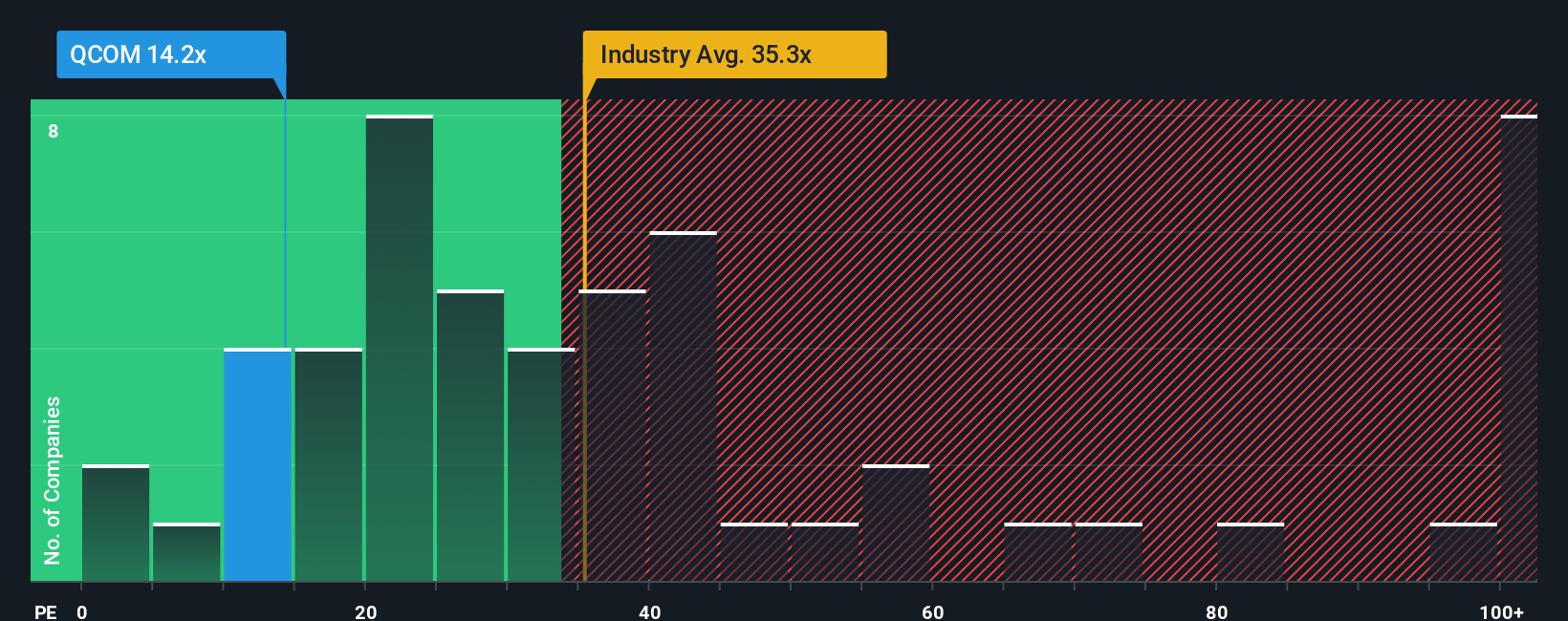

While the narrative fair value suggests upside, the market is less generous on current earnings. QUALCOMM trades on a P/E of 33.4x versus a fair ratio of 33x, only a slight premium that hints at limited margin for error if growth stumbles. Is that a tightrope you are comfortable walking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QUALCOMM Narrative

If this storyline does not fully resonate, or you would rather dig into the numbers yourself, you can build a fresh view in minutes: Do it your way

A great starting point for your QUALCOMM research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a shortlist of fresh opportunities using the Simply Wall St screener so you are not leaving smarter potential returns on the table.

- Capture growth potential at bargain prices by targeting companies screened as these 898 undervalued stocks based on cash flows that still boast strong fundamentals and room for sentiment to catch up.

- Ride powerful innovation trends by focusing on these 24 AI penny stocks that benefit from compounding demand for automation, data processing, and intelligent software.

- Secure reliable income streams by filtering for these 10 dividend stocks with yields > 3% that can support and grow payouts through varying market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion