- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

A Look at Qualcomm's Valuation Following Major AI Expansion and Saudi AI Systems Deal

Reviewed by Simply Wall St

QUALCOMM (QCOM) has announced a major move into AI infrastructure with the unveiling of its AI200 and AI250 chips. A high-profile collaboration with HUMAIN will bring 200 megawatts of Qualcomm AI systems to Saudi Arabia starting in 2026.

See our latest analysis for QUALCOMM.

QUALCOMM's push into large-scale AI infrastructure has sparked strong momentum in its shares, with a 1-day share price return of 2% and a 22% gain over the past 90 days. The enthusiasm has carried into the bigger picture, as the company boasts a robust 12% total shareholder return over the last year and an impressive 82% for the past three years. This trend signals that investor confidence in QUALCOMM's long-term growth is building as its AI ambitions take center stage.

Curious what other innovators are tapping into the AI wave? Browse our Tech & AI Growth Screener to see the full list of standouts: See the full list for free.

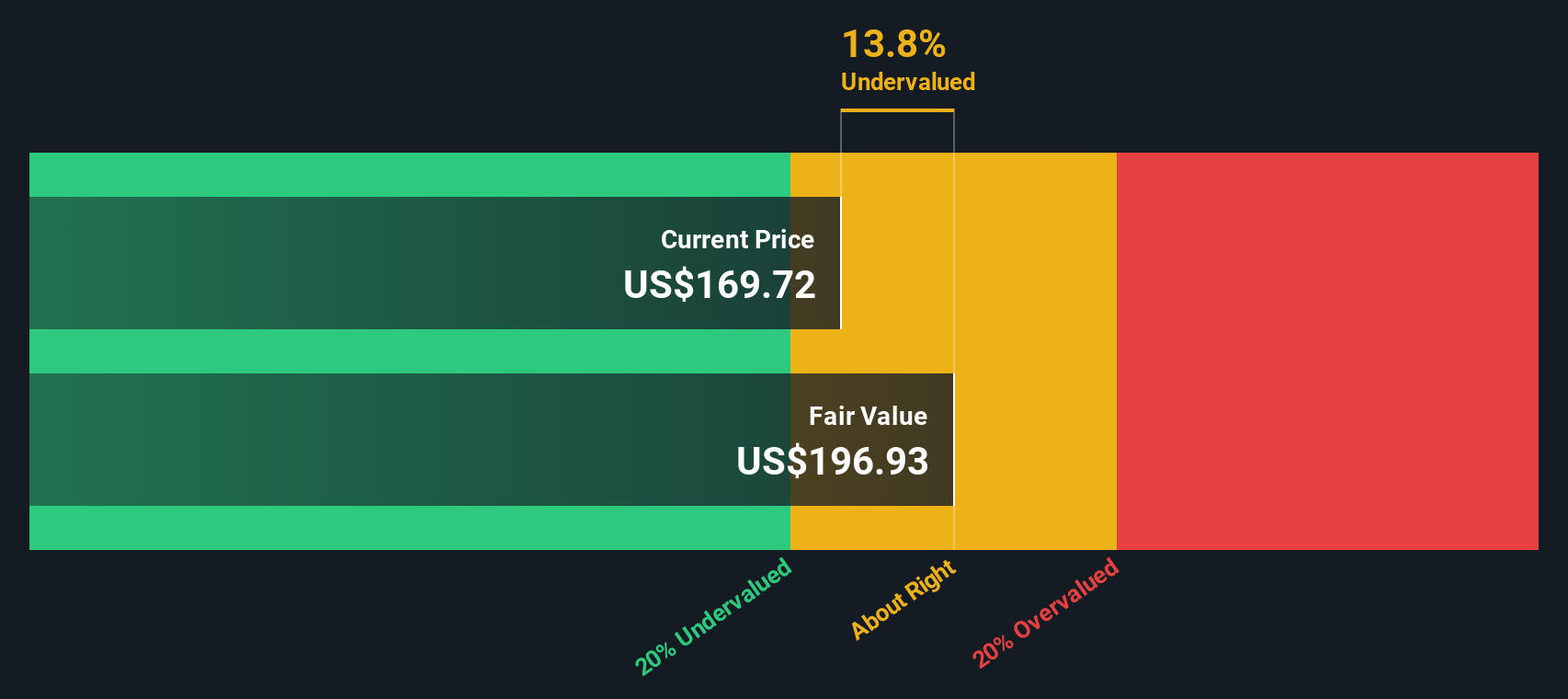

With QUALCOMM stock near record highs and optimism swirling around its AI-driven expansion, the key question for investors now is whether Wall Street has already accounted for this growth or if an attractive entry point still exists.

Most Popular Narrative: 0.7% Overvalued

QUALCOMM closed at $180.90, which is just above the most closely followed narrative's fair value estimate of $179.67. This razor-thin gap puts extra focus on the evidence and assumptions driving that projection.

Bullish analysts highlight growing demand for Qualcomm's AI accelerators and rack-scale solutions, which are now being deployed in large-scale projects set to generate significant revenue. Momentum in emerging markets, such as advanced driver-assistance systems, robotics, and industrial automation, is viewed as a catalyst for Qualcomm's long-term growth prospects, especially from fiscal year 2027 onward.

Want to know what market trends fuel this razor-close valuation call? The foundation of the narrative is surprisingly ambitious growth in next-generation technologies, paired with earnings assumptions that could shake up Wall Street expectations. The price target hides a unique blend of optimism and caution. Which daring forecast tips the scales? Read on for all the numbers and logic behind this fair value calculation.

Result: Fair Value of $179.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from industry giants and unpredictable geopolitical tensions could quickly challenge QUALCOMM's growth story and change sentiment on future earnings.

Find out about the key risks to this QUALCOMM narrative.

Another View: What Does the SWS DCF Model Indicate?

Switching perspectives, the Simply Wall St DCF model points to a fair value estimate of $213.79 for QUALCOMM, which is well above current trading levels. This suggests shares may actually be undervalued by about 15% if you trust this cash flow outlook. Could market caution be masking real opportunity, or is the DCF model overlooking risks the market sees?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own QUALCOMM Narrative

If the current narrative does not reflect your view or you want to dig into the data yourself, you can shape your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding QUALCOMM.

Looking for More Investment Ideas?

Don’t limit yourself to one opportunity. Smart investing means staying nimble. See what else could be waiting if you broaden your search for great potential.

- Start earning while you hold by finding steady income opportunities through these 22 dividend stocks with yields > 3% with yields above 3% that can bolster your portfolio.

- Target the growth stories everyone is buzzing about by spotting game-changers using these 26 AI penny stocks in the booming artificial intelligence landscape.

- Get ahead of the next tech leap by tapping into the power of these 28 quantum computing stocks, featuring tomorrow’s quantum computing leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion