- United States

- /

- Semiconductors

- /

- NasdaqGS:POWI

Does Power Integrations’ Recent 31% Surge Reflect Its True Value in 2025?

Reviewed by Bailey Pemberton

Trying to figure out whether Power Integrations is a buy, sell, or hold? You are not alone. This stock has been on quite a ride recently, with a remarkable 31.3% jump over the last week, enough to catch anyone’s interest. However, zooming out, the bigger picture shows more caution; returns have lagged, sliding 27.9% in the past year and staying deep in the red over the last 3 and 5 years. There is no specific blockbuster news driving the latest move. Rapid shifts in sentiment around the broader chip sector, along with shifting market appetite for growth names, seem to be playing a role. Investors are clearly re-examining the potential here and weighing up the risks and rewards.

Now, the numbers: Power Integrations earns just 1 out of 6 on our value score, signaling that by typical valuation measures, it looks undervalued in only one key area. But as you probably suspect, there is much more to the story than just a simple checklist. Let’s dig into the classic valuation approaches next, and before we’re done, I will share a slightly different way to look at what this stock might really be worth.

Power Integrations scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Power Integrations Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This approach is grounded in the idea that a stock is ultimately worth the present value of the cash it can generate in the years ahead.

For Power Integrations, the most recent free cash flow is $83.4 million. Analysts forecast that cash flows will grow annually, reaching about $122.2 million by 2035. Estimates beyond five years are extrapolated rather than directly forecasted. These projections are all in US dollars and offer a forward-looking perspective on the company’s potential to generate cash over the next decade.

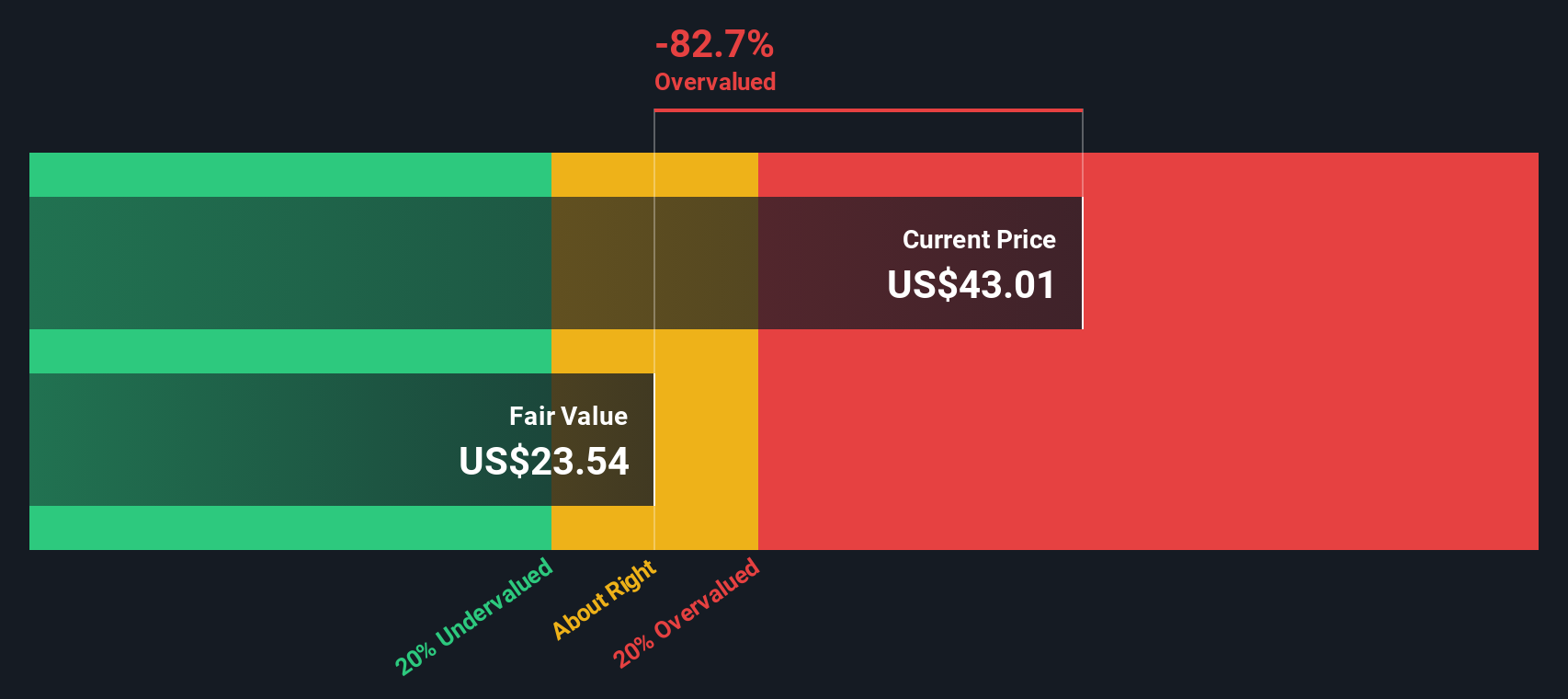

Based on these assumptions and discounting all future cash flows to the present, the DCF model puts Power Integrations' estimated fair value at $23.59 per share. When compared to the current market price, this implies that the stock is trading at a premium of roughly 92.8 percent. This means shares appear significantly overvalued under this framework.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Power Integrations may be overvalued by 92.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Power Integrations Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like Power Integrations because it offers a simple snapshot of how much investors are willing to pay for each dollar of earnings. This multiple reflects not just how profitable a business is today, but also how quickly it is expected to grow and how risky that future might be. Generally, higher growth prospects or lower risk warrant a higher PE, while slower-growing or riskier companies trade closer to the industry norm.

Power Integrations sits at a lofty PE ratio of 76x, which is well above the semiconductor industry average of 35.88x and the peer average of 44.06x. This suggests the market is pricing the company as if it will grow much faster or face far less risk than its competitors. However, Simply Wall St’s proprietary Fair Ratio for Power Integrations is 43.62x. The Fair Ratio model adjusts for not just industry benchmarks but also takes into account the company’s own earnings growth outlook, profit margins, market size, and overall risk profile. This makes it a much more nuanced and accurate tool than a straight industry comparison.

Looking at the numbers side by side, Power Integrations’ actual PE ratio of 76x is significantly higher than its Fair Ratio of 43.62x. This points to shares being overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Power Integrations Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story. It connects the business’s future (your forecast for revenue, profits, and margins) with your view of what the stock should be worth, making sense of the numbers through the lens of what you believe about the company.

Narratives take financial data and analyst assumptions and turn them into a living, breathing story, allowing you to clearly see how your expectations, or those of the wider community, translate to a fair value. They are easy to use and accessible for all Simply Wall St users within the Community page, where millions of investors compare their forecasts with others in real time.

By using Narratives, you are empowered to decide if it’s time to buy, hold, or sell, since you can instantly see whether your fair value is above or below today’s price. Narratives update automatically whenever key news or earnings arrive, so your perspective always stays up-to-date.

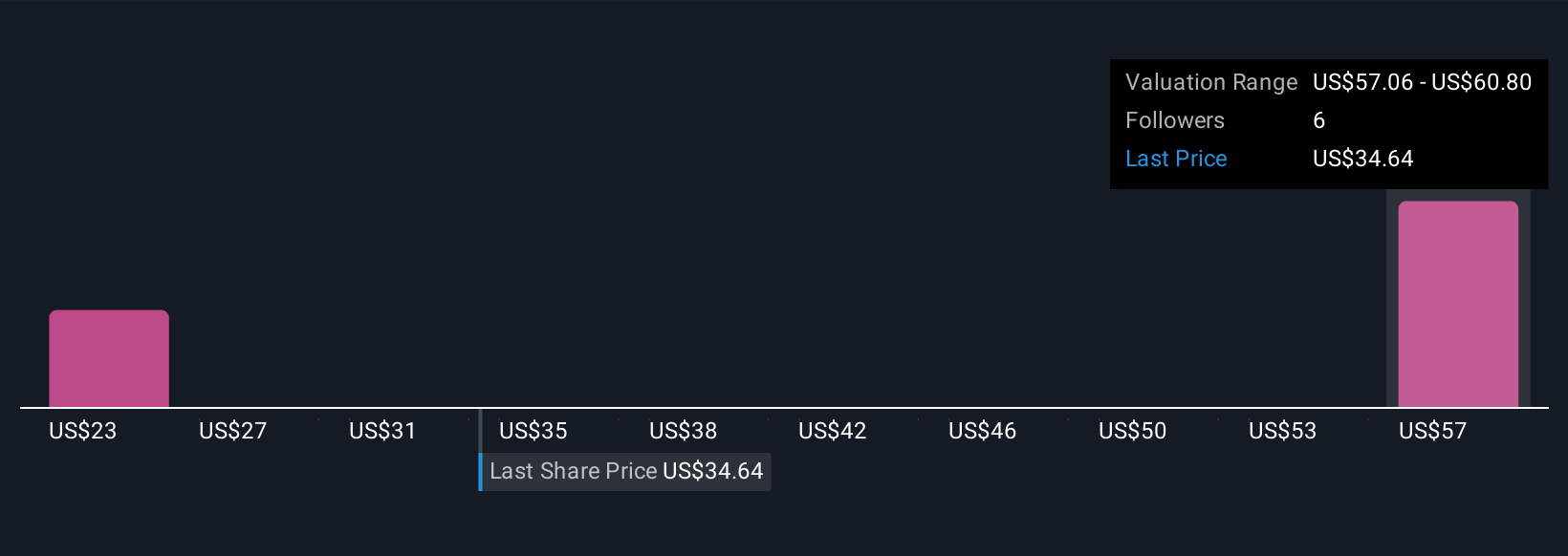

For example, with Power Integrations, one community member’s optimistic Narrative values the stock at $70, assuming big gains in EVs and AI data centers. A more cautious investor sets fair value at $55 given persistent margin pressures, trade risks, and tough competition.

In short, Narratives let you invest with conviction based on your own outlook, not just the consensus or static metrics.

Do you think there's more to the story for Power Integrations? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWI

Power Integrations

Designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives