- United States

- /

- Semiconductors

- /

- NasdaqCM:PXLW

Improved Revenues Required Before Pixelworks, Inc. (NASDAQ:PXLW) Shares Find Their Feet

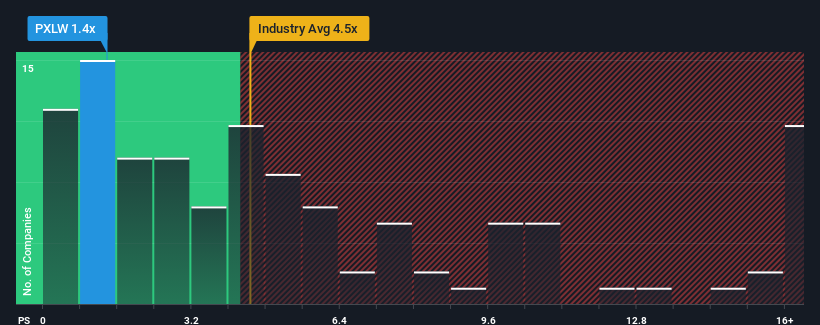

You may think that with a price-to-sales (or "P/S") ratio of 1.4x Pixelworks, Inc. (NASDAQ:PXLW) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in the United States have P/S ratios greater than 4.5x and even P/S above 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Pixelworks

What Does Pixelworks' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Pixelworks' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Pixelworks' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Pixelworks would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 25% as estimated by the three analysts watching the company. With the industry predicted to deliver 40% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Pixelworks' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Pixelworks' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Pixelworks that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PXLW

Pixelworks

Develops and markets semiconductor and software solutions for mobile, home and enterprise, over-the-air, and cinema markets in the United States, Japan, China, and Taiwan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives