- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Does the Recent Semiconductor News Signal a New Opportunity for Photronics?

Reviewed by Bailey Pemberton

- Wondering if Photronics is underestimated or overpriced right now? You are not alone; many investors are taking a closer look at where true value might lie in this stock.

- Despite a dip of 2.7% over the past week and a 10.1% slide in the last month, Photronics still boasts an impressive 90.3% return over the last five years, which may hint at strong long-term potential.

- Recent news around advancements in semiconductor manufacturing processes and broader industry consolidation is sparking renewed debate on Photronics' role in the digital transformation wave. These headlines may have influenced recent price movements by shifting investor expectations about the company’s strategic positioning and growth outlook.

- By the numbers, Photronics gets a 3 out of 6 on our value checks, so there is a case to be made on both sides of the valuation debate. Now, let’s dive into the different ways to assess what the market might be missing and stay tuned for an even more insightful approach to valuing the stock at the end of the article.

Find out why Photronics's -10.7% return over the last year is lagging behind its peers.

Approach 1: Photronics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method provides investors with a sense of what the business is truly worth, based solely on its ability to generate cash in the years ahead.

For Photronics, the current Free Cash Flow stands at $80.99 million. Analysts anticipate cash flow to decrease slightly in the next five years. Projections beyond that rely on longer-term trends and assumptions. For example, the model extrapolates an estimated Free Cash Flow of $67.20 million by 2035, marking a modest long-term decline from the most recent levels.

Based on these projections using a two-stage Free Cash Flow to Equity model, the DCF calculation suggests Photronics has an estimated intrinsic value of $12.60 per share. However, when compared to the current stock price, the DCF model implies the stock is trading at a 67.7% premium. This makes it significantly overvalued by this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Photronics may be overvalued by 67.7%. Discover 878 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Photronics Price vs Earnings

When valuing profitable companies like Photronics, the Price-to-Earnings (PE) ratio is often the preferred metric. This ratio tells investors how much they are paying for each dollar of the company’s current earnings. It is a straightforward measure for companies with consistent profitability.

A company’s “normal” or “fair” PE ratio depends on factors such as its future growth expectations and the risks investors face. Higher growth prospects and lower risk generally justify a higher PE ratio, while slower growth or higher risk should result in a lower one.

Photronics currently trades at a PE ratio of 11.5x, which is considerably lower than both the Semiconductor industry average of 34.2x and the peer average of 41.7x. At first glance, the stock may look undervalued compared to these benchmarks. However, taking a step further, Simply Wall St’s proprietary Fair Ratio for Photronics incorporates not only industry factors and earnings growth, but also the company’s profit margins, size, and risk profile. This more holistic measure produces a Fair Ratio of 18.3x for Photronics.

Because the Fair Ratio is tailored to Photronics’ unique fundamentals, it is a more reliable yardstick than simply relying on peer or industry averages. This allows investors to make a more informed judgment about whether the market’s pricing is justified.

With the stock’s current PE of 11.5x well below its Fair Ratio of 18.3x, Photronics appears undervalued by this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

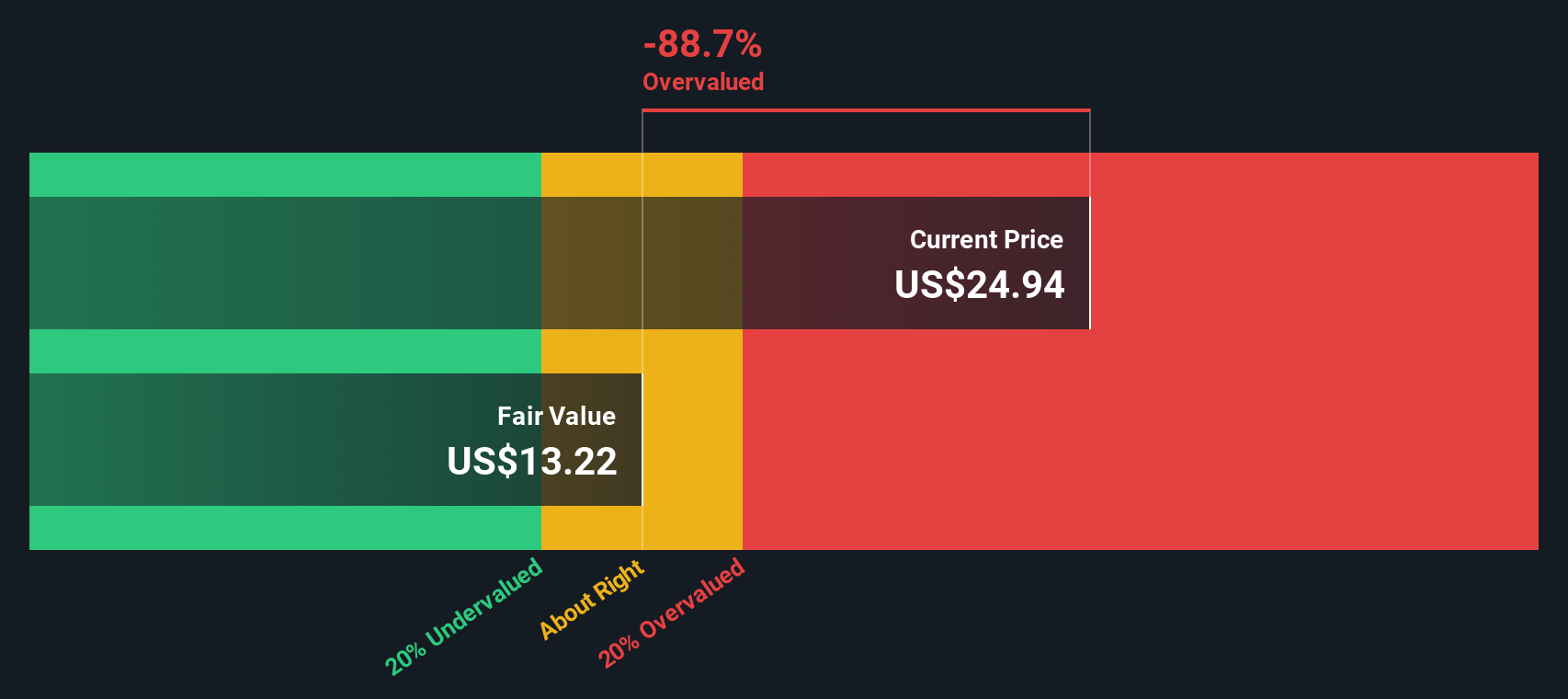

Upgrade Your Decision Making: Choose your Photronics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal investment story about a company. It is how you connect the big picture of what a business is doing to the actual numbers you expect (like future revenue, profit margins, and growth rates) and what you think is a fair share price.

Narratives help you bridge the gap between your insights about Photronics, your financial forecasts, and a clear, actionable fair value. On Simply Wall St's Community page, millions of investors use Narratives as an accessible tool to share their perspectives, test scenarios, and see how their thesis plays out as the facts change.

With a Narrative, you can quickly see if your estimated fair value is way above or below the current share price, making it much easier to decide when to buy or sell. Even better, Narratives update dynamically when new results or news comes in, keeping your decisions powered by the latest data.

For example, some investors think Photronics should be worth as much as $33 per share if it continues capturing market share and improving margins, while others see risks that could limit its fair value to just $12. This shows how your Narrative directly shapes your investment call.

Do you think there's more to the story for Photronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives