- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Impinj (PI): Assessing Valuation Following Strong Q3 Results and Renewed Analyst Optimism

Reviewed by Simply Wall St

Impinj (PI) delivered third quarter results that beat both revenue and adjusted profit forecasts, driven by record endpoint IC volumes and reader sales. The upbeat performance has sparked fresh interest in the stock.

See our latest analysis for Impinj.

Impinj’s upbeat results and lease expansion plans have prompted a wave of renewed optimism around the stock. Still, after climbing steadily earlier this year, momentum has cooled in recent weeks with a 19% seven-day share price drop, leaving the one-year total shareholder return at -19.6%. Over the longer term, total returns remain impressive, with shareholders seeing gains of 46% over three years and a remarkable 376% over five years.

If you’re interested in tech trends beyond Impinj’s story, now’s the perfect moment to discover See the full list for free.

With the share price recently slipping, but analyst targets suggesting substantial upside, the big question is whether Impinj is undervalued at today’s levels or if the market is already factoring in brighter days ahead.

Most Popular Narrative: 33.6% Undervalued

Impinj’s most closely tracked narrative implies a fair value much higher than the latest close of $163.63, pointing to significant upside if its financial forecasts materialize. This perspective centers on breakthrough opportunities in key sectors and ambitious expansion plans.

Expanding deployment of RFID solutions for food traceability and freshness, especially at the item level driven by pilots with major retailers, presents a multi-year growth opportunity. This trend is underpinned by regulatory and consumer demand for improved traceability and waste reduction, which is already leading to additional pilot programs and is expected to ramp into meaningful unit volumes in 2026 and beyond, supporting outsized future revenue growth.

Want to know what’s fueling this bullish view? One set of game-changing growth projections, rapid adoption across new markets, and a powerful margin story are at the heart of the case. Curious which numbers analysts are betting on to justify it? Dive into the full narrative and see what could move the needle for Impinj.

Result: Fair Value of $246.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or slower adoption in new markets could quickly challenge even the strongest growth outlook for Impinj.

Find out about the key risks to this Impinj narrative.

Another View: Market Ratios Offer a More Cautious Signal

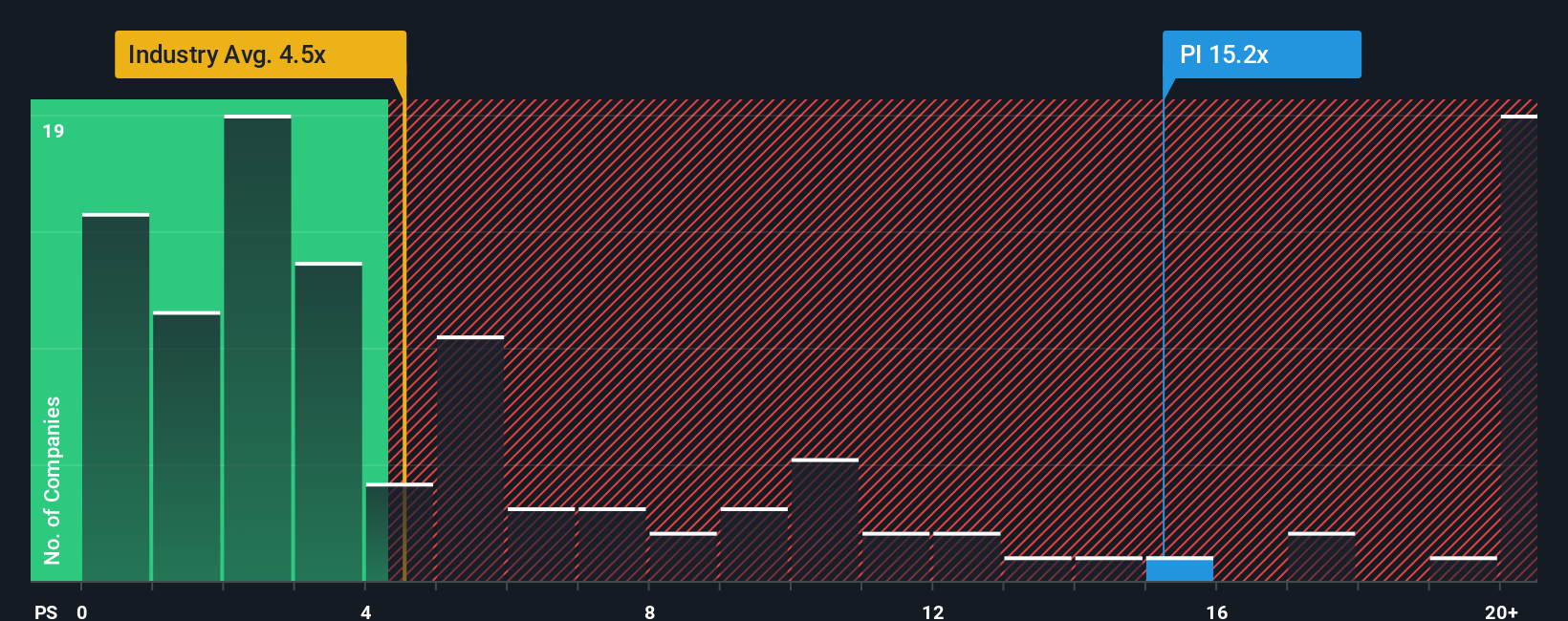

While DCF valuation points to Impinj being undervalued, a look at its price-to-sales ratio tells a different story. The company trades at 13.7 times sales, much higher than the peer average of 6.2, the industry average of 4.5, and above the fair ratio of 7.7. This premium suggests investors may be accepting added risk for future growth potential. However, what happens if market sentiment cools and multiples revert?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Impinj Narrative

If you want to put your own spin on the story or dig into the figures that matter most to you, building your own take is quick and insightful. You can get started in under three minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Impinj.

Looking for more investment ideas?

If you want even more opportunities, don’t wait on the sidelines. The right stock pick could supercharge your portfolio and keep you ahead of market trends.

- Unlock the potential of tomorrow’s biggest tech trends by checking out these 25 AI penny stocks. Get in early on innovation shaping the future.

- Catch steady income potential with these 16 dividend stocks with yields > 3%, featuring stocks poised to deliver robust yields above 3% to help strengthen your returns.

- Ride the wave of digital transformation by exploring these 82 cryptocurrency and blockchain stocks, where companies are powering the next chapter in the blockchain revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives